Halfway There

As we cross the halfway point for 2020, I write, in a paragraph or so, about the best performing equity indexes across the globe.

Welcome to the Global Capitalist - A newsletter on emerging and frontier markets viewed through the lens of history and culture.

Hey everyone, welcome back!

I’m on vacation this week so anticipate my next couple of letters to be pretty brief.

This past Wednesday marked the halfway point for 2020, punctuating a tumultuous first half of the year. Given all that has happened, I want to explore the best and worst performing equity indices across the globe. This week, we’ll be discussing some of the best performing indexes in the world and next week we will circle back to the worst performing markets halfway through 2020.

FREE HATS: Details can be found here.

If you’d like to support me financially, you can BUY a hat at Etsy.com.

A friendly reminder that you can find all of my old work here in case you ever miss a letter.

I welcome feedback, questions, or insights here.

Follow us on Twitter: @TGC_Research

Follow us on Instagram: @TGC_Research

Follow Tom on Twitter: @TominalYield

**If you subscribe through Gmail, please move us from your ‘Promotions’ tab into your ‘Primary’ inbox so you never miss a letter!**

**None of this should be conveyed as investment advice. Speak with your advisor before investing in emerging markets.**

Last Week Briefing:

Hong Kong’s extradition bill went into effect on July 1st this past week. Pro-democracy advocates are reportedly shutting down their social media accounts, going into hiding, and looking to find refuge in countries such as the U.K. or Australia to avoid persecution from the Chinese Government.

Russian President Vladimir Putin has effectively extended his reign until 2036, following a revision of the Russian constitution which reestablished term lengths and limits for Russian politicians.

India has banned over 50 different Chinese phone applications, most notably “TikTok” the popular video creation app. This decision stems from whistleblower reports explaining how these Chinese-made applications mine and harvest user data.

South African GDP shrunk 2% in the first quarter of 2020, citing struggles with weak manufacturing activity. The country’s GDP is expected to contract over 7% for the full year 2020.

Markets 101

If COVID-19 prevented you from exercising and getting your heart rate up, have you considered following the U.S. equity markets as a substitute?

In the period between February 19th to March 23rd, the S&P 500, the most commonly used benchmark for U.S. stocks, fell a harrowing 34%, marking the quickest move from 52-week high to 52-week low since the 1930’s. The severity of the drop had startled economists, drawing parallels between our current environment and the Great Depression. However, as I write this today, that same index is up nearly 40% since late March. What happened?

It is, more often than not, a fool’s game to try and make sense of what the stock market does. After all, the marketplace is a complex mechanism in which billions of different participants — all with different levels of risk, time horizons, and goals — exchange trillions of dollars a day.

However, none of the complexities of the market seemed to impede the avalanche of theories trying to explain the miraculous rebound in American stocks. Fund managers and institutional buyers will cite unprecedented monetary stimulus from the Federal Reserve alongside a $6 trillion fiscal stimulus package from the U.S. Treasury. Meanwhile, financial news media pundits debate whether this rally was driven by the sophomoric “Pajama Trader” as online communities such as R/WallStreetBets and Barstool Sports (specifically, Davey Day Trader) have gamified the stock market.

Outside of the U.S., global equity returns have varied. Countries who have curbed the health effects of coronavirus such as Taiwan, South Korea, and Japan haven’t necessarily seen the outperformance that some investors had anticipated. On the other hand, countries that have struggled in taming the coronavirus such as the U.S., China, Turkey, and South Africa have seen resilience in their respective equity markets. Let this serve as a reminder to investors, both foreign and domestic, that nobody can tell you — with conviction — what the market is going to do in the short run.

Rhymes, not repeats: The market selloff in 1Q20 was the fastest drop since the 1930’s. What was the largest publicly traded company back then? What about today?

Best of the Best:

Performance as of close 7/2/20 - Data from TradingView

Shenzhen Component Index: +19.20% YTD

The Shenzhen Component Index is China’s second largest equity benchmark by market capitalization, placing them behind the Shanghai Composite yet ahead of the Hang Seng located in Hong Kong.

On the outside, China’s performance seems uncharacteristic for the country in which this whole pandemic started. However, Chinese market data should not be mentioned outside the context of their economy. As mentioned in my conversation with Perth Tolle a few weeks back, China banned short selling, institutional selling, and commanded that their manufacturers go back to work to prop up their halted economy. In fact — manufacturing — which comprises over 60% of the Shenzhen Component, has been integral to the strength of China’s stock market this year.

