Welcome back everyone! This week we will be covering Eastern Europe; Specifically Russia, Poland, and Turkey.

In case you missed last week’s letter, we are now giving away FREE hats to subscribers who share this newsletter to five (5) friends.

Rules

Subscribers who share this newsletter with five (5) other people will receive a free Global Capitalist hat. They cannot be subscribers already.

After you’ve shared the link, please email the.global.capitalist.news@gmail.com a list of the emails you sent the newsletter to.

Once the emails are in my system, I will be reaching out to you personally for shipping details.

(The hats will also be on sale for $20)

In case you’re new here:

Last Week Briefing:

The Reserve Bank of India (RBI) injected 500 billion rupees (~$6.5 billion) into the Indian economy to help shore up their economy amid COVID-19.

South Korea reported no locally transmitted COVID-19 cases for the first time in two months, per the FT.

The Brazilian supreme court launched an investigation into President Jair Bolsanaro’s dealings with Brazilian police.

Mexico & the European Union agreed to a new free-trade agreement, lifting duties on virtually all exchanged goods.

Let’s talk about PPP… (No, not that one.)

When looking at the numbers coming out of the global economy, economic data can often seem rather arbitrary. After all, how are we expected to gauge economic prosperity from only a handful of metrics? Surely, people aren’t losing sleep over what the PMI numbers will be this quarter.

If you recall from our first letter, we traditionally use Gross Domestic Product (GDP) as a barometer for economic output. However, critics may argue that GDP is a flawed metric for comparison, given the fact that government spending can overcompensate for a dormant private sector. When comparing economic output through the lens of foreign exchange, we use purchasing power parity, or PPP, to eliminate price differences. The underlying logic behind PPP essentially says that the exchange rates in foreign currencies are derived from the prices of similar goods. That means, a $5 beer in the U.S. versus a $10 beer in Hong Kong would indicate an exchange rate of 2 Hong Kong Dollars to every 1 U.S. Dollar.

Some of you actually may be vaguely familiar with the concept of PPP. The Economist releases their Big Mac Index each year. The survey has been given the moniker ‘Burgernomics' and aims to measure the difference in exchange rates by comparing prices of a McDonald’s Big Mac. Obviously, the metric is not perfect. Foreign exchange rates are influenced by many indirect elements such as international duties, political instability and monetary policy. Nonetheless, the Big Mac Index is another reminder of how interconnected our globalized economy really is.

Big Mac Index from 2017 (P500 = $10 USD)

More Money, More Problems: Can you name the top three countries with the most expensive Big Macs? Answer will be at the bottom.

With Love

“Any attempt to calculate [Putin's net worth] won’t succeed. He’s the richest person in the world until he leaves power.”

-Sergei Pugachov, aka: ‘Putin’s Banker’

Russia’s economy operates in the wake of Post-Soviet perestroika or, “restructuring”. In 1985, Communist Leader Mikhail Gorbachev sought to liberate the centrally-planned Soviet market as economic stagnation ailed the country. He believed the fundamentals of communism were strong, although the Soviet economy needed a few tweaks to help the working class. Gorbachev explicitly did not want to replicate the capitalism of the West, although he ultimately discovered the structural flaws of the Soviet economy to be worse than expected. He then advocated for partial privatization of state-owned industries and economic liberalization. These policies would be contentious amongst his communist contemporaries as they accused him of peddling the ideals of Western capitalists. The haphazard shift towards a free market lead to a drastic increase in wealth inequality and the ascent of ‘New Russians’.

New Russians was a pejorative term used to describe the oligarchs who disproportionately gained from privatization efforts. The select few who grew wealthy did not reinvest their capital back into the Russian economy. Rather they would invest elsewhere with freer markets, a phenomenon called capital flight. Gorbachev would eventually become the scapegoat for Russian cronyism as his political opponents accused him of being a capitalist puppet. Boris Yeltsin, alongside other supporters of Communism, would ultimately oust Gorbachev and place him on house arrest in Crimea. Gorbachev was the last leader of the Soviet Union.

