Uber Rich

This week, we switch up the pace a little bit with a specific focus on Saudi Arabia's (in)famous Public Investment Fund.

Welcome to the Global Capitalist - A free newsletter on international developed, emerging and frontier markets viewed through the lens of history and culture.

Hey everyone — I just decided to hone in on one sovereign wealth fund this week. I may have something special in store for some of the remaining sovereign wealth funds.

Also — My apologies ahead of time but I’ll probably be pretty inconsistent with my writing throughout the holiday season. However, you all can expect some cool new changes to the newsletter starting in the new year!

Happy Thanksgiving! I am eternally grateful that you have included my work in your newsletter repertoire.

— Tom

Not a subscriber yet? Join over 300 weekly readers by subscribing below!

You can expect a new letter every Tuesday or Wednesday!

If you enjoy this newsletter, please consider sharing it on Twitter, Facebook, LinkedIn, or anywhere else people may enjoy it.

Additionally, I ask that you go ahead and “Like” this post (Click the Heart Symbol above) to help me get noticed by Substack’s algorithm.

Finally, if you’d like to support me financially, I ask that you purchase a hat from my Etsy page. This helps cover my costs incurred in researching, writing, and editing this letter every week.

Plus, I think the hats look pretty cool…

Thank you all for your continued support!

Last Week Briefing:

Asia Pacific Countries sign the largest free trade agreement in history. This deal, brokered between 15 different sovereign nations, including China, Australia, Japan, New Zealand, and the Association of Southeastern Asian Nations (ASEAN). — Bloomberg

U.S. President Donald Trump signed an executive order banning American investors from buying shares of Chinese companies tied to the People’s Liberation Army. This ban will come into effect on January 11th, 2021. — CNBC

The Republic of Peru is on its third president in two weeks as civil unrest consumes the South American nation. Beloved President Martín Vizcarra was unexpectedly impeached for “moral incapacity”, despite his anti-corruption agenda. — New York Times

Happy (belated) Diwali to my Indian readers!

This is part three of a series on sovereign wealth funds. To read parts one and two, please click the button(s) below:

The PIF

“Saudi Arabia… the heart of the Arab and Islamic worlds, the investment powerhouse, and the hub connecting three continents.”

In the first part of our Sovereign Wealth Series™, we touched upon the Saudi Kingdom’s lofty goal of building the world’s largest sovereign wealth fund.

Indeed — the Public Investment Fund of Saudi Arabia currently stands as the eighth largest sovereign wealth fund in the world, yet seeks to join Norway and China in assembling their own trillion-dollar investment behemoth. In order to achieve this feat, the Kingdom has marshaled the capabilities of the PIF to act as the engine driving the Saudi economy. As detailed in the PIF Program within the Vision 2030 initiative, the fund will seek to optimize their returns from energy and mining while simultaneously adding to the non-oil industries within the domestic economy. To the dismay of the al-Saud family (and the schadenfreude of the KSA’s opponents) the PIF has sputtered under their new governance, burdened by depressed oil prices and the dismal performance of SoftBank’s first Vision Fund. Assuming the fund has $390 billion in assets at the beginning of 2021, the PIF would need to reach an annualized return of 11% to reach $1 trillion by 2030. Should the PIF wish to become the world’s largest sovereign wealth fund, they would need to hurdle a ~12.5% return over the next 9 years — assuming the Norway Pension Fund and the Chinese Investment Corp remain the size they are today. In other measures, the PIF will have to add the asset equivalent of Switzerland’s GDP over the next nine years to fulfill this aspiration.

The fund was originally established in 1971 by royal decree of King Faisal Al-Saud with the goal of leveraging the Kingdom’s assets to harness the greater Saudi economy — specifically the lucrative petroleum and mining industries.

The decades prior were characterized by oil’s growing significance: OPEC was created and energy production went parabolic, more than doubling between 1960 and 1970. Naturally, the Saudi Kingdom was determined to capitalize on oil’s growing significance, given their geographic and cost advantages in producing oil. Not to mention, the United States was swiftly approaching the prophesized production peak, expected to hit by 1970. Meanwhile, Aramco (The Arab-American Oil Company) was still a byproduct of Standard Oil’s trust-busting, meaning that the company was predominately owned and operated by foreign (American) parties, despite the business being domiciled on the Arabian Peninsula. Gradually, the PIF grew their equity stake in Aramco, eventually becoming its sole owner in 1988. Under new ownership, the company was renamed Saudi Aramco, signaling the Kingdom’s hegemony over the world’s petroleum trade.

Black Gold: American oil production would surpass its 1970’s peak in what year? Answer below.

