There is Always Money in the Banana Stand

This week, we begin our multi-part series on sovereign wealth funds. We explore how they were started, what their purpose is, and what they invest in.

Welcome to the Global Capitalist - A newsletter on emerging and frontier markets viewed through the lens of history and culture.

Hey everyone, sorry for the delay. This week we are starting a multi-part series on sovereign wealth funds. We will start off at home in the United States, with a focus on Alaska’s permanent fund, CalPERS, and UTIMCO.

This one is long, so feel free to skip around, or come back to it if you’d like. Thanks again for all your support!

— Tom

Not a subscriber yet? Join over 300 weekly readers by subscribing below!

You can expect a new letter every Tuesday or Wednesday!

If you enjoy this newsletter, please consider sharing it on Twitter, Facebook, LinkedIn, or anywhere else people may enjoy it.

Additionally, I ask that you go ahead and “Like” this post (Click the Heart Symbol above) to help me get noticed by Substack’s algorithm.

Finally, if you’d like to support me financially, I ask that you purchase a hat from my Etsy page. This helps cover my costs incurred in researching, writing, and editing this letter every week.

Plus, I think the hats look pretty cool…

Thank you all for your continued support!

Last Week Briefing:

The Nigerian Police Force disbanded the Special Anti-Robbery Squad, or SARS, after weeks of violent protests. #EndSARS trended on social media as victims of the rogue police force documented their stories of corruption and abuse. — Al Jazeera

Ant Group, the world’s most valuable unicorn, is expected to carry out their IPO next week. The company, owned by Chinese billionaire Jack Ma, is conducting a dual listing on both the Hong Kong and Shanghai exchanges and is expected to raise over $30 billion at a $280 billion valuation. — Wall Street Journal

Remember the Thailand protests? They’re still going — and getting worse. The Thai monarchy has gone as far to restrict local media coverage and ban gatherings of more than 5 people to try and quell the anti-government movement. — CNBC

The Bank of Mozambique has released a proposal that would endow the country with the 17th largest sovereign wealth fund in the world. The fund, which is expected to accumulate $96 billion in assets, will be bankrolled by the nation’s abundant natural gas reserves. — Bloomberg

“Funding Secured.”

Remember this? Such a simpler time.

For those unfamiliar with the story— Elon Musk’s erratic “Funding Secured” tweet sent tremors throughout the financial community. Who was this financier? What was the incentive for taking Tesla private? Is this even legal? Pundits and investors alike weighed the merits of his decision — not to mention — poking fun at his $420 price target.

Two years prior to Musk’s tweet, there had been some rumors that the PIF, or the Public Investment Fund of Saudi Arabia, had approached Musk about buying a stake in Tesla and urged Musk to take the company private. The fund had already purchased 5% of the company through the public markets as they believed the electric car maker could serve as a perfect hedge on their oil-dependent economy. As some of you may recall from our letter in April, the Kingdom of Saudi Arabia aims to surpass $2 trillion in assets by 2030 in order to become the world’s largest sovereign wealth fund. We’d soon discover that Tesla was just the tip of the iceberg for the PIF.

Over the last five years, the PIF has taken minority stakes in hot startups such as Uber, Magic Leap, and Jio Platforms, a subsidiary of Reliance Industries. Even amidst the coronavirus pandemic, the fund scooped up minority stakes in battered names such as Live Nation Entertainment and Carnival Cruise Lines. Despite this aggressive buying, achieving the title of world’s largest sovereign wealth fund will be no easy endeavor. As I write this, the PIF is only the world’s eighth largest sovereign wealth fund by assets. In the Middle East alone, the Kuwait Investment Authority (KIA) and Abu Dhabi Investment Authority (ADIA) dwarf the PIF by a collective $750 billion in assets. The largest sovereign fund in the world, the Norwegian Government Pension Fund, holds almost $1.2 trillion in assets, including 1.5% of all of the world’s publicly listed companies.

If it feels like you’ve heard a lot more about sovereign wealth funds lately you are definitely not alone. These vehicles have grown more prominent recently as rich, developing nations such as China and Saudi Arabia seek to utilize their state-held affluence in order to elevate the broader economy. Many funds, such as the PIF, were born out of the need to reduce a country’s reliance upon commodities, exports, or both! In channeling revenues from cyclical businesses (such as oil) towards other underdeveloped facets of the economy, a country’s government can reduce the severity of market contractions. Other vehicles, such as the Chinese National Council for Social Security Fund, aim to perpetuate their country’s wealth and endow their citizens with a healthy nest egg for future needs. Even though some of you may have never heard of these institutions, the impact of sovereign wealth funds on global markets is quite remarkable. The world’s top 10 funds hold nearly $9 trillion, or 69% of the world’s total assets. These types of funds are known to take stake in public (and private) equities, real estate, and even professional sports teams.

