The Healthiest of the Poor

The Republic of Cuba lays claim to the world's best healthcare services, but at what cost?

Welcome to the Global Capitalist - A newsletter on emerging and frontier markets viewed through the lens of history and culture.

Hey everyone, welcome back! I hope you all had a nice Labor Day Weekend.

This week, I wanted to circle back to our conversation on the dollar while touching upon the conundrums of the Cuban economy.

Not a subscriber yet? Join over 200 weekly readers by subscribing below!

You can expect a new letter every Tuesday!

If you enjoy this newsletter, please consider sharing it on Twitter, Facebook, LinkedIn, or anywhere you read business news.

Additionally, I ask that you go ahead and “Like” this post (Click the Heart Symbol above) to help me get noticed by Substack’s algorithm.

Finally, if you’d like to support me financially, I ask that you purchase a hat from my Etsy page. This helps cover my costs incurred in researching, writing, and editing this letter every week.

Plus, I think the hats look pretty cool…

Thank you all for your continued support!

Last Week Briefing:

Disney’s widely anticipated Mulan release did not come without controversy. #BoycottMulan trended on social media last Friday as activists shone a light on Disney’s troublesome partnership with the Xinjiang Province. Similarly, the actress portraying Mulan, Liu Yifei came under fire for comments back in August that indicated her support for Chinese and Hong Kong police amidst the Hong Kong Protests. — Wall Street Journal

South African GDP fell an annualized 51% in the 2nd Quarter, marking the worst recession in South Africa since 1990. The South African Reserve Bank has cut interest rates by 3% this year to help cushion their floundering economy. — Bloomberg

Big Hit Entertainment, the talent agency which represents BTS, the world-famous Korean boy band, conducted an initial public offering last week on the Korean Exchange. The offering raised over $800 million and valued the company at nearly $4 billion. — Financial Times

Aaaand… Sold! On Sunday, it was announced that Oracle Corporation would be acquiring TikTok’s American business from Bytedance. This deal, however, is only just getting started. Bytedance has reportedly said that they will not allow the American entity to use TikTok’s proprietary algorithm. Meanwhile, the deal still awaits approval from the People’s Republic of China as officials in Beijing will surely seek to secure their technological interests. — Bloomberg

Dollar Milkshake

Something that a lot of people found very perplexing was the fact that the dollar actually appreciated in March this year. That’s right. On March 22nd (ironically, also the day before the U.S. equity markets ‘bottomed-out’) the dollar index printed at 102.43, a level not seen since January, 2017. Considering the actions of the Federal Reserve, one would conclude that the price action of the dollar defies the laws of supply and demand. After all, more dollars should equate a lower value for the dollar, right?

Well, yes — that would be the case if our economy operated in a vacuum. The global economy, on the other hand, does not operate in a vacuum. In fact, our entangled, globalized economy can help us understand the dollar’s resilience. Recall our Dollar Mania issue: the U.S. dollar’s status as the reserve currency has embedded the dollar deeply into our global commercial system. Sovereign countries, businesses, and individuals around the world will routinely demand U.S. dollars (or dollar-denominated assets) because — odds are — they hold or owe dollar denominated debt. Also — recall that most international commodities transactions are settled in dollars. That means, if a Japanese shipping company was paying a German energy provider, chances are that transaction was executed in U.S. dollars. As a consequence of this structure, an estimated 60% of global foreign reserves are held in U.S. dollars.

This international monetary structure place a natural price floor under the dollar. In other words, because the dollar is so deeply intertwined into our global economy, the technicals of the market will support its value even when fundamentals won’t. This idea isn’t necessarily anything new. In fact, Brent Johnson of Santiago Capital coined the term, “Dollar Milkshake Theory” in which he tries to delineate this phenomenon. Johnson’s theory, in short, explains that in times of economic turmoil, allocators and investors alike will demand dollars as a short term, “safe haven” asset. This, in effect, enables the dollar to “suck up” the remaining liquidity in a foreign market as liquid securities (Think: currency, short-term treasuries) are converted into U.S. dollars or dollar-denominated assets.

It’s easier to conceptualize in practice. Put yourself in the shoes of the Argentine Republic: You are about to default on your (dollar-denominated) debt for the tenth time in 200 years and the Argentine peso is in free fall. What do you do? Simple — you should hold, or acquire U.S. dollars, of course. This can be accomplished several ways, but is primarily done by selling Peso-denominated assets and converting those pesos into U.S. dollars. This conversion translates into a bid for the U.S. dollar, support its price as many dollar-seekers chase relatively few dollar-sellers.

