Prince of Persia

Where would you like me to place your 1,000 barrels of oil, sir?

Welcome back everyone. While the referrals software appears to not get along with SubStack’s platform, I have successfully broke ground on the very first TGC hats!

* - Logo & lettering will be embroidered.

Subscribers who share this newsletter with five (5) other people will receive a free Global Capitalist hat. They cannot be subscribers already.

After you’ve shared the link, please email the.global.capitalist.news@gmail.com a list of the emails you sent the newsletter to.

Once the emails are in my system, I will be reaching out to you personally for shipping details.

This will be one of many giveaways to come!

(If you’d rather just buy one, they will be for sale for $20.)

- Tom

I welcome feedback, questions, or insights here.

Follow us on Twitter: @TGC_Research

Follow Tom on Twitter: @TominalYield

Last Week Briefing:

South Africa announced a $26 billion stimulus package to cushion the economy’s stagnation amid COVID-19.

The Mexican Central Bank executed an emergency rate cut on Tuesday, cutting rates 50 basis points down to 6%.

Oil Futures briefly traded below $0/bbl for the first time ever. What does it mean for you? We explore in the next section.

Hot Potato!

On Monday, the May 2020 crude oil contract closed negatively for the first time ever. If you’re confused as to what that means, you’re not alone. There were a ton of memes this week about “negative oil prices” which isn’t necessarily accurate. A futures contract represents a legal obligation between two parties to buy or sell a specific commodity at a predetermined price. Generally speaking, a futures contract is used by companies in the commodities business to “lock-in” a specific price in the future, effectively hedging their expected earnings against fluctuating prices in the underlying commodity. A futures contract also requires that the owner “take delivery” if the contract is held until expiration. Monday, April 20th, was the expiration date for the May futures contract.

The negative price for the contract reflects the halt in the global economy. As oil storage units are struggling to find buyers for their excess supply, producers are similarly having trouble finding people to store their oil. The price action on Monday reflected a “hot potato” of sorts as both retail and institutional investors desperately sold-off their contracts to avoid the obligation of receiving 1,000 barrels of crude oil. One Reddit trader learned the hard way…

The oil futures market has calmed since, although they are not out of the woods quite yet. Traders will be keeping a close eye on the June 2020 contract as debates over re-opening the economy may hinder demand for the resource.

Ahlan wa Sahlan!

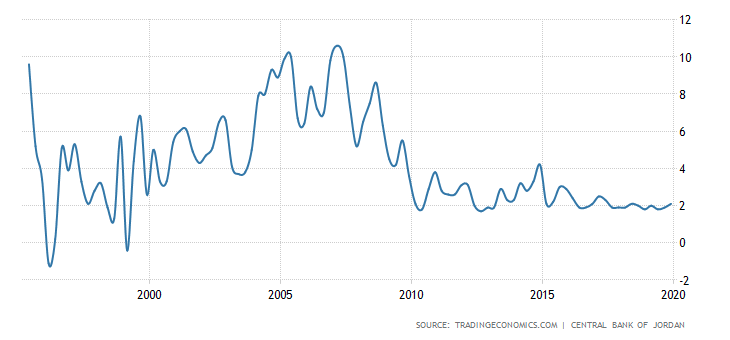

I bet by now you’re pretty tired of hearing me speak about oil. Fortunately for you, Jordan does not share the same petroleum aptitude of their Middle Eastern peers. The Jordanian economy has been in a standstill since the early 2010s. Interestingly enough, Jordanian GDP grew an average of 6% from 2000-2010, although it quickly dropped to an average of under 2.5% since 2011.

Located in between Israel, Palestine, Saudi Arabia, and Syria; Jordan is wedged amongst a hotbed of civil unrest. The Arab Spring in 2011 brought upon a wave of pro-democracy protests across the region. Across the Middle East, protestors were forced to flee their home countries to avoid political persecution. Jordan, which is a constitutional monarchy, faced their own array of protests as Jordanian citizens were fed up with high inflation, unemployment, and cronyism. Although, it can be argued that the Jordanian economy was hurt more by its staggering influx of Syrian and Palestinian refugees. As a matter of fact, the World Bank estimates that it costs Jordan $2.5 billion per year, or 25% of government revenues, to accommodate the the volume. The cost of this population boom is reflected in the country’s debt-to-GDP ratio. Not to mention, the country’s dependence upon foreign energy imperils the country amid political instability. In fact, the natural gas pipeline running from Sinai to Jordan has been the target of a handful of terrorist attacks from the Islamic State.