Nasdaq Composite Index: +13.76% YTD

The Nasdaq Composite Index is predominantly tilted towards technology stocks. Exciting technology companies such as Apple, Microsoft, and Tesla populate this benchmark. These have also been, coincidentally, some of the best performing stocks this year. Tesla, specifically, has nearly tripled its market cap since the beginning of the year. This resilience in technology stocks, particularly in the U.S., affirms that our lifestyles are growing increasingly digitized. Legacy business models such as real estate, travel, and retail are threatened by the convenience of remote work. This begs the question as to whether or not coronavirus was simply just a catalyst for “software to eat the world.”

Nasdaq OMX Copenhagen 25 Index: +10.02% YTD

The Danes boast the third highest performing stock market through the halfway point of 2020. These returns can be characterized by the index’s heavy exposure to healthcare. In fact, over 50% of the Copenhagen 25 is comprised of healthcare stocks. A global spike in demand for healthcare and health-tech products is likely the driver behind Denmark’s impressive performance. Companies such as Novo Nordisk (+12.03%), Ambu (+102.78%), and Novozymes (+19.54%) are just a few examples of health-related companies driving the lion’s share of market returns. Denmark’s equity performance, however, should not mask the economic onslaught of the coronavirus pandemic. In June, the Danish government injected the equivalent of over $45B to rescue their ailing economy. Denmark’s Finance Ministry forecasts a 3-6% economic contraction for the full year 2020.

Nasdaq OMX Vilnius: +4.32% YTD

If you predicted that Lithuania’s stock market would be one of the best performers halfway through 2020 please come up to the front to collect your prize…

The Nasdaq Vilnius is one of three different Baltic stock market indices and the primary stock exchange for Lithuania. The index is comprised of 30 different companies and has a market capitalization of over $4B. Similar to other quarantined nations, Lithuania has seen an uptick in retail trading activity as investors capitalize upon cheap equity valuations. What’s more, the country is anticipating strong economic growth stemming from the proliferation of 5G technology. The largest component in Lithuania’s stock market is Telia Lietuva, is a pioneer of 5G technology. The country is anticipating to plant a 5G tower in every major city by 2022 and cover the country’s whole population by 2025.

I reached out to Nasdaq Vilnius for comment as I struggled to find up-to-date information on the Baltic indices. For regulatory reasons, they are not allowed to provide any insights as to not a partial exchange provider. Instead, they said this in regards to the Lithuanian IPO Market:

We can characterize the first quarter of this year as turbulent. However, stability and positive trends have gradually returned to the Baltic capital markets already in April and such companies as Viada, Poor Food, InMedica, Šiaulių bankas, Sakret Holdings, Ignitis Group listed their securities on the Nasdaq Baltic Bond List. Despite Covid – 19 factor, we see further interest of companies in raising capital by issuing bonds in Lithuanian and Baltic public securities market.

It is expected companies to turn even more into the exchange as an alternative source of funding after COVID – 19 pandemic and will familiarize themselves with the opportunities the capital market offers. As the result, we do expect a continued activity on Nasdaq Baltic capital market. The market has proved resilient in previous volatile periods and our conversations with prospects indicate that they would like to proceed. Many companies will however continue to come to the market for financing and we expect a continued level of activity in the longer term.

Shanghai Composite Index: +3.37% YTD

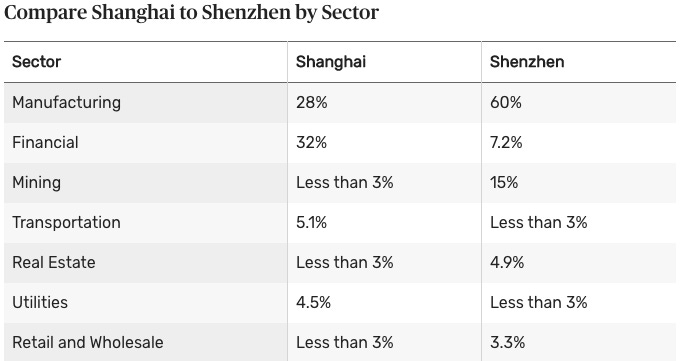

Back to China… The Shanghai Composite Index is the largest of all of the Chinese-based equity indices. As you can see below, what separates the Shanghai Composite from the Shenzhen Component is basically sector exposure and concentration. The Shenzhen Component tracks 500 of the country’s publicly traded companies while the Shanghai Composite tracks many of China’s state-owned enterprises (SOEs) such as Kweichow Moutai, a Chinese beverage company and the world’s most valuable liquor stock. Shanghai’s underperformance can likely be attributed to its underweighted exposure to manufacturing and mining relative to the Shenzhen.

