Bitcoin is an Asset

We dissect the present day utility of Bitcoin and examine our obsession with upending the Foreign Exchange market.

Welcome to the Global Capitalist — A free newsletter on international developed, emerging and frontier markets viewed through the lens of history and culture.

I may have some updates soon!

Cheers,

— Tom

Money, Money, Money

“Bitcoin fixes this” is a phrase that, for those of us who spend a lot of time on Twitter, are far too familiar with. Of course, this saying has now been meme—ified beyond any serious interpretation. Yet, the “Bitcoin Maximalist” crowd remains sanguine about the revolutionary prospects of digital assets.

Indubitably, bitcoin has seen an emphatic return into the mainstream since the first wave of crypto—mania seen back in 2017. During that time, bitcoin (amongst other cryptocurrencies) were largely dismissed as fads or scams by respected leaders of the business community. Bitcoin’s subsequent decline from $20,000 to $3,500 served to vindicate the skeptics who warned of bitcoin’s speculative nature. Then again, Bitcoin’s supporters were unperturbed by BTC’s drawdown. Surely, the price was irrelevant! The booming popularity of bitcoins (note, lowercase “b”) reflected the growing potential of the (uppercase “B”) Bitcoin network and contingently, blockchain technology. Generally speaking, a bitcoin maximalist believes that bitcoin will eventually supplant the U.S. dollar as the world’s reserve currency.

Fast forward to today and bitcoin trades north of $50,000, over an +150% premium versus its 2017 high. Concurrently, this rally endows Bitcoin with a market capitalization1 of over $1 trillion, a figure only matched by multinational juggernauts like Apple, Amazon, Microsoft, and Saudi Aramco. Not to mention, cornerstone financial institutions such as BNY Mellon, PayPal, and MassMutual have shown an unprecedented appetite for cryptocurrencies, accelerating Bitcoin’s adoption into the global financial system.

Finally, how could we forget Coinbase’s bombastic public listing? The offering, which valued Coinbase at a whopping $100 billion2, signaled yet another major milestone in Bitcoin’s maturity. Coinbase, the world’s largest crypto exchange, commanded a valuation over two times greater than Nasdaq Inc, the parent company of the Nasdaq Composite, which — ironically enough — hosted $COIN’s direct listing.

Yes, I know— I’m complaining about valuation again. Before you start drawing the pitchforks, and this is not investment advice, take this into consideration:

Coinbase, on average, will trade $3-$4 billion worth of crypto a day ($1.5 trillion per annum). Nasdaq, by comparison, is expected to trade about $1.3 trillion of European equities alone in 2021. Then again, the appraisal of Coinbase, much less any cryptocurrency, appears to be beyond the comprehension of any traditional valuation methods.

To summarize thus far: A lot has happened in the crypto community since 2017. It’s all too much to fit into one newsletter, quite frankly. Fascinating new ventures are born every day as this technology continues to transform the economics of computing.

Yet, the thought persists: Why are Bitcoiners celebrating $BTC’s rise to $60,000? Sure, okay— As a bitcoin investor, bitcoin has been a remarkable investment. There are few, if any, asset classes that can hold a candle to bitcoin’s returns over this past decade. But, again, what does this mean for bitcoin’s utility as a crypto currency?

Fundamentally, returns are not a quality we seek in our currencies. An appreciating currency is inherently deflationary and would (in theory) reduce future expected consumption. Indeed, one could make the argument that we saw this dynamic unfold last spring. Prospective airline passengers were hesitant to purchase new flights on the possibility that they might turn even cheaper in the future. Renters, particularly in urban settings, delayed leasing new apartments in hopes of capitalizing on a reduction in prices. Meanwhile, as consumption plummeted, the dollar index hit a three year high.

Bitcoin, by extension, is a deflationary asset relative to government-issued currencies. In general, people don’t purchase goods with bitcoin because the price of a bitcoin is up over 3 million percent since 2011. In fact, the aversion towards spending your bitcoins (opposed to saving, or HODLing it) stems from an infamous folktale within the crypto currency community.

The first ever recorded bitcoin transaction took place on May 22nd, 2010. A man exchanged 10,000 bitcoin for two pizzas, or the equivalent of about $40 during that time. Today, those two pizzas live in infamy, with an estimated present—day value of over half a billion dollars.