Communist Party Leader & Soviet President Mikhail Gorbachev

One of the economic overhauls attempted by the Russians during perestroika was the voucher privatization program. The Russian government tried to alleviate wealth inequality by issuing privatization vouchers to their citizens. Citizens could acquire ownership in newly-privatized Russian enterprises by redeeming the voucher. Alternatively, they could sell the voucher for cash. What’s more, the Russian government lifted all price controls and trade restrictions in hopes of stimulating their sluggish economy. This swift overhaul was known as “shock therapy”, understanding that the economy would correct itself in the short term, but prosper over the long run. While the attempts for economic liberalization were earnest in theory, the asymmetric results from the voucher program, amongst other privatization endeavors, is demonstrative of Russia's struggle with its economic identity.

Saint Basel’s Cathedral — Moscow Russia

2001 ushered in the era of President and former KGB Agent, Vladimir Putin. Putin is often conspired to be the “richest man in the world” due to his omnipresent influence in Russia’s largest corporations. Although, if you were to ask the Kremlin, you’d receive a much more modest response. Regardless, it is impossible to ignore Putin’s role in the state-private partnership of the Russian Federation.

Russia’s privatization had been a futile endeavor. ‘New Russians’ who remained scattered within major industries inhibited progress towards divesting government ownership. Ministers of energy, finance, and transportation actively protested the divesture of these parastatals as they claimed it would jeopardize Russia’s strategic interests. On top of that, the 2008 financial crisis halted the divestitures as market conditions presented an unfavorable valuation for their assets.

The decade following the crisis showed much more success in privatization as the country struggled to recoup tax revenues. In November of 2019, Russia sold off a chunk of Russian Railways, Russia’s largest state-owned transportation company, for nearly $1B. March 2020 marked an important feat as the Russian government finally divested over 50% of Rosneft, the state-owned oil exploration company. Rosneft was a contentious candidate for privatization as Igor Sechin, the company’s CEO, refused to sell until oil traded over $100/bbl. This specific divestiture had been in the works for decades, although saw momentum in 2013 when British Petroleum (BP) purchased a ~20% stake in the oil explorer.

The world’s largest country by landmass, Russia is home to the eighth largest oil reserves and is the third largest oil producer in the world. Not to mention, Russia exports over 5 million barrels of oil per day, earning them the title of second largest exporter in the world. The Russians have shown concern over the price of oil given the budget’s dependence upon the mineral for tax revenue. Petroleum products comprise over 50% of tax revenues and over 60% of GDP.