Jordanian Yearly % GDP Growth since ‘95

Jordanian % Debt-to-GDP since ‘95

This is not to say the Jordanian economy is poor. As a matter of fact, Jordan’s dependence upon imported energy has forced the country to build a formidable services and manufacturing sector. The Arab Bank, one of the oldest, largest financial institutions in the Middle East, moved to Amman, Jordan in the 1940’s to establish their new HQ. Since then, multinational banks from across the world including Citi, Kuwait National Bank, and Standard Chartered have set up operations in Jordan. In fact, Jordan’s banking sector comprises nearly 20% of GDP.

Jordan has also brokered free-trade agreements with developed economies such as the U.S., European Union, and Singapore to bolster their manufacturing capacity. Manufacturing consists another 20% of the Jordanian economy. Popular brand names such as GAP, Victoria’s Secret, and Hanes can be found sporting tags reading: “Made in Jordan”. They have also been members of the World Trade Organization since 2000, indicating their commitment to liberalized, free trade.

Jordan also specializes in a niche service known as medical tourism. Jordanian hospitals surpass international health quality standards at fractions of the cost for U.S. healthcare. Doctors are accredited by U.S. and U.K. standards and are even taught in English to break any linguistic barriers. According to the World Bank, Jordan has is the best medical tourism destination in the Middle East and is top 5 in the world.

The Treasury — Petra, Jordan

Jordan’s plan for economic growth into the future has to do with their focus on sustainable energy sources. As a matter of fact, the country has made large investments into renewable energy. By 2025, the country hopes to have a fully operational, commercial, nuclear reactor. This technological advantage stems from their historical stress on domestic defense, as the King Abdallah Design and Development Bureau (KADDB) acts as the state-owned incubator for their defense industry. In fact, the KADDB exports its equipment to over 42 different countries.

Lastly, consumer technology is the fastest growing segment of Jordan’s economy. Smartphone penetration is 76%, putting it at par with the median of global, developed economies. The Jordanian Kingdom has unraveled a multitude of top-down policies aimed at priming their economy for a technological overhaul. One Million Jordanian Coders is an example of one of the government initiatives which mandate that students learn a basic foundation of coding skills. In fact, the government has been able to capitalize upon the remote learning element of COVID-19, as students are encouraged to refine their programming skills.

Third Times the Charm: In Jordan, it is considered polite to refuse three times before accepting what?

The Elephant in the Room

Home to over 80 million people, the Islamic Republic of Iran is the hegemonic counterpart to the Saudi Kingdom. In the Middle East, Iran is the largest country by population and the second largest economy by GDP, behind Saudi Arabia. The country is also home to the second largest natural gas reserves and the fifth largest proven crude oil reserves in the world. Like its Middle Eastern contemporaries, Iran seeks to reposition their economy away from the oil trade. Although, the country has found themselves in hot water over geopolitical tensions. For starters, the Iranian government has been accused of sponsoring terrorism and developing nuclear weapons. As a result, the country has been eschewed from the global marketplace since 2006 when international trade sanctions were placed on the country.

In 2015, the Obama administration brokered a deal with the Iranian government, granting limited U.S. surveillance of their nuclear operations in exchange for the removal of sanctions. The Iranian economy began to show signs of recovery only until the Trump administration dismantled the nuclear deal in 2018 and reinstated the crippling sanctions on their economy. President Trump has been vocal about his goal to bankrupt the Iranian government. He has been quoted saying he’d like to bring their ‘oil exports to zero’. The violent gap between the U.S. and Iran can be attributed to a complicated history dating all the way back to the origins of the Cold War. Although, it’s hard to look past Iran’s attitude towards Israeli, one of America’s strongest allies, to understand why the U.S. is so adamant on curtailing their nuclear power.