It’s called Soccer: Earlier this year, the PIF was reportedly shopping for a couple different European football clubs. Can you name them? Answer below.

The Alaskan Permanent Fund Corporation

The Alaskan Permanent Fund Corporation is the largest sovereign wealth fund in the United States and the 19th largest in the world, holding over $65 billion in assets. The fund, as depicted in the Simpsons Movie, is notorious for their eponymous Alaskan Permanent Fund dividend, or Alaska’s own universal basic income. Every permanent Alaskan resident will receive an annual check of roughly $1,000-$2,000— contingent upon the performance of the fund and the price of oil.

The Corporation, which is a quasi state-owned enterprise, was established as a means of drawing a boundary between state legislators and the state’s oil royalties. It is mandated in Alaskan constitution that 25% of the state’s oil royalties must be allocated towards the Permanent fund for future generations. Additionally, roughly 5% of the fund’s assets are escrowed for next year’s state budget. After all, you’re not going to stop the U.S. from drilling, so you might as well get paid for it.

All of that said, the market value of the fund has historically been married to the price of oil. Given recent slumps in the price for petroleum, the fund has been forced to reposition their portfolio to adapt in our new investment paradigm. In fact, 2018 was the first year in which oil royalties were not the largest source of revenue to the state of Alaska (The state does not levy an income, nor a sales tax, in case you were wondering.) This new capital structure has become a topic of contention within Alaska’s legislative bodies as the Permanent Fund dividend has been cut in recent years in order to maintain the fund’s longevity. Nonetheless, the corporation is committed towards maintaining Alaska’s fortune through meticulous capital allocation. The principal component of the fund is non-spendable, and invests in income-bearing instruments. Meanwhile, the earnings reserves component represents the earnings or interest from the rest of their portfolio and can be appropriated by Alaska’s legislators. These assets are commingled and invested into the same overall allocation. Generally speaking, the fund aims to outpace the growth of inflation, plus a specified premium, varying upon the asset class or strategy being measured.