Federal Reserve Board Press Releases, 2020

Now, let’s rewind to the beginning of this year. As soon as the coronavirus revealed itself as a legitimate threat to the global economy, countries frantically rushed to get their hands on U.S. dollars. As we know, sovereign treasury departments want to bolster foreign reserves, to facilitate debt servicing and maintain fiscal solvency. Similarly, higher levels of foreign reserves demonstrate healthy monetary hygiene and allows governments to negotiate favorable terms on their debt. In that same vein, we saw individual investors abandon their convictions in the stock market as they naturally sought shelter in the dollar. Lastly, multinational corporations exhausted their sources of liquidity to cushion against a prolonged economic shutdown. This liquidity would come in the form of — you guessed it — U.S. dollars. All of this may appear bearish for the global economy, yet ironically rings bullish for the U.S. dollar.

In conclusion: Yes — the U.S. Federal Reserve “printed” an exuberant amount of money. Then again, so did the Bank of Japan, European Central Bank, Bank of England — You name it. All of the world’s major financial institutions flooded the economy with liquid currency because they understood the forthcoming liquidity crunch. Unfortunately, the demand for liquidity did not stem from the demand-pull inflation desperately desired from central bankers. Rather, this liquidity was sucked up by dollar denominated assets as newly-created money went towards servicing debt and reinforcing fiscal stability. Additionally, what was meant to ease the capital pressures on foreign nations actually exacerbated them, as developing currencies depreciated against the dollar.

Conceptually, emerging currencies should appreciate as the value of the dollar dwindles. That hasn’t necessarily been the case this year, however. So far, emerging currencies have floundered against the dollar, reinforcing Johnson’s Dollar Milkshake Theory. In addition, one could argue that the dollar’s steadiness reflects the hierarchical structure of our global economy. Emerging and frontier countries are characterized by heightened exposure to economic downturns, as they don’t celebrate the same sophistication that advanced economies do. The United States, up until the end of July, had effectively replaced over 100% of monthly income for many unemployed or furloughed workers. Germany, in a similar effort, has continued to distribute relief checks for affected workers in the tourism, leisure, and travel businesses. Unfortunately, developing countries don’t have the same leeway as developed countries do when it comes to deficit spending. Rather, they must rely upon the assistance of international financial institutions (IFIs), such as the World Bank and IMF to backstop their sputtering market.

Despite the unprecedented level of relief underwritten by international financial institutions, this year’s economic crisis has unearthed the dichotomy between “developed” and “developing” markets and how they are expected to handle crises. Some developing economies, who typically rely upon monetary relief, have outwardly rejected the help of the IMF, citing years of ineffective guidance. The IMF can boast a long list of achievements, yet their glaring failures have often repelled those who need their help the most. To the credit of the IMF, a lot of this negative outlook has political origins. Recently, the People’s Coalition in South Africa released a statement condemning the the advice of the IMF, not wanting to succumb under the economic imperialism of Western nations. Similarly, Egypt had rejected a loan from the IMF back in February, claiming that the $12B loan they received in 2016 had failed to make any material improvements in the Egyptian economy.

Throughout history, the IMF has worked closely alongside a plethora of developing nations to help them get on track towards economic viability and ‘developed market’ status. In doing so, the IMF tends to implement a conservative fiscal policy regime, primarily designed and orchestrated by the U.S., E.U. and U.K.. Additionally, the IMF seeks to cultivate new business landscapes, and shore up the capital base of sovereign governments. Again, not all of these have been successful or popular. In Chile, Augusto Pinochet’s experiment with the IMF and the Chicago Boys not only failed to kick-start the Chilean economy, but initiated an era of hyperinflation in the Chilean peso. Similarly, countries most affected by the Asian Financial Crisis will criticize the IMF for their role in creating the crisis and also failing to foresee the ripple effects of their actions.

Faith in the IMF has resurfaced this year, albeit not in the best of times. The coronavirus pandemic has forced allocators and investors towards the “safe haven” U.S. dollar. However, looking forward, how will trust play a role in our global financial system? If, in 10 years from now, Argentina is facing yet another debt default, why would they seek the help of the IMF? How can we ensure that sovereign nations can trust us, relative to our geopolitical adversaries?

I don’t know, to be honest. That’ll have to be a story for another time.

Alias: The 1997 Asian Financial Crisis also goes by what gastronomical name? Answer at the bottom.