We’ve grown familiar with this kind of trajectory in the world of petroleum — a country (or company) strikes it big from an enormous oil boom (Read: the taxing oil embargoes of the 1970’s) that endow the country (or company) with comfortable wealth and resource. Eventually, however, the anticipated growth of the fund’s core businesses no longer provide the expected returns necessary to meet the company’s future obligations and goals. In this case, the Public Investment Fund, Saudi Aramco, and Saudi Arabia as a whole have been plagued from low oil prices since the early 2010’s. This, in turn, inspired the rollout of the Vision 2030 Initiative.

As detailed in the Public Investment Fund Program, the fund would be under control of the Council of Economic and Development Affairs (CEDA) with a written objective of diversifying the Kingdom away from the petroleum and mining industry. Prince Mohamed bin Salman, the Kingdom’s de facto ruler, would Chair the Board of Directors while Mohammed Al-Jadaan, the Minister of Finance, will lead the Investment Committee. In 2019, the PIF orchestrated the public listing of Saudi Aramco, selling 1.5% of the company for $26 billion, the largest public listing ever. To be clear, the PIF has not divested completely from oil and mining. Aramco remains one of the Kingdom’s largest holdings, alongside Maaden, the largest mining company in the Middle East, and Saudi Telecom, the largest communications company in the nation. The remainder of the portfolio, however, is guided by six different investment pools:

International Diversified

A diversified global basket of fixed-income, public & private equity, real estate investments.International Strategic

Long-term international direct and indirect investments focused on secular economic trends and industries of the future.Saudi Real Estate & Infrastructure Development

Investments catered towards priming the Kingdom for domestic and foreign direct investment.Saudi Equity Holdings

Private & public equities domiciled within the Saudi Kingdom.Saudi Sector Development

Unlocking access to underdeveloped industries through targeted investmentSaudi Giga Projects

Enormous, groundbreaking projects such as artificial islands, destination cities and amusement parks

Public Enemies: The Aramco IPO was the biggest public listing in history. Can you name the top 5 largest public listings in history? Answer below.

Of the listed themes above, Saudi Arabia’s Giga Projects are poised to be the most emphatic and exciting of the bunch. This division of the PIF is capitalized to fund transformational endeavors that seem to draw inspiration from science fiction novels. Take for example, NEOM, the $500B smart-city that is soon to be perched on the coast of the Red Sea. NEOM, which literally means “New Future”, is being built with the purpose of being the world’s most innovative city; supported by robotic workers, glow-in-the-dark sand, and an artificial moon. The city is said to be within a 4-hour plane ride of 40% of the world’s population and expects to lodge one-million ex-patriate citizens by 2030. The Kingdom insists that NEOM will be a distinct city under separate governance, as to extinguish any reservations about the Kingdom’s illiberal theocracy. In line with the Vision 2030 plan, NEOM is expected to add $100 billion to the Kingdom’s economic output over the next nine years.

In addition to NEOM, the PIF has invested a significant sum into Qiddya, Saudi Arabia’s premiere entertainment and leisure destination. Qiddya is being constructed for the purpose of reducing “leakage” from Saudi tourism expenditures. For context, Saudis collectively spend $23 billion a year on tourism expenses. Seldom, however, does that spending remain within the Saudi economy. Instead, affluent Saudis frequent destinations such as the U.K., U.A.E., and Indonesia (Keep this in mind next time you see a hyper-car parked on the street in London). Qiddya, in turn, is built for the purpose of retaining Saudi tourists and curating a domestic entertainment industry for their burgeoning population. Qiddya has contracted over 45 different projects, including the world’s largest Six Flags and the Kingdom’s first Formula One Circuit. The city is planning to open in 2023.

To the credit of the Saudi Kingdom, these are not pure vanity projects for the Crown Prince. Instead, the PIF has positioned these futuristic, unprecedented projects to transform the Kingdom into an international, cosmopolitan hub. Noticeably, the Kingdom has identified tourism as an incredibly potent method of promulgating their Vision 2030 initiative. Mecca and Medina, two of the holiest cities in the Islamic faith, have been targeted as opportunities for the Kingdom to increase their global tourism footprint. For starters, the PIF created Rou’a al Haram, a real estate development company specifically designed to manage the residential and tourism infrastructure around Saudi Arabia’s holy cities. By 2030, the holy city of Mecca is expected to have an additional 70,000 hotel rooms and another 9,000 residential units. The same can be said for Medina; the PIF seeks to add an additional 80,000 hotel rooms and 500 housing units by the end of the decade. In total, these projects expect to create 160,000 jobs and add over $2 billion to Saudi gross domestic product.