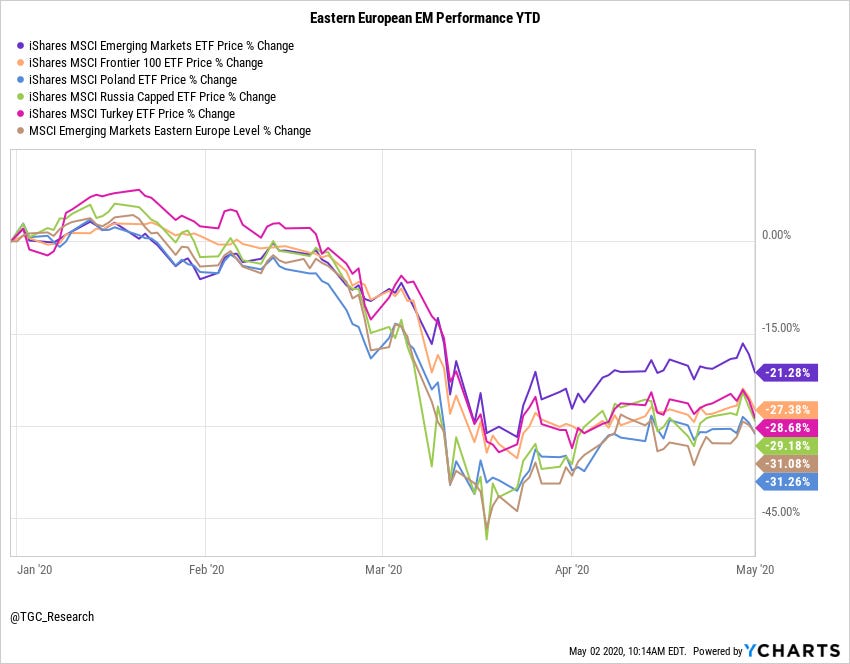

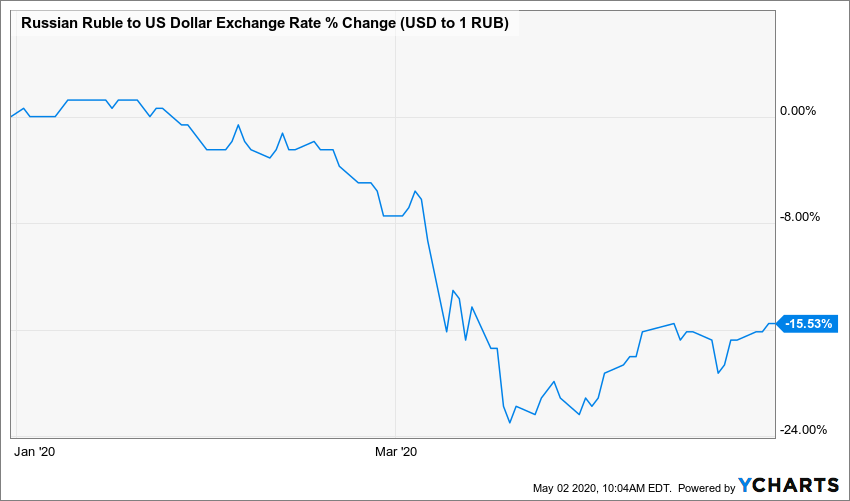

The Russian Federation found itself back in the conversation over oil as they failed to compromise upon a production deal with OPEC+ amid the COVID-19 crisis. Interestingly enough, OPEC+ was formed in 2016 as a way to incorporate Russia into the policy-making of petroleum exports. This shortfall was felt in the Russian markets, as foreign assets fleeing the country knocked the Ruble down 15.5% year-to-date.

The Russian economy, all things considered, has shown resiliency since the turn of the century. Buoyed by a growing services sector, high oil prices in the early 2000’s, and recent government divestitures, Russian GDP is the 6th largest by PPP and is the 11th largest in nominal terms. In 2015, the Russian ruble was floated after years of pegging the currency to the Euro, indicating Russian independence in global trade.Russia holds the fourth highest level of foreign reserves, indicating ample solvency for imported goods. On top of that, Russian Debt-to-GDP is a mere 14.6%. The Russians have built an intimate trading relationship with China in the wake of crippling sanctions from the U.S., Japan, and E.U..

The annexation of Crimea in 2014 is emblematic of Russia’s sporadic nature. The Obama Administration, alongside European allies levied sanctions against the Russians in hopes of retrenching their imperialist actions. At the end of last year, the E.U. announced that the sanctions would continue until the end of 2020. Investors have been concerned about Russia’s reversion to the authoritarian, centrally-planned economy it once employed in the late 80’s. That said, the country’s focus on returning state-owned assets to private ownership should prove to be a tailwind for Russia’s emerging economy.

As Seen on TV: President Mikhail Gorbachev was featured in an advertisement for which popular American business? Answer will be at the bottom.

Slow & Steady Wins the Race

“The economy was an alcoholic for 1,000 years. Then, over the weekend it sobered up and won a marathon.

-Marcin Piatkowski, World Bank economist, on the Polish economy

Before I continue, I should clarify that Poland has seen such incredible growth that it isn’t exactly classified as an emerging market. In 2018, Poland was promoted to developed market status per FTSE Russell. However, In the eyes of Standard & Poor’s, Dow Jones, and MSCI, Poland is still an emerging market.

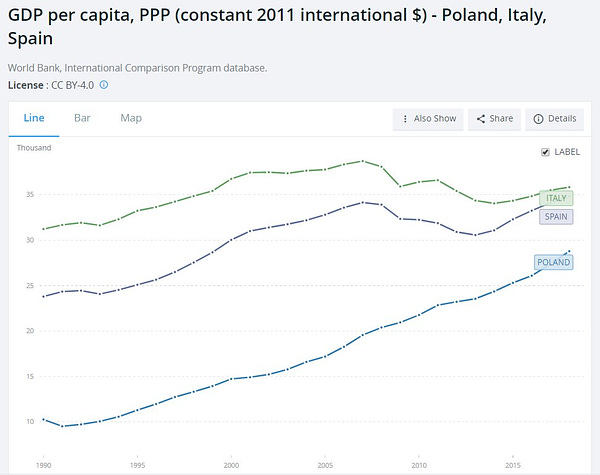

Nonetheless, the former member of the Soviet bloc is the fastest growing economy in Europe and the only Soviet alumni to achieve average annual growth higher than the G7. I understand that may not be saying much, given Europe’s stagnant economy the past decade. Still, Poland’s astronomical growth is nothing to turn your nose up at. Poland is the sixth largest economy in Europe and the twenty-fourth largest economy in the world.

