Crypto Permanence

Real world applications for cryptocurrency remain elusive... but does it matter?

Hi all — Thank you all for your kind words and “welcome back” wishes. I can’t promise I will be publishing weekly but I hope to be posting on somewhat of a more frequent basis looking forward.

In case you missed some of my last articles:

Party like it's 2021

I don’t think, however many days we are into this nonsense, that GameStop is a particularly important story (though of course it’s a fun one!), or that it points to any deep problems in the financial markets. There have been bubbles, and corners, and short squeezes, and pump-and-dumps before. It happens; stuff goes up and then it goes down; prices are i…

Russia's War Economy

In emerging and developing Europe, growth is projected at 0.0 percent in 2022 and 0.6 percent in 2023, with a 1.4 percentage point upgrade for 2022 and a 0.3 percentage point downgrade for 2023, compared with the July forecast. The economic weakness reflects –3.4 percent and –2.3 percent projected growth in Russia in 2022 and 2023

Onto the article!

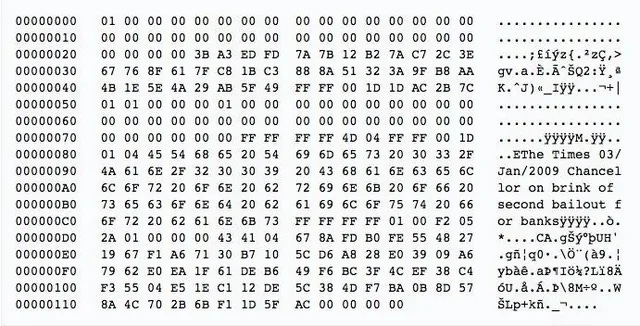

Bitcoin’s genesis block, or the first bitcoin ever minted, is coming up on its 17th birthday this January. On the genesis block you can find a snippet of a newspaper headline left in the coinbase1 by Satoshi Nakamoto, Bitcoin’s anonymous founder who has become somewhat of a modern religious figure. The headline stems from an article in the Times, detailing yet another bank bailout in the wake of the Global Financial Crisis. The message suggests that Nakamoto was taking a jab at the British banking system, insinuating that bitcoin could emerge as an alternative to the existing monetary and banking system that we utilize today. Said another way, banks were corrupt and fragile. In that same vein, fiat currencies were unreliable stores of value, given that they could be produced at the whim of governments and central banks.

Legacy banking systems were also subject to the permission and regulatory structure of the local government. There was no guarantee that you were able to retrieve “your cash” from your bank. After all, “your cash” is merely a banknote, or a debt obligation from the central bank, backed by the full faith and credit of a sovereign issuer. This dynamic was particularly salient in Cyprus circa 2013, in which Cypriots were unable to access cash from the bank in the fallout of the Eurozone crisis.

Bitcoin was said to be the antidote to this system by allowing holders (hodlers?2) to bear ownership of their own currency, rather than having their wealth be comprised of debt obligations. Bitcoin is also “permissionless”, meaning that you may transact in bitcoin without any impediment from any unrelated third party. By contrast, the Bitcoin blockchain and node operators govern every transaction. Fees generated by the blockchain on behalf of node operators create an incentive structure in which transactions are processed safely, accurately, and secure. The technological foundation of bitcoin and cryptocurrency writ large have created an entirely new asset class with an anti-establishment ethos — promulgated by brokers like Coinbase.

Paradoxically, however, bitcoin’s remarkable performance makes it a poor currency. A rational actor would prefer to hold an appreciating asset, instead of spending it on non-durable goods and services. Intuitively, this description doesn’t apply to fiat currencies. Inflation (gradually depreciating currency) serves as a built-in incentive to spend or invest, which is why “cash equivalents” typically carry some interest. This hasn’t, however, dampened the market’s enthusiasm for crypto products.