Tehran, Iran

To understand Iran’s instability, one should consider the events of the Iranian Revolution in the late 1970’s. The country had been undergoing radical, industrialized reform in all facets of Iranian life. The Iranian coup d’etat in 1953 had ignited a trend of Westernization to the country. It is widely understood that the coup d’etat marked the first time that the United States and Great Britain overthrew a democratically elected leader in the Middle East. While this doesn’t seem very characteristic for those Western nations, keep note this was amidst the rising influence of the Soviet Union. The West did not want to risk allowing a communist power control of their energy reserves. Mohammad Reza Pahlavi was the first Iranian shah who shared the ideologies of the West and rejected the zeitgeist of the Soviets. He would ultimately flee Iran in 1979, marking the last time Iran was ruled by a shah.

The shah was vehemently unpopular amongst the Iranian people. The oil wealth which was promised did not materialize, the religious establishment was concerned with secular reforms to legislation, and the shah ruled under a hostile, authoritarian rule. Ayatollah Ruhollah Khomeini, an exiled victim of the Pahlavi reign, began to build an audience of opposition to the shah. As an Islamic nationalist, he proclaimed that the corruption of Iranian culture and a degrading economy was the fault of the West, specifically the U.S. and Israel. On top of that, he accused the shah of conspiring with the West for their own benefit. His audience grew so large and powerful they would flock to the streets by the thousands with posters of his face. Not long afterwards, they would successfully overthrow the Pahlavi Dynasty. The existing monarchy was swapped out with Khomeini’s proposed Islamic Republic. The Ayatollah would be the Supreme Leader and operate under a theocratic republic.

Pro-Khomeini protests in Iran — 1979.

Recently, the Iranian—U.S. tensions have been underscored by Iran’s attempt at acquiring nuclear weapons and their sponsorship of rogue terrorist groups. Groups such as Hamas, Hezbollah, and Al-Qaeda have been allegedly tied to Iran’s defense force. The Iranian Revolutionary Guard Corps (IRGC) has been the tool in which the Islamic Republic has bestowed its power over its neighbors. Responsible for maintaining Islamic integrity in the region at any cost necessary, the IRGC carries serious political and economic sway within Iran. The Quds Force, the warfare intelligence unit within the corps, has frequently come under scrutiny by U.S. intelligence for their role in funding rebel militant groups. The Trump Administration has taken a much more hawkish approach to curtailing the IRGC. Just this past February, Qasem Soleimani was assassinated via drone strike, driving a wedge deeper into the divide between the two nations.

Iran’s current day economy suffers from a common symptom of political risk known as “Brain Drain”. Brain drain is the phenomenon in which talented, skilled labor leaves their domestic country for better, safer opportunities elsewhere. The IMF claims that nearly 25% of Iranians with tertiary education live in OECD countries and nearly 5 million Iranians have left since 1979. The Iranian government has made it extremely difficult for foreign investment to prosper, as foreign investment is clunky and restrictive due to the inherent distrust in outside influence.

Inflation in Iran — since ‘50

Economic sanctions have caused the country to clearly struggle as of late. The World Bank predicts the economy contracted 9% in 2019 and will contract an average of 1.4% per year until 2021. On top of that, the Iranian economy The Iranian economy is ailed by hyperinflation (pictured above). The country will have to work on making amends with some of the world’s largest importers if they hope to generate the abundance of wealth that the Ayatollah once promised.

Roger That: Ayatollah Khomeini’s correspondence with protestors became synonymous with what audio device?

New Kid on the Block

The smaller Arabian Peninsula states all tell share a similar story. Kuwait, like its neighbors, has created a prosperous economy from their abundant petroleum resources. The country reportedly holds over 6% of the world’s oil reserves and 85% of the country’s export revenues come from petroleum products. The country ranks 7th in the world in GDP per capita and has the most valuable currency in the world, relative to the U.S. dollar. Kuwait, like Qatar and the Emirates, suffers from a disproportionately high foreign workforce. Roughly 70% of Kuwaiti workers are ex-pats. On top of that, the public sector has crowded out private investment, with 80% of the working population working for the government. New Kuwait 2035 represents the top-down initiative towards reshuffling their economy.