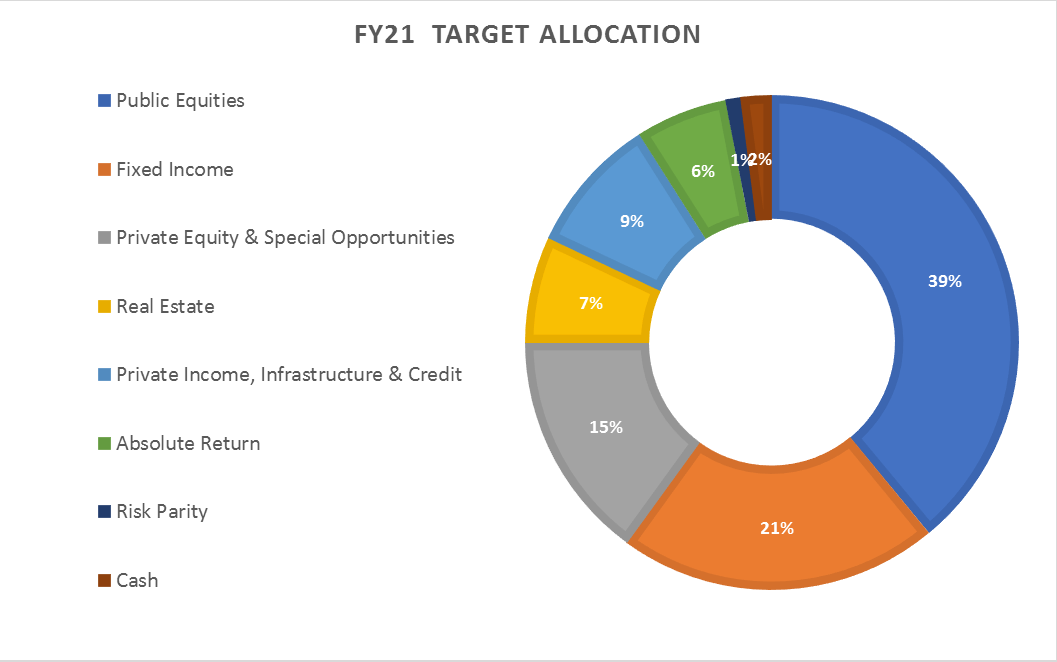

APFC Diversification Framework — FY2021

In order to perpetuate Alaska’s oil wealth, the corporation has replicated a college-like endowment model in their portfolio. College endowments (which, funny enough are just a different kind of sovereign wealth fund) are diversified in a way in which the the fund will last in perpetuity. As you can see above, the corporation aims to create exposure across several different asset classes spanning six different continents. In the real estate portfolio, the fund owns several different kinds of properties, including office space on Park Avenue, shopping centres in the U.K., and apartment buildings in Austin. In total, the fund owns 54 different properties between Europe and the United States with an aggregate value of about $4 billion. Retail properties comprise about 40% of the real estate portfolio.

ALEGRO SETÚBAL — One of APFC’s commercial properties, located in Portugal.

Public equities comprise the lion’s share of the fund’s total assets, totaling $25.5 billion spread across 11,000 holdings. Some of the fund’s largest positions include Microsoft Corporation (~$400m), Tencent Holdings (~$250m), and Reliance Industries (~$45m). Within public equities, the fund has nearly $10 billion invested in international equities, with $3.7 billion allocated towards emerging markets and $6 billion towards developed markets. Of the emerging market allocation, $1.7 billion is invested in the BRIC countries while Japanese companies comprise $1.6 billion of the developed segment. According to CIO Marcus Frampton, the fund’s ample liquidity enabled their allocators to deploy $2 billion into the equity markets amidst the decline in March. Unfortunately, however, this positioning kept the fund mostly out of the meteoric global equity performance in 2019.

Another cardinal feature of the endowment model is a sizable allocation towards alternative and special opportunity investments. The fund has committed $18 billion, or roughly 15% of the portfolio towards private equity and special opportunities, also known as PESO. The fund will co-invest alongside other private equity groups with the goal of taking stake in private enterprises such as Achieve 3000, an education technology company, and Varo Energy, a European mid-stream company. Similarly, the fund will directly invest into attractive businesses including Senvion, a wind-turbine manufacturer, and JUNO Therapeutics, a biopharmaceutical company. Within the PESO allocation, the fund aims to achieve double digit annualized returns over a 5-10 year time horizon. Then again, those who deal in the private markets will assure you that illiquidity is a feature, not a bug.

All in all, the fund finished up just over 2% for the fiscal year ending in June of 2020. The fund’s total assets dwindled to $65.3 billion, down from $66.3 at the conclusion of FY2019. The swift injection of capital in the battered equity markets helped the fund’s performance for FY2020, although the problem still remains: Oil is not yet obsolete, yet its receding utility will certainly be an obstacle to navigate in the future for the Permanent Fund.

Pure Alpha: The Permanent Fund, in an unprecedented move, added what hot commodity to their portfolio for 2021?

CalPERS

Depending upon who you ask, the California Public Employees Retirement System (CalPERS) may or may not be a sovereign wealth fund. By technical definition, it varies upon the governing body. The U.S. Treasury, for example, defines a sovereign wealth fund as an investment vehicle funded by foreign exchange and managed separately from official reserves. Meanwhile, the OECD classifies a sovereign wealth fund as any pool of assets owned and managed directly or indirectly by the government to achieve national objectives — I could go on, but you get the point.

For this newsletter’s sake, let’s just say that CalPERs is a sovereign wealth fund. In that case, CalPERS is the largest sovereign wealth fund in the United States and the ninth largest in the world by assets. The fund, which manages over $400 billion in assets, is more valuable than the collective value of the top twenty college endowments in the U.S.. That in itself, however, poses a separate problem. CalPERS is reportedly underfunded by about $350 billion, stemming from nearly two decades of underperformance. Without digging too much into the politics of CalPERS entitlements, the fund is a glaring example of how difficult institutional asset management truly is, especially in the face of floundering interest rates. The fund, following a roaring bull market in 1999, decided to increase the plan’s entitlements given their asset surplus. The raise in entitlements would be offset by an annualized growth rate of 8.25%. In 2003, that expected rate was cut to 7.75%. By 2011, the fund lowered their target returns to 7.5%. In 2016, return expectations were lowered again, all the way down to 7%. Given this shortfall, the fund has explored several different methods of boosting their annual returns, including a heightened allocation towards private equity and the use of leverage (borrowing) in their investments. That said, CIO Ben Meng, who championed the idea of a higher private equity allocation and the use of leverage, left his role in August of this year, citing ethical conflicts of interest. Regardless, the fund’s struggles still remain present and significant as ever.