Za: Can you guess what kind of pizza was purchased?

Answer at the bottom.

Curiously, despite Bitcoin’s advances since 2011, bitcoins still serve as a rather poor medium of consumption. On average, bitcoin transactions take 10 minutes to settle— although that duration will vary depending on the level of traffic on the Bitcoin blockchain. What’s more, bitcoin market volume appears to move in lockstep with price, incurring potential liquidity risks should a “race for the exit” ever occur. In other words, the higher bitcoin loads, the more people will trade it. Conversely, one could expect volume to plummet should the price of bitcoin decline. This is a perilous flaw in the bitcoin market microstructure.

Bitcoin’s validators are compensated in bitcoins. Intuitively, a drawdown in $BTC would attract fewer validators to the Bitcoin network, which would make it more difficult to transact bitcoins at, or near, fair market value.

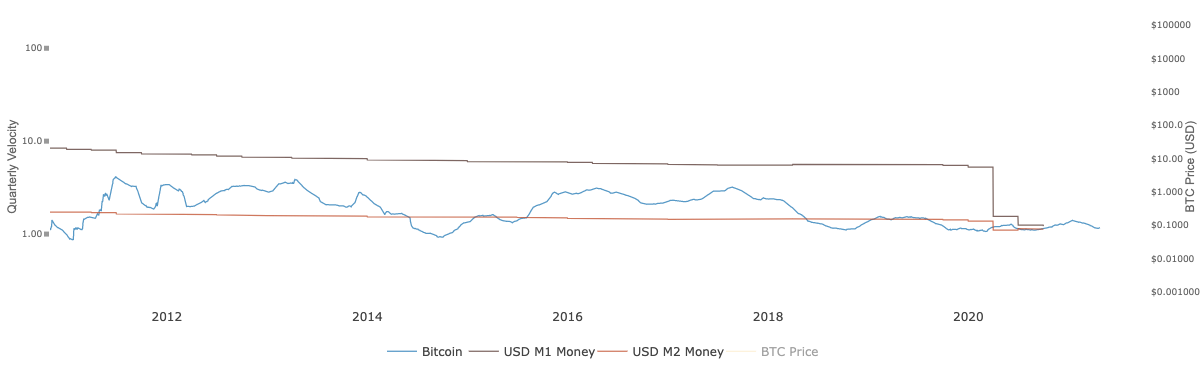

It should be noted — albeit with a grain of salt — that Bitcoin’s velocity, or the frequency at which it exchanges hands, has recently surpassed that of M1 money supply. Granted, monetary velocity has floundered since the onset of the coronavirus recession. Regardless, this occurrence poses an interesting question about the relationship between government “money—printing” and inflation... But that will have to be a conversation for another time.

Conclusively3, bitcoins fail to demonstrate currency—like characteristics. Rather, the sensitivity of bitcoin against varying macroeconomic backdrops indicates that bitcoins trade similarly to a‘risk—on’ asset. In turn, I subscribe to the belief that Bitcoin is the first in what is the new frontier of digital assets, serving as a “Proof—of—Concept” for future cryptographic technologies and applications.

Should bitcoin ever become money, however, a lot would have to change.

Friendly reminder that this is a free publication. Please consider subscribing below or sharing this post to support my work.

Not A ForEx Scam

So if not Bitcoin, then who?

Ripple Labs, the parent company of XRP (“Ripple”) is one of the more controversial cryptocurrencies of our era. For starters, the company has ambitions of disrupting the colossal foreign exchange (“ForEx”) market. This will be no easy task — the ForEx market is the largest and most liquid of all the capital markets, reaching over $6.5 trillion in daily volume in 2019. For context, the NYSE traded roughly $47 billion in total volume on 4/27/21.

Ripple aims to disrupt this market using their XRP token in tandem with the RippleNet platform. RippleNet enables customers to cheaply and quickly exchange currencies via their mobile device, using the XRP token as the medium of exchange. On a grander scale, Ripple’s technology seeks to upend the market for foreign exchange services, helping both retail and institutional customers swap currencies.