Saudi Sector Development is the foundation of the PIF’s mandate — responsible for incubating new companies to develop high-growth, yet domestically nascent, sectors of the economy such as tourism and defense. The Saudi Arabian Military Industries Company, or SAMI, is a state-owned enterprise tasked with developing the arms and defense sector of the Saudi economy. In line with the Vision 2030 Initiative, SAMI aims to create over 40,000 jobs and add roughly $3.5 billion to the Kingdom’s economic output by the end of the decade. American defense contractors — fear not! SAMI has signed several early agreements (MOU’s) with multinational defense companies including Boeing, Lockheed Martin, Raytheon, and General Dynamics. Currently, Saudi Arabia is the world’s third largest buyer of defense goods.

Moving along, the Saudi Investment Recycling Company (SIRC) is the Kingdom’s foray into the waste management industry. Prior to the inception of the SIRC, only 10% of Saudi waste was eligible for recycling. The remaining 90% is conventionally deposited in engineered landfills for gas extraction. Following the Vision 2030 plan, the SRC intends to recycle as much as 52% of their waste, creating nearly 77,000 new jobs and adding $32 million to GDP.

A quick break and a friendly reminder that this is a FREE publication. Should you wish to support my work, please consider subscribing or purchasing a hat.

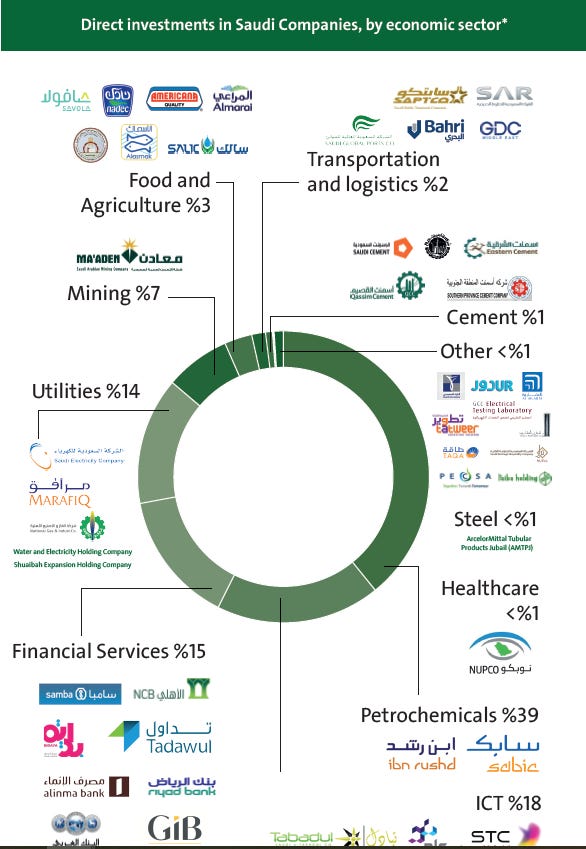

The Saudi Equity Holdings component of the portfolio represents the domestic holdings (both private and public) of the PIF. Given the PIF’s mandate and origins, this is one of the biggest components of the portfolio, owning and operating some of the Kingdom’s largest corporations. As a consequence, energy and mining comprise nearly 50% of this segment, reflecting petroleum’s dominance in the Kingdom’s economy. Besides Saudi Aramco, the fund has exposure to names such as Arabian Industrial Fibers Company (Ibn Rushd) and Saudi Basic Industries Company (SABIC). Telecom and technology stocks are the fund’s second largest domestic segment, comprising a fifth of the portfolio. Portfolio names include Saudi Telecom, the Kingdom’s largest mobile provider, Elm, an IT consulting and security company, and Tabadul, an AI-driven logistics company. Another third of the portfolio is dominated by financial and utility stocks. Companies populating this segment include National Gas and Industrial Company (GASCO), National Commercial Bank and Tadawul, the Saudi Stock Exchange. Finally, sectors including food, agriculture, steel, and cement round out the remaining 10% of the portfolio. With respect to food and agriculture, the Saudi Kingdom hopes to become food self-sufficient by 2030, producing over 31 million metric tons of food annually.

The Kingdom’s international strategic investments can be seen as some of the more diplomatic capital allocations by the PIF. These investments are commonly characterized by large co-investments alongside sovereign governments or multinational corporations for an externalized objective. For starters, the PIF was one of the first investors of BlackStone’s American Infrastructure Fund, committing $20 billion in capital. In addition, the PIF has committed $10 billion alongside Russia’s sovereign wealth fund, the RDIF, initiating the Russian-Saudi Investment Fund. This vehicle, similar to some of the PIF’s domestic objectives, is targeting opportunities in Russian infrastructure and agriculture. Finally, in 2015 the PIF allocated $2 billion towards French private equity funds with a focus on renewable energy and small industries.

