This Week In Emerging Markets (Vol. II)

News, data, and curated content from across the globe.

Welcome to This Week In Emerging Markets, a weekly wire for topics in, from, and about emerging markets.

Hey everyone — I’ll have a piece on cryptocurrencies & the FX Market out next week.

Enjoy the weekend.

Tom

South China Morning Post: Biden’s US$50 billion for US chip industry puts South Korea on the spot with China

Samsung and SK Hynix together control more than two-thirds of the market for memory chips that handle an ever-expanding sea of data, while in Taiwan, Taiwan Semiconductor Manufacturing Company (TSMC) supplies processors that power Apple’s iPhones and Google’s artificial intelligence technology.

——————————————————

South Korea’s semiconductor exports stood at US$99 billion in 2020, 60 per cent of which went to China and Hong Kong, he said.

TSMC and Samsung were among the companies invited to a White House discussion on Monday when Biden described his proposal, and this was widely seen by observers as an implicit message they should build more plants in the US.

Samsung is reportedly considering ploughing US$17 billion into a new chip plant in Austin, Texas, in addition to its foundry factory there.

Financial Times Opinion ($): Dollar threatens the emerging markets party

Before the pandemic, emerging markets interest rates were higher than those in major economies to compensate investors for taking more risks. Currencies in EM economies tend to be more volatile and vulnerable to sudden shocks than the dollar or the euro. But in 2020, central banks across the world moved in concert to slash rates to near zero, leaving little to tempt investors.

The key question is how they respond and how fast. Ed Al-Husseiny, a senior rates and currencies analyst at Columbia Threadneedle, says South Africa, Brazil and others will have to raise rates much faster than before to keep inflation in check and stop their currencies plummeting. But raising key rates too fast can kill off budding economic recoveries.

“The Fed is priced for no hikes this year but the market expects a four percentage point hike in Brazil, that’s how bad it is,” Al-Husseiny says. “EM central banks cut rates last year and they’re now paying the price.”

alizila: A Letter to Our Customers and to the Community

Author’s note: Alibaba was issued a $4 billion fine for anti-competitive practices last week. That figure is equivalent to 95% of $BABA’s 2019 CapEx, or 20% of EBITDA.

Today Alibaba Group received the Administrative Penalty Decision issued by the State Administration for Market Regulation (SAMR) of the People’s Republic of China. We accept the penalty with sincerity and will ensure our compliance with determination. On this occasion, the entire team at Alibaba would like to express our gratitude to the trust and patience that our merchants, consumers, partners and shareholders have given us. We would like to share our thoughts and plans for the long-term healthy development of our business in the future.

——————————————————

Alibaba would not have achieved our growth without sound government regulation and service, and the critical oversight, tolerance and support from all of our constituencies have been crucial to our development. For this, we are full of gratitude and respect.

Reuters: China factory gate prices rise by most in nearly 3 years as economic recovery quickens

China’s producer price index (PPI) rose 4.4% in annual terms, the National Bureau of Statistics (NBS) said in a statement, far above a 3.5% rise forecast in a Reuters poll and up sharply from a 1.7% increase in February.

—————————————

China’s consumer price index (CPI) rose 0.4% from a year earlier in March, the statistics bureau said in a separate statement, beating a median forecast for a 0.3% rise in a Reuters poll and returning to inflation after two months of price falls. CPI fell 0.2% year-on-year in February.

Falling food prices, especially for pork, continued to drag on consumer inflation last month, according to a note from an NBS official released alongside the data.

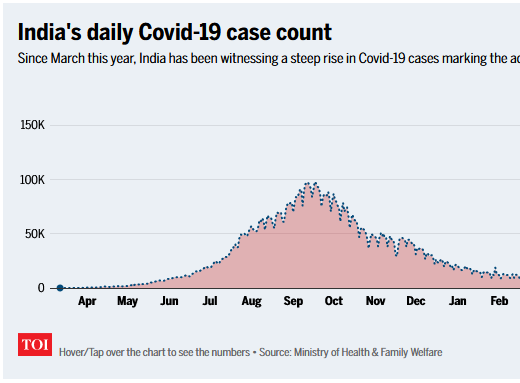

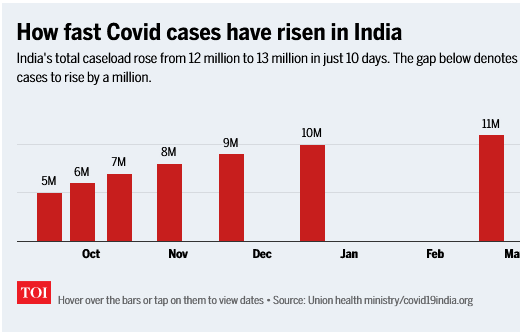

Keeping Up With India: The Cat is Out of the Bag

Tiger Global Management, the NY-based American Investment Fund, has been quite active in India of late. Just last week, they participated in four investments in the country that would value each company over $1B dollar - CRED on April 6th, Groww on April 7th, ShareChat and GupShup on April 8th.

—————————————

But Tiger isn't alone in propping up the venture market in India. This by far has been the buzziest and busiest the industry has been since 2015, though there is a key difference this time around - we might actually get a couple of public exits in 2021. If 2019 and 2020 were years when Seed rounds in the country were exploding, 2021 certainly seems like the year where Series A and growth stage firms are chasing companies who are growing quickly and on a breakout trajectory and pre-empting future rounds.