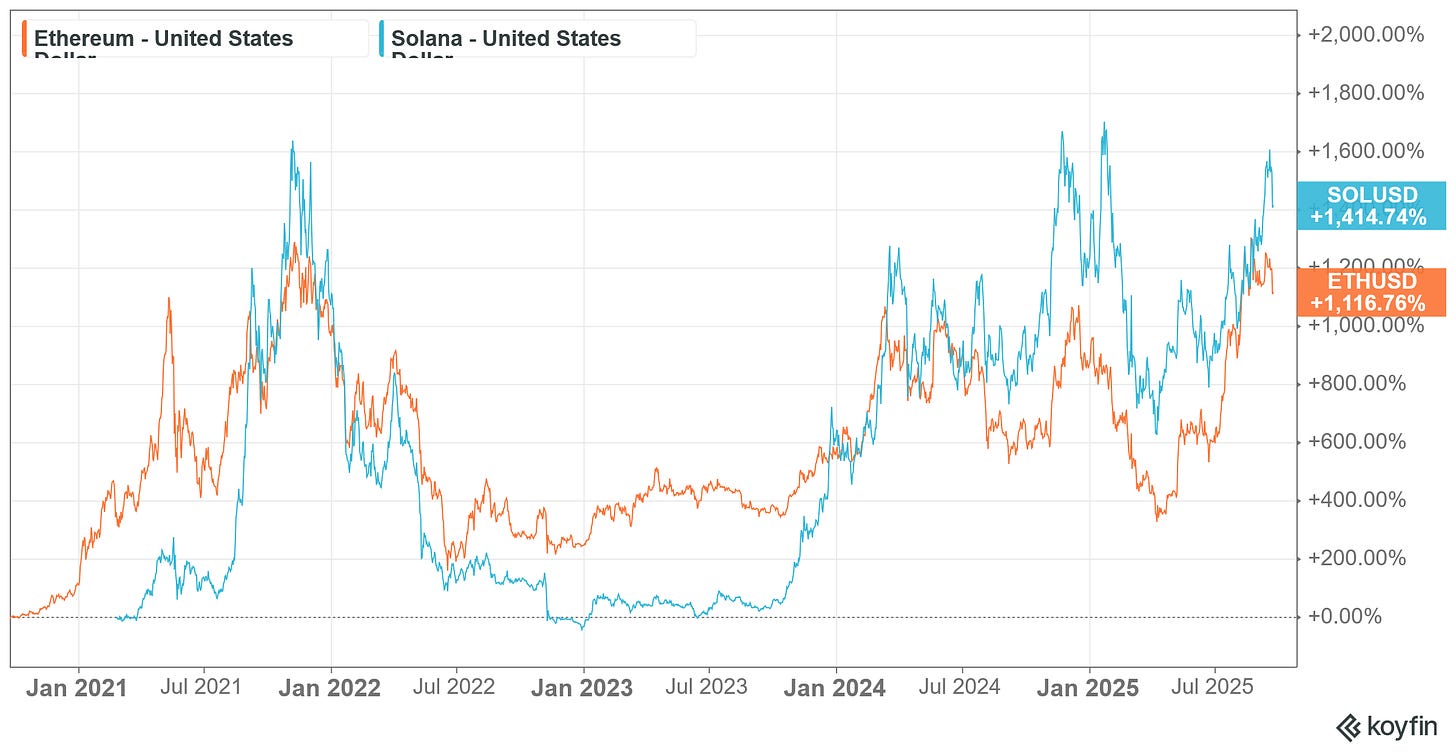

Bitcoin caught an enormous bid in 2021 as the global economy was flush with cash, resulting in eye-watering inflation prints. On top of that, Donald Trump, the then-former president of the United States, was banned from social media, sparking outrage from his supporters and advocates of free speech. Trump’s suspension was orchestrated at the management levels of large tech companies, revealing that users and content could be unilaterally suppressed by only a handful of powerful individuals. The risks of centralized authority galvanized Bitcoin, given its characteristics of immutability and decentralization. Affinity for these principles ultimately spilled into other cryptocurrencies like Ether (Ethereum) and Solana — digital ecosystems underpinned by blockchain, transparency, and the ability to bear ownership of your digital presence. No longer would Google and Facebook be able to solicit your data to inquiring advertisers — users themselves would be able to harness the fruits borne from their own online activity. This architecture was branded “Web3” and promised to be the next frontier of internet economics. Blockchain technology, in a way, reinforced the concept of a digital identity, leveraging financial incentives for people looking to capitalize on time and money spent on the internet. It was a compelling pitch, prompting rapid price jumps in $ETH and $SOL, the cryptocurrencies associated with the Ethereum and Solana blockchains. Patrons of the crypto community compared buying web3 infrastructure tokens like Ethereum and Solana to “buying a piece of the internet”. Then again, it’s crucial to recall how, in the post-pandemic, zero-interest rate era — there was a large appetite for outlandish forecasts.