Traditionally, on an institutional level, multinational companies will hire a bank or other financial intermediary to help hedge currency risk via the foreign exchange market. An oil company in Nigeria, for example, may be advised to purchase a currency swap or forward to hedge against a decline in the naira. While this practice helps businesses forecast future costs and revenues, it remains extremely costly and carries perilous tail risk.

In the consumer vertical, foreign exchange services have mainly been used by expatriate laborers who send remittances to their home countries via a money transfer service (Read: Western Union, Money Gram).

This service, however, faces a similar dilemma to institutional ForEx. In this situation, expatriate workers require a means of wiring money internationally, yet are limited in their options (although, there are certainly no shortage of startups looking to supply one). It is not uncommon for money—transfer services to offer unfavorable exchange rates and corrosive fees on simple cash transfers. Not to mention, the additional costs incurred in sending money to the underbanked always seems to penalize those who can least afford it.

That all said, it is not hard to see why people are hungry for alternatives.

Ripple’s most notable partnership is held with Banco Santander, one of the world’s largest banks by assets. Banco Santander has been particularly vocal about their partnership with Ripple, as Ripple’s blockchain serves as the engine driving Santander’s One Pay FX platform. According to the bank, customers from across 6 different countries have exchanged a total of over €450 million since the program’s inception. Besides Santander, Ripple assists hundreds of other financial companies their international payments across over 50 different countries.

Interestingly enough, Ripple was one of only a few cryptocurrency—oriented businesses with registered members advising on ISO 20022, the new international, standardized manual on business payments. Other registered members include some of the world’s largest central and multinational banks, regulatory bodies, and financial technology companies. However, two of Ripple’s listed members have since left the company — presumably because of this:

Washington D.C., Dec. 22, 2020 —

The Securities and Exchange Commission announced today that it has filed an action against Ripple Labs Inc. and two of its executives, who are also significant security holders, alleging that they raised over $1.3 billion through an unregistered, ongoing digital asset securities offering.

I’ve never seen The Wire, but I do know that if you come at the king, you best not miss. Besides the premise that Ripple might be an unregistered security, XRP is simply an unlikely candidate to become a widespread medium of exchange. First, the token has revealed itself to be prone to manipulation and unwanted volatility. Ripple’s protocol, unlike Bitcoin’s, is centralized, or in this case, privately managed by Ripple Labs. The company, despite the aforementioned allegations of manipulation, has full discretion over the circulation of XRP tokens. Keep note: Total supply is capped at 100 billion tokens.

There is a strong argument to be made that the structure of Ripple’s enterprise effectively defeats the purpose of cryptography. Additionally, you could make a similar (albeit weaker) argument that Ripple is a FinTech company masquerading behind an ICO... but I digress.

King in the Castle: Where does Ripple rank amongst other cryptocurrencies in terms of market capitalization? Can you name the top 5 cryptocurrencies by market capitalization? Answer below.

By this point, one could make the fair assumption that I am a cryptocurrency pessimist. Rest assured, I am not. The ecosystem for cryptography is still quite young and exposed to growing pains. To be frank, we may look upon this letter in the future and laugh at antiquated this thought process is...

... And it may happen sooner than we think! The People’s Bank of China is apparently close to releasing their own digital currency in the coming weeks. Naturally, however, that is a conversation for another time.

Trivia

Za: The Bitcoin pizza was ordered through Papa John’s in 2011. Papa John’s, unfortunately, did not have the foresight to add BTC to their balance sheet.

King in the Castle: Ripple is the fourth largest cryptocurrency by market capitalization. The Top 5 are as Follows:

1) Bitcoin

2) Ethereum

3) Binance Coin

4) Ripple

5) Tether

The Global Capitalist

Follow us on Twitter / Instagram

Follow Tom on Twitter

**If you subscribe through Gmail, please move us from your ‘Promotions’ tab into your ‘Primary’ inbox so you never miss a letter!**

**None of this should be taken as investment advice. Do your own research or speak with an advisor before investing in emerging or frontier markets.**

Market capitalization is an odd measure of value for cryptoassets. There is no other alternative, sadly.

On the day of listing, the stock rose as high as $424, giving the company a $100 billion valuation.

I’m aware this isn’t a new discovery. Apologies if this reads as a strawman argument.