Poland is especially unique due to their near seamless transition from communist nation into free market economy. While other Soviet alumni suffered from political instability and oligarchy, Poland’s meticulous transparency ensured they would not make the same mistake. Piatkowski (mentioned above) argues that other former-Soviet countries hastily divested their government assets in attempt to ramp up their economic growth. These assets were ultimately sold to private investors at poorly measured, cheap valuations. By the time Poland had decided upon it’s divestiture, ten years had passed and fair market values had already been established for their assets.

The country has enjoyed average GDP growth of over 3.5% in four of the last five years, even surpassing 5% annual growth in 2018. In addition, GDP per capita has grown 6% on average, per year since 2000. Poland struggled with unemployment initially during their ‘shock therapy’ experiment but now boasts a fruitful labor market. Unemployment checked in at 3.27% as of February, 2020. As a matter of fact, Poland suffers from a shortage of labor as there are not enough people to fill open job opportunities. Consequentially, Poland has seen a massive influx of ex-pat workers, many of them Ukrainians. In fact, the Polish government issued over 600,000 residence permits in 2018. That said, immigration has become a contentious issue in Polish politics.

Warsaw, Poland

In spite of the coronavirus pandemic, Poland is scheduled to hold a presidential election this upcoming Sunday, May 10th. This election is especially vexed given the outcome of the Parliamentary elections last October. The Prawo i Sprawiedliwość (English: the Law and Justice Party) is a populist Christian-orthodox democratic party. The group won the highest vote share ever recorded in parliament since Polish independence in 1989.

The Law and Justice Party leans to the left fiscally but to the right on social issues. The party is known for being one of the least liberal parties in the entire European bloc, opposing issues such as LGBT rights and abortion. Although, the party gained immense popularity through a universal basic income program for families. The program, titled Family 500+, grants every Polish household zł500 (Poland złoty, $120 in U.S. dollars). Despite Poland’s meteoric rise to European juggernaut, many of the country’s citizens feel disenfranchised due to the massive influx of foreign workers. The party’s hawkish stance on immigration appeals to the lower classes while the existing economic prosperity pacifies the upper class. Nonetheless, supporters of the European Union are concerned about the party’s recent shady tactics used to pass legislature and remain in power.

Pro EU Rally in Poland

Despite only having 16 coronavirus deaths, Poland has unraveled the largest quantitative easing program in Europe, sending Polish interest rates plummeting below 0%. In fact, Poland is the first emerging market to ever issue negatively yielding debt. This stimulus is equivalent to around 6.5% of Poland’s GDP. Poland, however, is well equipped to handle the coronavirus pandemic. Poland’s debt-to-GDP dipped below 50% in 2017 and has stayed there since. Interestingly enough, Poland showed resiliency in the 2008 financial crisis as well. Perhaps their developed market status is justified, after all.

Netflix & Chill: In 2019, a popular Polish video game was turned into a popular television show. What is it?

Erdogan-omics

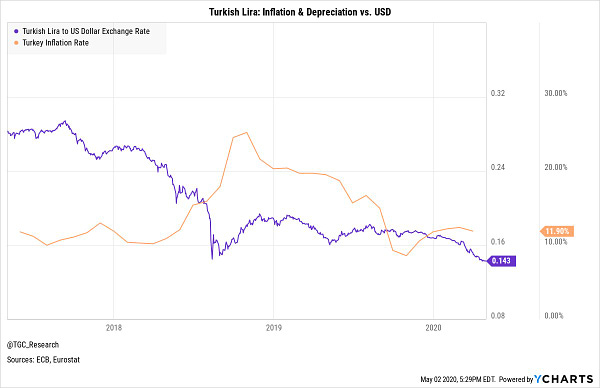

Picture this: It is spring of 2018. The Lira is trading at its lowest level ever. Hyperinflation has plagued the Turkish economy. President Erdogan, defying all logic of monetary theory, demands the Turkish Central Bank cut rates in order to curtail inflation. (If you’re unfamiliar with monetary theory, cutting interest rates is typically a catalyst for more inflation.) A snap election has been called for next month, eighteen months ahead of the scheduled election date.