Kuwait City, Kuwait

Kuwait’s economy is uniquely plagued by its mismanagement of land. The state allocates all of the land (most of it being desert) to government agencies who then sell it to third parties. As you could probably guess, that can get pretty messy. Kuwait has some of the most expensive land prices in the world. As a matter of fact, plots of land in Kuwait sell for an average of 80% of housing value, compared to the worldwide average of 30%. On top of that, only Kuwaiti nationals are allowed to own land. While that issue is inherently problematic, the problem is exacerbated when immigrants comprise a majority of a population. Kuwait is also home to the Kuwait Investment Authority (KIA), the oldest sovereign wealth fund in the world. The KIA acts as the vehicle in which Kuwait has attempted to diversify its economy away from the petroleum trade. As a matter of fact, the Future Generations fund allocates 10% of oil profits towards infrastructure and social welfare programs. The KIA is also the parent company of the Kuwaiti National Bank. Kuwait’s prowess in the financials sector is anticipated to be the vehicle which propels them into the 21st century.

KIA Headquarters in Kuwait

Kuwait is the latest addition to the MSCI Emerging Markets Index. Although, Kuwait’s inclusion into the benchmark hasn’t fully materialized. MSCI announced on April 15th that any portfolio changes would be postponed until November given an uncertain economic outlook. MSCI, however, noted that Kuwait still holds all of the necessary qualifications for membership. For example, 65% of Kuwait’s population is under the age of 35, indicating a growing population and consumer base. What’s more, Zain Mobile, the Kuwaiti-based global telecom company, is an example of some of strong multinational corporations coming out of Kuwait. Zain has grown to a nearly $4 billion valuation with over 49 million customers in North Africa and the Middle East.

Kuwaiti financial services are another position of strength for the country. The two largest banks, Kuwait Finance House and the National Bank of Kuwait, have been actively taking minority stakes in burgeoning companies and providing financing for government infrastructure projects. The country, however, fails to provide a comfortable vehicle for foreign direct investment. As a matter of fact, while the country does not rely upon FDI, they have demonstrated a goal towards attracting more investment to help diversify their economy. Kuwaiti investors will be hoping for calmer oil prices before the MSCI’s semi-annual review.

Flying High: What is the state bird of Kuwait?

Give it Time

Iraqi protestors in Baghdad.

Iraq is certainly far from an ideal investing environment. Following its toil with ISIS and other radical groups in the region, Iraq is focused on rebuilding its infrastructure and joining its neighbors in transforming its economy.

Iraq is extremely dependent upon oil — even compared to its Middle Eastern peers. 93% of their government budget is derived from oil revenues. Once upon a time, it was the second largest economy in the Middle East. Now, it is the sixth largest economy, struggling to keep pace with their Persian counterparts. That said, I’d like to highlight a handful of facts about Iraq for investors to keep an eye on:

Iraq is home to over 40 million people, making it the fourth largest country in the Middle East.

Nearly 60% of the Iraqi population is under 25 years old.

Iraq holds the fifth largest proven oil-reserves in the world.

Iraq’s economy is slowly rebounding from the war against the Islamic State. That said, its reliance upon oil should hurt restructuring efforts in the coming months. On top of that, poor infrastructure and corruption will anchor their centrally-planned economic activity. In fact, the government has been asking for donations to keep its public sector afloat. The dichotomy between Iraq’s public sector and their struggling private sector will remain an issue moving forward amid coronavirus closures. I’d expect monetary relief from the World Bank or IMF in the coming weeks as frontier economies continue to struggle.

What I’m Reading/Watching:

Watching (TV): Silicon Valley: I’ve never actually watched it all the way through. I think it’s one of the funniest shows in television history. I’ve never laughed harder.

Reading (Blog): What the Hell is Going On?: David Perell writes on our current ecosystem and what exactly the hell is going on.

Listening (Podcast): Invest Like the Best with Patrick O’Shaughnessey: The latest episode features Manny Stotz, a prolific frontier markets investor. There are some great insights in how COVID has affected some frontier economies.

Listening (Audiobook): Dune by Frank Herbert. The old Sci-Fi tale is being rebooted in theaters this upcoming December and I’m stoked to see what Denis Villeneuve has in store.

Meme of the Week:

Trivia Answers

Flying High: The state bird of Kuwait is the falcon. In fact, falcons can be found frequently throughout Kuwait including in nature, on stamps, even on planes.

Roger That: Khomeini’s lectures were recorded and distributed via cassette tape. The cassette tape became synonymous with his movement as it was the only way to dodge the shah’s surveillance of mass media.

Third Time’s the Charm: It is polite in Jordan to refuse a meal three times before accepting.