Baseball Updates

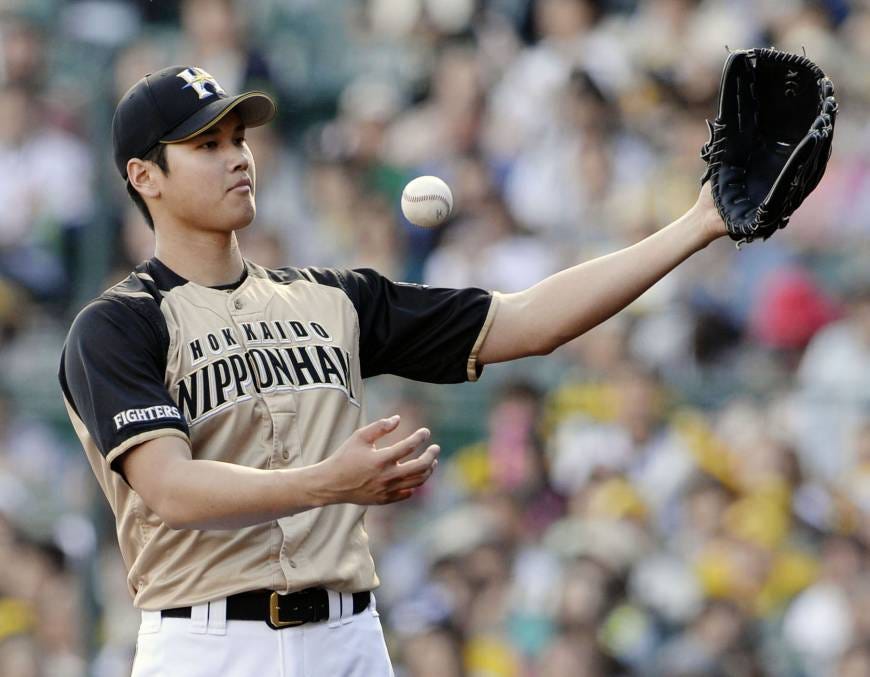

We’re Talkin’ Baseball: Los Angeles Angels Superstar Shohei Ohtani hails from which NPB Team? Answer listed below.

Twitter

Bloomberg Green: Secrecy and Abuse Claims Haunt China’s Solar Factories in Xinjiang

Almost no one outside China knows what goes on inside these factories, or two others elsewhere in Xinjiang that together produce nearly half the world’s polysilicon supply. State secrecy cloaks the raw material for a green boom that researchers at BloombergNEF project will include a nearly tenfold increase in solar capacity over the next three decades. Solar is set to grow by about a quarter this year after record installations in 2020 backed by almost $150 billion in investment. That means millions of homeowners buying solar panels everywhere face moral uncertainty: Embrace the green future, and you have no way of knowing if you're purchasing products made by forced labor and dirty coal.

—————————————

That corporate pride about uplifting the poor people of Xinjiang turns to secrecy when journalists show up. A policeman stood at the government office near the Xinte facility, and two men carrying leather briefcases stepped out from a gray car following behind. A guard at the complex said all the polysilicon executives were busy in a meeting. “Don’t take any pictures,” he said.

The Straits Times: Grab nabs world's biggest SPAC deal but traders hold their applause as market fervour eases

As it stands, the blockbuster tie-up would be the largest special purpose acquisition company (SPAC) merger ever, dwarfing the one announced between Lucid Motors and Churchill Capital IV in February, valued at US$24 billion. The transaction is expected to close in July and the company will trade at the Nasdaq with the catchy symbol GRAB.

But investors do not seem much interested in seizing this SPAC opportunity.

Shares of Altimeter SPAC rose on the day merger rumours surfaced, but modestly relative to others, and they have since fallen towards pre-announcement trading levels in the latest example of Spac market pain.

Trivia Answer:

Shohei Ohtani played for the Nippon-Ham Fighters for 5 seasons before joining the Angels.

The Week Ahead:

Sunday — 🇮🇱 Israeli GDP, 🇯🇵 Japanese Trade Balance, Industrial Production; 🇦🇪 UAE CPI;

Monday — 🇮🇱 Israeli Interest Rate Decision; 🇨🇴 Colombian Trade Balance;

Tuesday — 🇬🇧 British, 🇷🇺 Russian Unemployment; 🇩🇪 German, 🇨🇿 Czech, 🇰🇷 Korean PPI; 🇷🇺 Russian Retail Sales; 🇳🇿 New Zealand CPI; 🇮🇩 Bank Indonesia Policy Rate Decision;

Wednesday — 🇬🇧 British, 🇿🇦 South African, 🇨🇦 Canadian CPI; 🇵🇱 Polish PPI, Industrial Output; 🇨🇦 Bank of Canada Interest Rate Decision; 🇳🇱 Dutch Retail Sales;

Also: Tiradentes Day (🇧🇷 Brazilian Markets Closed); Hung Kings Festival (🇻🇳 Vietnam Markets Closed); Ram Navami (🇮🇳 Indian Markets Closed);

Thursday — 🇵🇱 Polish Retail Sales, 🇹🇼 Taiwan, 🇲🇽 Mexican, 🇭🇰 Hong Kong Unemployment; 🇦🇷 Argentine Industrial Activity; 🇯🇵 Japanese, 🇲🇾Malaysian CPI; 🇯🇵 Japanese PPI; 🇪🇺 ECB Interest Rate Decision;

Also: 🇮🇸 Icelandic National Day;

Friday — 🇸🇬 Singapore, 🇭🇰 Hong Kong CPI; 🇺🇸 U.S. 🇩🇪 German, 🇫🇷 French PMI; 🇬🇧 British, 🇲🇽 Mexican Retail Sales; 🇱🇹 Lithuanian, 🇹🇼 Taiwanese,🇦🇹 Austrian Industrial Production;