CalPERS HQ — Sacramento, CA

Let’s talk asset allocation: As of September 30th, 2020, the fund held $216 billion (52%) in public equities, another $27 billion (7%) in private equity, $110 billion (27%) invested in fixed-income instruments, and finally $43 billion (10%) worth of real assets. This underexposure towards private equity is peculiar, even after the departure of Dr. Meng. Then again, much of the segment’s meager performance (at least, relative to other asset classes) can be attributed to the fund’s decision to forego reinvestment in their existing deals. Of the fund’s measurable private equity deals, their average deal yielded an internal rate of return (IRR) of just under 10% while half of their deals returned less than 9.5%, annualized. For context, the Cambridge Associate Private Equity Benchmark has returned 13.5% annualized over the last 10 years. However, that underperformance has not deterred the fund from making a bid for the Italian Serie A soccer league, alongside private equity giants like Bain Capital and Advent.

Within public equities, the fund has invested $78 billion in international stocks, including a $900 million stake in Alibaba Group and a $90 million holding in Mercadolibre Inc.. Besides that, the fund’s largest positions resemble that of the S&P 500 Index. Microsoft, Apple, and Amazon comprise a little under $10 billion, or 4.5% of the total public equity portfolio. This is to be expected. The fund has been vocal about their desire to compress external management fees in favor of an internally managed indexing strategy. During the second quarter, however, the fund demonstrated their conviction in pharmaceutical stocks by multiplying their stakes in Gilead (+141%), Regeneron (+355%), and Vertex Pharmaceuticals (+273%). All in all, CalPERS public equity segment returned a disappointing 0.6% for the fiscal year ending in June, 2020.

Amongst the fund’s fixed income holdings, $11 billion, or 10% of fixed income is allocated towards sovereign debt securities, not to mention, a quarter-billion position in foreign currencies. Interestingly enough, the New Taiwan Dollar (~$35m), the Japanese Yen (~$26m), and the Indian Ruble (~$41m) comprise over 45% of their foreign currency reserves. Similarly, the fund’s sovereign debt portfolio includes $100 million worth of Brazilian 10-years, $400 million in Russian OFZ’s, and $317 million in fixed-rate Mexican bonos. With respect to developed market treasuries, the fund’s largest issuers include the United Kingdom, Canada, and Japan. On top of sovereign debt, the fund has nearly $22 billion in mortgage-backed security exposure, indicative of the fund’s appetite for risk amidst our compressed interest rate environment.

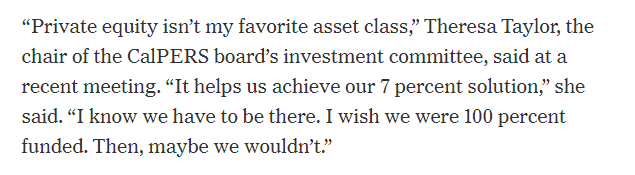

As mentioned above, CalPERS (and California’s legislature as a whole, frankly), is in need of some serious soul-searching. The deficiencies within their fund have sent ripple effects throughout the greater Californian economy. Social services, specifically school districts and fire departments, have been forced to lay-off staff in order to protect existing worker’s benefits. Irregardless, the fund is committed (albeit reluctantly) towards Dr. Meng’s partiality to private equity and distressed debt.

New York Times — 10/19/20

UTIMCO

The University of Texas/Texas A&M Investment Management Company (UTIMCO) is the second largest sovereign wealth fund (ex. public pensions) in the United States and the 24th largest in the world. The Company acts as the endowment for both the University of Texas and Texas A&M school systems — managing $51 billion in assets. Under the umbrella of UTIMCO are four different endowments, the Permanent University Fund (PUF), the Permanent Health Fund (PHF), the Long Term Fund (LTF), and the Separately Invested Funds (SIF). The assets of the PHF and the LTF are pooled together and are invested into the General Endowment Fund (GEF). Sadly, there is no West Texas Fund (WTF) — that would be pretty funny.

In contrast to UTIMCO’s endowment funds, their operating funds, as the name suggests, are built to assist the university system in covering their financial obligations every year. Generally speaking, these funds are predominantly invested into liquid instruments such as money market mutual funds, short-term treasuries, or cash, and are held for under a year. Meanwhile, endowment funds comprise the vast majority of UTIMCO’s assets and are generally capitalized for long-term appreciation, with an investment horizon ranging from 5 to 30 years. Capital gains and interest accrued within the endowment funds are cycled over into the operating funds through the Available University Fund (AUF).