2022 was a less fortuitous year for bitcoin and cryptocurrency, as the market endured “crypto winter”. High-profile fallouts from TerraLuna (May 2022), Voyager (July 2022), Celsius (July 2022), BlockFi (November 2022), and of course, FTX — reinvigorated crypto skepticism. Before FTX’s collapse, the company had achieved a $32 billion valuation backed by blue-chip venture capitalists like SoftBank, Insight Partners, Lightspeed Venture Partners and others. Sam Bankman-Fried, FTX’s chief executive, had even testified in front of congress to advocate for a new regulatory framework for digital assets.

As bitcoin sank to two-year lows, the company was on the precipice of a rescue acquisition by Binance, one the largest crypto brokers in the market. As negotiations progressed, FTX revealed that their balance sheet was far more rickety than originally advertised. The company held roughly $900MM of liquid securities and over $15B of “less liquid” assets, compared to $9B in liabilities. The issue, however, is that the “less liquid” bucket was mainly comprised of random tokens issued by FTX themselves. The tokens were marked at far higher prices than where the market was willing to pay, thus driving FTX into insolvency. Bankman-Fried was arrested and subsequently sentenced for securities fraud in the months thereafter.

Trivia: FTX was infamously backed by several professional athletes. Can you name them? Answer below.

Cryptocurrency was left for dead by the end of 2022 — investors had concluded that crypto businesses were more concerned with financial engineering rather than shipping innovative products. Cryptocurrency investors, however, were rescued by the advent of the bitcoin ETF. In June 2023, Blackrock ( BLK 0.00%↑ ) submitted an application to list a “spot” bitcoin ETF3, which allowed traditional (“TradFi”) investors to gain tangible exposure to bitcoins through an exchange-traded product. No longer would you have to go through the pain of opening a Coinbase account, or connecting your MetaMask wallet to a decentralized exchange — you could simply buy and hold bitcoins in your brokerage account or IRA. Bitcoin finished 2023 up over 150%, ultimately breaking into a new all-time-high by March 2024.

As bitcoin rallied into new highs, the concern of “TradFi” co-opting the decentralized nature of crypto was noticeably absent. The world’s largest money managers — Blackrock, Fidelity, Invesco, to name a few — would effectively own bitcoins on behalf of their clients. Again, if we are to subscribe to the idea that Satoshi invented bitcoin to contend against the inherent risks of centralization, this participation feels rather puzzling.

For better or for worse, index fund providers have come under fire in recent years for their outsized role as public company shareholders. That said, it hasn’t mattered much to the crypto markets — the launch of bitcoin ETFs coincided with the “halvening”, thereby cutting the supply of newly minted bitcoins in half. Fundamentally, of course, a shorter supply of new bitcoins, coupled with a wave of demand from institutional investors, was bullish for the token.