Havana-na-na-na

I apologize for getting that song stuck in your head…

Before I continue, I should clarify that Cuba is not an emerging market. I don’t think any faction of Cuba’s economy really warrants a position in yours, or anyone else’s portfolio. I’m choosing to write about Cuba because I’m under the impression that there are some misplaced, romantic assumptions about the Cuban economy that need corrected. Furthermore, I want highlight the trade-offs that exist in every economic regime, yet are more glaringly obvious with Cuba’s state-planned economy. Remember, this publication is titled The Global Capitalist, not the Global Statist, so you already have a feel for what I’m getting at here. All in all, there are little to no reasons to be bullish on the Cuban economy.

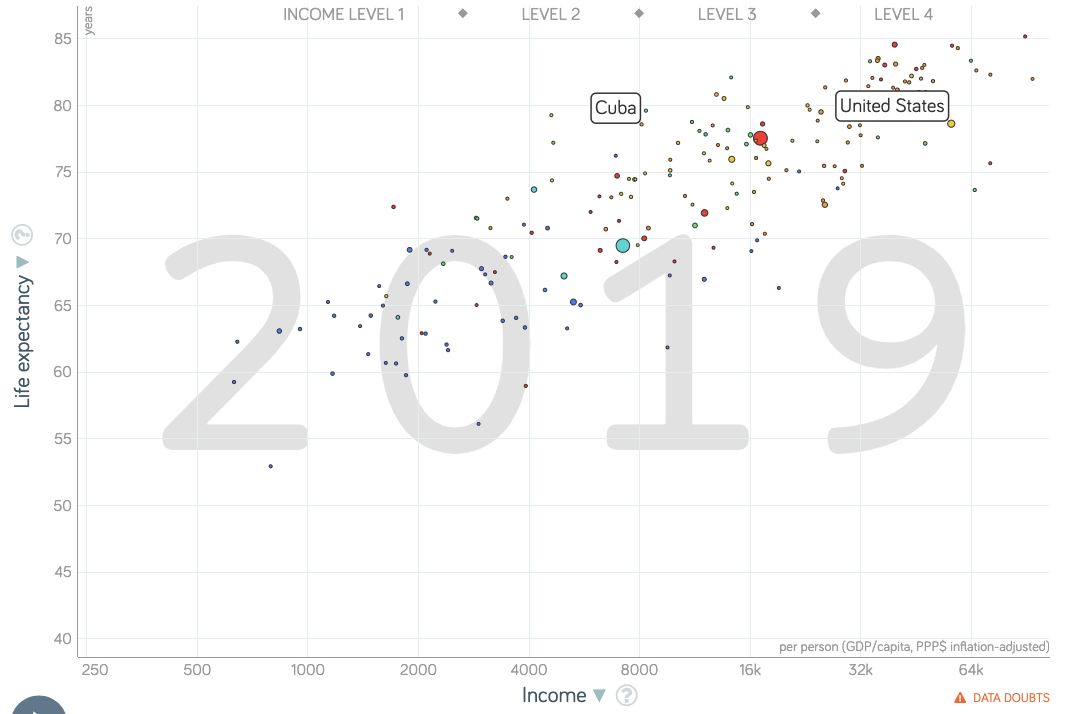

Data/Chart from Gapminder

Hans Rosling, the author of Factfulness, adequately described Cuba as the “healthiest of the poor”, meaning that the nation claims one of the healthiest, longest-living populations yet fails to provide a basic economic infrastructure for their citizens. There are countless stories of skilled professionals such as doctors, teachers, or nurses eschewing the long waits of a food rationing line in favor of fishing, or hunting for their own food. Cuban grocery stores and pharmacies are often characterized by empty shelves and little variety. The scarcity of Cuban nutrition has created a lucrative black market for small delicacies such as chicken, beef, and pork. In fact, Cuba’s penal code has an entire chapter dedicated to the crime of slaughtering a cow, and slaughtering a cow would warrant a greater punishment than committing homicide.

Embargoes levied by the U.S. in the 1950’s halted all automobile exports to the Cuba, hence the large fleet of vintage cars

To add insult to injury, Cuba’s healthcare statistics are barely reliable, as there are no private media outlets and it is illegal to criticize both socialism and the Cuban government. Supporters of Cuban healthcare will be swift to cite the spread between Cuba’s and the U.S.’ infant mortality rates, but how accurate are those numbers?

Not very. A 2015 study revealed the ethical dilemma Cuban doctors face on a daily basis. Physicians and hospitals are penalized for reporting unfavorable healthcare statistics. Thus, Cuban physicians are often incentivized to fudge numbers and manipulate healthcare data. In the case of infant mortality rates, Cuban physicians had reportedly reclassified neonatal deaths as late fetal deaths, compressing the infant mortality rate and lifting the life-expectancy rate. Similarly, physicians have been said to perform abortions without consent of the mother, as this too compresses the infant mortality rate. In Cuba, there are an estimated 72.8 abortions performed for every 100 live births. In other words, over 40% of pregnancies are terminated in Cuba.