Kyle Field @ Texas A&M

Amongst UTIMCO’s family of funds, the Permanent University Fund (PUF) is the largest, totaling over $24 billion in assets. The PUF, established in 1876, was originally bankrolled by mineral and grazing leases issued upon the resourceful land grants given to the University of Texas. Skeptics were initially uninspired by the barren lands of West Texas, asserting that oil revenues would be meager, if existent at all. Jokes on them, I guess — by 1925, the fund pulled in $4 million a year in oil revenues.

As characteristic of a Texan, the PUF is an iconoclast amongst the institutional investment community, mainly because of their early adoption of gold, beginning in 2009. Funny enough, the fund credited gold, in tandem with their private equity and alternatives investments for their performance in fiscal year 2019, concluding at the end of August last year. That isn’t really saying much, however. The fund returned a pedestrian 4.48% during the same period. Then again, if my math is correct (and assuming no changes were made) the PUF will see an unrealized gain of 25% in their gold position for FY2020.

Another intriguing aspect of the PUF’s portfolio is their allocation towards foreign markets, relative to domestic securities. Of their public equity holdings, $1.9 billion (70% of public equity), is invested in foreign common stock, compared to $776 million in domestic equities. Additionally, the company has over $820 million allocated towards EM public equity funds, totaling about 23% of public, externally managed funds. In the same vein, the fund holds an aggregate of $2.15 billion in fixed-income instruments. Of that segment, $800 million is invested into foreign government and provincial debt, while U.S. treasuries comprise another $742 million. Last, but not least: Hedge funds and private equity dominate the composition of the PUF, totaling over $12 billion of invested assets. $1.1 billion is invested into private, emerging market equity, trailing behind general private equity ($1.6B), venture capital ($1.7B), natural resources ($1.5B), and real estate ($1.8B).

The second largest fund managed by UTIMCO is the General Endowment Fund (GEF) which manages over $15 billion in assets. Together, the GEF and PUF comprise over 70% of UTIMCO’s assets under management. As hinted above, the GEF acts similar to a mutual fund, in the sense that the PHF and LTF pool their assets in order to purchase “units” of the GEF.

The GEF has seen nearly a 20% boost since the conclusion of last fiscal year, tallying yet another year of double digit growth. The fund, like the PUF, credited their outperformance to gold, private equity, and investment-grade fixed income. What’s more, the GEF also has a large preference to international equities compared to domestic. Foreign common stock comprises $1.1 billion, or 73% of the fund’s entire common stock portfolio. In contrast, emerging market equity funds comprise half a billion dollars, or a paltry 5% of total public equity funds. Within the private equity segment, emerging markets funds only comprise 15%, or $600 million worth of assets.

UTIMCO can boast one of the more successful track records amongst American public endowments. Their performance has remained resilient, even in the face of falling oil prices and capitulating interest rates. What’s more, the fund’s willingness to be contrarian has enabled the fund to capture gains in overlooked secular trends, including the mercurial performance of gold in 2020.

I will have to do another one of these when their FY2020 report comes to light!

Roughnecks: In which city was Texas’ first ever oil drill? Answer below.

Trivia

It’s called Soccer: According to Bloomberg, the PIF proposed a £250 million bid for a stake in Newcastle United, a football club in the English Premiere League. Similarly, the fund was reportedly interesting in purchasing Olympique de Marseille, a club in Ligue 1, France’s Premiere League.

Pure Alpha: The APFC, according to CIO Marcus Frampton on the Angelo Robles Podcast, apparently acquired a small stake in gold. Frampton cited UTIMCO’s conviction in the commodity as a reason to include it in their portfolio.

Roughnecks: While oil has been found and used in Texas since the 1500’s, the first oil drill, located in Melrose, TX, wouldn’t be erected until 1866.

The Global Capitalist

Share TGC with 5 Friends, Win a Hat! Details can be found here.

If you’d like to support me financially, you can BUY a hat from me at Etsy.com.

Old letters can be found here.

Feedback, questions, or insights can be submitted here.

Follow us on Twitter: @TGC_Macro

Follow us on Instagram: @TGC_Macro

Follow Tom on Twitter: @TominalYield

**If you subscribe through Gmail, please move us from your ‘Promotions’ tab into your ‘Primary’ inbox so you never miss a letter!**

**None of this should be perceived as investment advice. Do your own research or speak with an advisor before investing in emerging markets.**