Erdogan has been vocal about his frustration with Turkish monetary policy. In fact, he’s been quoted calling the independence of the central bank to be “the mother and father of all evil.” An Erdogan victory in June would almost certainly result in the central bank merging within the presidency. Don’t pay any mind to the GDP numbers next quarter. They won’t tell you the whole picture.

The Turkish economy is in turmoil.

President Recep Tayyip Erdogan with Ali Babacan (left) and Central Bank Governor, Erdem Basci (right).

Fast forward to today and that string of events would come to be known as the 2018 Turkish Debt & Currency Crisis. The country had originally been the beneficiary of cheap financing as President Erdogan had built his platform upon cheap, domestic interest to drive economic growth. The conclusion of the 2008 global financial crisis created quantitative easing programs deployed by the E.U. and U.S. that made it cheaper to borrow in foreign currencies, exacerbating Turkey’s borrowing habits. As a result, Turkish banks had accumulated up to $330B of foreign debt by the end of August 2018.

Up until 2018, the country had been outpacing their inflation target three-fold. Instead of 5% inflation, the country saw double-digit inflation. Inflation even reached over 20% in 2019. Turkey’s enormous debt load had become unsustainable. The depreciation of the Lira meant dollar-denominated debt became harder to pay off in nominal terms. American credit agencies such as Fitch and Moody’s had no choice but to downgrade the rating of Turkish sovereign debt, alongside some of their most prominent financial institutions. Erdogan, a man not known for taking criticism well, did not take kindly to their demotion.

Turkey’s monetary flaws bedevils the country to this day. CitiBank predicts that inflation will hit 13% in 2020 amid the COVID-19 pandemic. Turkish banks have exhausted nearly $20 billion of their foreign reserves in efforts to combat their capitulating currency. What’s more, friction between Erdogan & the Trump administration has left Turkey out of crucial “dollar-swaps” orchestrated by the U.S. Federal Reserve. Dollar swaps serve as an essential tool for liquidity during times of financial crises.

When utilizing a dollar-swap:

A foreign central bank will purchase dollars from the Federal Reserve in their domestic currency at a fixed exchange rate.

The two parties will broker an agreement for a future date in which those currencies are swapped again at the same predetermined rate.

The foreign central bank will then loan out those dollars to banks and other institutions to support their domestic currency.

The idea is to hedge foreign exchange and currency risk during economic crises.

The U.S.’ hesitation to issue swaps is directly tied to Erdogan’s history of interference in Turkish monetary policy. Although swaps are technically binding agreements, there isn’t enough evidence for the Fed to support the transaction.

The Lira fell to an all time low last week, trading at over 7 Lira per every U.S. dollar. Turkey has shunned IMF relief despite economic woes. In fact, the Turkish government has actually been asking their citizens for their gold belongings to help shore up their monetary base. This will be a tough ask, again, as the Turkish government certainly does not boast a reliable track record. On top of that, low interest rates have disincentivized saving among Turkish nationals.

It’s fair to say things will get worse before they get better in Turkey.

Galata Tower — Istanbul, Turkey

While coronavirus will levy lasting damage on the Turkish economy, there is evidence to support their growth prospects in the future

65% of Turkey’s population is under the age of 35. That is over 50 million people.

Turkey has brokered trade agreements with European countries. In 2019, the Turkish economy exported over $140B in goods.

Turkey is shifting from agricultural economy to industrial economy. Industrial production was up 7.5% year-over-year in February, 2020.

The Turkish economy is kind of like the New York Knicks. If we just got rid of the guy up top, we’d probably be in a better spot.

Locked Out: Which NBA player has recently come under criticism from Turkish President Erdogan?

Trivia Answers

More Money, More Problems:

1) Swiss Franc (+18.4% Premium to USD)

2) Norwegian Krone (5.3% Premium to USD)

3) U.S. Dollar (Base Currency; 23.7% Premium to Euro)

Air Time: In 1997, Mikhail Gorbachev was featured in a Pizza Hut advertisement. You can watch the full, 60-second advertisement here.

Locked Out: Enes Kanter, a Turkish ex-pat, has been an outspoken critic of the Turkish leader. In fact, Kanter was not allowed to travel overseas with his team last year due to concerns over Turkish extradition.

Netflix & Chill: The Witcher on Netflix is based upon a series of short stories written by Polish author Andrzej Sapkowski.