Lastly, in a subtle nod to Pan-Arabism, the PIF secured a $500 million stake in Noon.com, an Emirati e-commerce platform headquartered in Riyadh, the Saudi capital. This investment was especially controversial, given the increasingly competitive landscape of international e-commerce. Noon’s founder, Mohamed Alabbar, asserted that his company would not be taken over by foreign interests, even proposing a rule requiring that Arabian e-commerce companies maintain 51% local ownership. Three years prior, Amazon.com acquired Souq.com, a regional e-commerce startup which was promptly renamed to Amazon.sa, the suffix for a Saudi web domain. Pundits opine that Alabbar’s proposal was a direct rebuke to Bezos’ encroachment on the Arabian Peninsula. Then again, could you blame him? To say there are opportunities in the Arabian e-commerce market would be an understatement. Over 440 million people reside on the greater Arabian Peninsula. In the Saudi Kingdom alone, nearly half of Saudi consumers shop online at least once a week while a quarter shop two or three times per week. Currently, online shopping comprises a meager 1.5% of the Kingdom’s total retail sales. By 2021, however, the Kingdom is estimated to do nearly $50 billion in online revenues.

The PIF’s activity in the international markets has been newsworthy, to say the least. The fund’s early commitment to SoftBank’s Vision Fund remains one of the biggest investment follies of the past decade. The first Vision Fund reportedly lost $27 billion, stemming from the collapse of portfolio names like WeWork, OneWeb, and Zume. While the precise P&L for the PIF’s stake is unknown, the Saudis were the largest investor in Masa Son’s brain-child, contributing $45 billion of the total $100 billion held under management. In 2016, the PIF took a ~5% stake in Uber Technologies at a $66 billion valuation. Assuming an original cost basis of $48.77, the company has seen an annual return of 0.45%, or 1.7% over four years. For context, Saudi inflation printed a little over 2% in 2016. Both figures fall far short of the PIF’s necessary 11-12% return threshold.

While the fund has lamented poor performance from the aforementioned holdings, the PIF has remained active amidst the coronavirus pandemic. In April of this year, the PIF announced a near 6% stake in Live Nation Entertainment and an 8.2% stake in Carnival Cruise Lines. Last quarter, the PIF disclosed a 4% stake in NovaGold Corporation, a Canadian exploration and mining company while liquidating big names such as Berkshire Hathaway and Bookings Holding Co.. Uber Technologies remains the fund’s largest American holding, occupying 37% of the portfolio. Interestingly enough, the fund’s second largest American holding is a $2 billion position in $XLU, the Standard & Poor’s utility-specific index fund. As of last quarter, the PIF has $7 billion invested into the American public markets.

I don’t think it has to be said, but the Public Investment Fund is by no means a benevolent entity. In fact, I’m one to believe that the Vision 2030 Initiative is a bunch of smoke and mirrors put in place to distract capital-hungry entities from the ethical paradoxes that come in doing business with the Saudis. Take for instance, the construction of NEOM. World leaders have been pressured to boycott the G20 Summit to protest the Saudi Kingdom’s expulsion of indigenous tribes. Last April, a member of the Howeitati tribe was shot for refusing to leave his home in the Tabuk province, the proposed site for the NEOM megacity.

Unfortunately, this is but a blip upon the laundry list of Saudi Arabian human rights violations. The Kingdom’s alleged involvement in 9/11, the assassination of Jamal Khashoggi, and the ongoing strikes on Yemeni civilians should be enough to disqualify the tainted capital of the Public Investment Fund.

Trivia

Black Gold: U.S. Oil Production initially peaked in 1970, as prophesized by M. King Hubbert. Thanks the emergence of fracking technology, U.S. oil production peaked again in March 2015 and then again in January of 2020.

Public Enemies: Sadly, the ANT Group IPO will not make this list… At least not this year. The five largest IPOs in history outside of Saudi Aramco are the following:

1) Alibaba Group — $26 billion raised

2) Agricultural Bank of China — $22 billion raised

3) Industrial and Commercial Bank of China — $22 billion raised

4) General Motors — $20 billion raised (post-bankruptcy)

5) NTT DOCOMO, Inc. — $18.4 billion raised

The Global Capitalist

Share TGC with 5 Friends, Win a Hat! Details can be found here.

If you’d like to support me financially, you can BUY a hat from me at Etsy.com.

Old letters can be found here.

Feedback, questions, or insights can be submitted here.

Follow us on Twitter: @TGC_Macro

Follow us on Instagram: @TGC_Macro

Follow Tom on Twitter: @TominalYield

**If you subscribe through Gmail, please move us from your ‘Promotions’ tab into your ‘Primary’ inbox so you never miss a letter!**

**None of this should be perceived as investment advice. Do your own research or speak with an advisor before investing in emerging markets.**