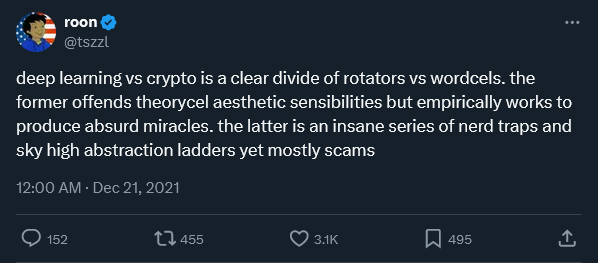

In the eyes of many, the whole episode of institutional adoption unmasked the true objective of cryptocurrency: Number Go Up. Bitcoin remains stubbornly above the $73,000 seen at the beginning of 2024, yet there are no glowing narratives about the revolutionary prospects of an unbanked society. Web3 economics have failed to accrue any sort of meaningful share in finance services, social media, or software. Farcaster, which posited itself as a decentralized Twitter, has an estimated 40,000-60,000 daily active users as of last September. Total value locked (“TVL”) across the decentralized finance ecosystem tallies up to about $150B, equivalent to the asset base of a mid-sized bank. Filecoin, Helium, among other “infrastructure” tokens have seen tepid adoption, despite what appears to be compelling technology.

Perhaps this was the objective since the beginning. Yes, blockchain adoption is occurring somewhere, according to press releases from consulting agencies. However, the average person doesn’t derive any meaningful utility from this technology. The crypto community’s apathy for user adoption, perceived utility, or simple fundamentals remains absent. This is particularly frustrating to technology enthusiasts and investors (like myself) who dream of cool, innovative products underscored by distributed ledger, or blockchain technology. Meanwhile, we are stuck with NFT artwork, dog coins, and pump-and-dump schemes orchestrated by the President of the United States.

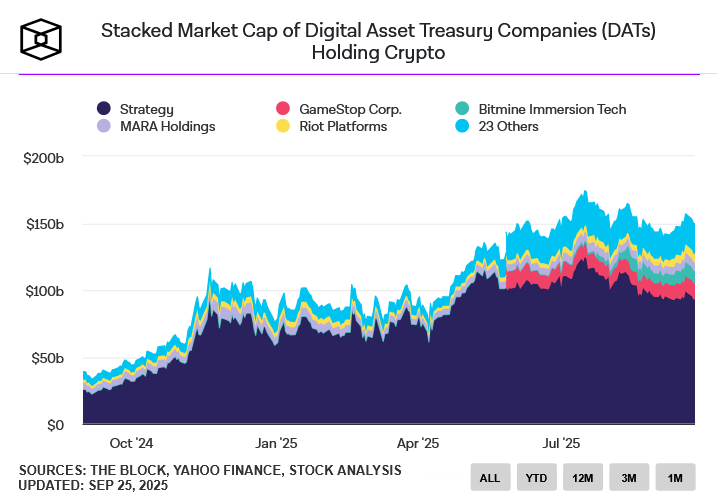

All of this being said — I don’t believe crypto is going away anytime soon, if ever. The money management industry has a tendency to slap fees on anything that attracts asset flows. Furthermore, trading desks can bask in the wide bid-ask spread found on digital assets. Bitcoin ETF inflows continue to climb while new ETF filings for tokens like Ethereum, Solana, — even Dogecoin, continue to garner investor attention. Digital asset treasury transactions, or “DATs”, are generating generous fees to bankers and crypto investors seeking to unearth the next Microstrategy (MSTR 0.00%↑ ). It’s worth noting that the companies undergoing these reverse mergers are effectively SPACs with the simple objective of owning and holding cryptocurrency in a publicly-traded vehicle.

The extent to which crypto has innovated beyond speculation and financial services remains limited. Blockchain gaming and social networking have, to a small extent, created a proof of concept for web3 economics. But let’s not kid ourselves here: The objective even for folks on a decentralized social network or video game is capital appreciation, not user adoption — if those two elements can even be separated.

Trivia Answer: FTX investors included household name athletes such as Tom Brady, Naomi Osaka, Shaquille O’Neal, and Stephen Curry.

A “coinbase” usually includes arbitrary data or extra nonce values

HODL or “Hold On For Dear Life” is an acronym often employed by cryptocurrency enthusiasts. The term stems from a typo in a bitcoin forum back in 2013 from a drunken commentor and has been adopted earnestly by bitcoin investors.

While Bitcoin futures ETFs have been approved and trading since 2021, the “spot” ETF mandated that the investment managers actually acquire and hold bitcoins on behalf of their investors. Futures ETFs only offer synthetic exposure to these assets.