Also — don’t be fooled by Cuba’s widely-praised “medical tourism” industry, either. Dr. Suchlicki, a researcher at the University of Miami’s Institute for Cuban Studies explains that the Cuban healthcare is split into two tranches. That is, foreign tourists are given the best care at the country’s best medical tourism facilities because they pay in hard, foreign currency. Beneath this gilded veneer of functional healthcare system is a dire reality for Cuban citizens. Hospitals are falling apart, frequently losing power and kept in derelict conditions. Cuban patients are also expected to bring supplies such as toilet paper, light bulbs, and bedsheets to the hospital, as healthcare workers are frequently stealing supplies and equipment to sell on the black market. Could you blame them? The average Cuban makes a little under 800 Cuban pesos, or about $30, per month. For context, Cuban state-run pharmacies reportedly sell cortisone cream at $25 a tube.

A Cuban hospital bathroom — Photo by Ivan Garcia

A Cuban Supermarket — Photo by Jen Lin-Liu

So what’s the deal? Why is Cuba so backwards, from an American perspective? For starters, Cuba has been steadfast in sticking to their Marxist, communist roots, even long after the collapse of the Soviet Union. Since then, they have encapsulated the struggles of country alienated by the U.S., burdened by cumbersome embargoes and severe emigration. Recently, however, Cuba has begun to take baby steps towards liberating their country’s economy.

Raul Castro, the brother and military leader under the infamous Fidel Castro, is mainly credited with introducing new luxuries into the Cuban economy. That is, of course, on a relative basis. In 1993, Cuba legalized small, private businesses and allowed the U.S. dollar into the country. The year after that, they would introduce what is known as the Cuban Convertible Peso (1:1 versus the dollar) to facilitate their integration into the global economy. Similarly, Castro lifted the equal wage mandate and legalized the use of cell phones and personal computers. This signified a monumental rebuke to Fidel’s Communist policies of the 1960’s. Even Fidel, towards the end of his life, lamented the failures of Cuba’s socialism system. Cuba, towards the end of the 1990’s, would ultimately opened their doors to the tourists of the world, attracting foreign capital and challenging the long-held socialist status quo. The E.U. would lift their embargoes on Cuba in 2008, not too long before President Obama would extend an olive branch in what we know today as the Cuban-Thaw.

In 2018, Cuba ratified a new constitution, ushering in a new era of (relative) optimism and economic proliferation. To be clear, the new constitution remains committed to the principles of socialism and Marxism, yet introduces some liberating reforms in the private sector. For starters, the constitution finally recognizes private property and restricts the state’s involvement in private transactions. The president is also bound to a strict term limit, hopefully barring another 70-some-odd years with a Castro in office. What’s more, the new constitution hones in on foreign direct investment as a crutch towards economic growth and societal development. American investors will be hard to convince, however. President Trump has resurfaced the contentious Title III, in which Cuban expatriates would be allowed to sue the Republic of Cuba for loss of private property. This will almost certainly sour the diplomatic relations between the U.S. and the small Caribbean nation.

At the end of the day, the problems evident in Cuba’s economy are not unique to Cuba. Every economic system and government must deal with the reality of scarcity. That is, all resources are finite in theory. It is the job of policymakers, capitalists, and allocators to minimize the opportunity cost of pursuing one objective in favor of another. In Cuba’s case, they strove for the world’s premiere healthcare system at the cost of mass starvation, absent personal liberties, and economic stagnation. Time will tell whether or not Cuba’s new constitutional experiment will prove beneficial.

Thirst Quenchers: One of the world’s most popular beverages is banned from only two countries, one of them being Cuba. What is this beverage? What is the other country? Answer at the bottom.

Trivia

Alias: The Asian Financial Crisis was also notoriously known as the Tom Yum Kung Crisis

Thirst Quenchers: Coca Cola is only banned in two countries. Those countries are Cuba and North Korea.

The Global Capitalist

Share TGC with 5 Friends, Win a Hat! Details can be found here.

If you’d like to support me financially, you can BUY a hat from me at Etsy.com.

Old letters can be found here.

Feedback, questions, or insights can be submitted here.

Follow us on Twitter: @TGC_Macro

Follow us on Instagram: @TGC_Macro

Follow Tom on Twitter: @TominalYield

**If you subscribe through Gmail, please move us from your ‘Promotions’ tab into your ‘Primary’ inbox so you never miss a letter!**

**None of this should be perceived as investment advice. Do your own research or speak with an advisor before investing in emerging markets.**