Sector Exposure in Shanghai Composite versus Shenzhen Component - H/T: The Balance

Nasdaq OMX Riga: +1.65% YTD

Nearly right behind their Baltic neighbor, Latvia tallies the second Baltic country in the top ten performing stock indices halfway through 2020. Latvia is a quaint country best known for its beautiful architecture and the birthplace of Dallas Mavericks superstar, Kristaps Porzingis.

Basketball and architecture aside, the Latvian stock market has shown remarkable resilience amidst the coronavirus pandemic. I reached out to Donatas Frejus, a fund manager with Orion Securities focused on Baltic equities to see what he had to say on the outperformance in both Latvia and Lithuania’s stock market.

Thank you for reaching out.

I do not know the exact weighting of the OMX Vilnius Index constituents, but I would presume that the index should be heavily weighted towards Telia Lietuvia, which is a local telco, and naturally its stock has performed quite well amid the Covid-19 crisis. Besides the index has quite a few consumer staples stocks (incl. farming and dairy producers, such as Auga Group, Linas Agro Group, Rokiskio Suris, Zemaitijos Pienas, Vilkyskiu Pienine, Pieno Zvaigzes) that have had only limited impact from the crisis.

In Latvia the index is presumably highly weighted towards Latvijas Gaze, which is a natural gas transmission company, and Olainfarm, a pharmaceuticals producer - both clearly defensive stocks in the current situation.

Also, outperformance of the Baltic stock market could be partially attributed to the fact that Lithuania, Latvia and Estonia have managed to handle the virus outbreak extraordinarily well and is now almost back to normal in terms of restrictions for businesses and life in general (except for foreign travel).

Night at the Museum: Latvia is home to what hilariously strange museum?

Nasdaq welcoming Latvia to their exchange — 1993

Borsa Istanbul 100 Index: +1.16% YTD

Turkey’s outperformance is yet another odd case of a stock market that appears to be trading completely separate from the fundamentals of their economy. Turkey has the 14th highest amount of coronavirus cases in the world and the highest amount in the Middle East. However, it should be mentioned that Turkey has been much more effective in combatting the fatality of the virus. Turkey has seen only 62 deaths per million people, citing their prowess in hospital capacity and swift treatment capabilities. This strength in combatting the virus has allowed the country to deploy aid to other countries, shipping PPP and other necessary equipment to help combat the virus. That isn’t to say the nation is immune from the economic impact of the virus. The IMF predicts that the Turkish economy will shrink 5% in 2020.

Borsa Istanbul, the primary Turkish stock exchange, has been rocketed by strong outperformance in their retail sector, specifically the supermarket BIM which has grown over 38% since the beginning of the year. Hilariously enough, Turkey is also attributing much of their market rally to the “pajama trader” as Turkish investors find themselves occupying themselves by following the equity markets. All of that said, Turkey’s economy still suffers from over 13% unemployment while the Lira has depreciated over 15% relative to the US Dollar. Domestic inflation spiked over 12.5% in June as the country struggles to corral their rampant hyperinflation.

S&P 50 New Zealand: +0.58% YTD

If you travelled to New Zealand today, you could easily convince yourself you have travelled back in time. New Zealand has been virtually untouched by the effects of the coronavirus and has essentially returned to normal. The New Zealand 50 grew over 32% in 2019, following a tremendous year for global equities. Come 2020, the index fell about 25% from February through March, although has exhibited relative stability compared to U.S. equities. Some of the largest components of the New Zealand 50 include Fisher & Paykel Healthcare and Spark Telecommunications, who deployed 5G capabilities earlier this year. In typical New Zealand fashion, one of the strongest performers in the NZ50 is A2 Milk, a dairy producer focused on the protein-rich properties of the beverage. A2 Milk’s share price has grown over 37% year-to-date, cementing them as the second largest position in the respective iShares ETF.

Looking forward, New Zealand will focus on better protecting their economy from another contraction by raising reserve requirements and banning dividends from Oceanic banks.

Taiwan Capitalization Weighted Stock Index: -0.73%

Taiwan, like many of the other “Bubble Tea” countries, immediately recognized the frantic Chinese coverup of the coronavirus and sprung to action. Within days, Taiwan had shuttered airports, restricted travel, and went into lockdown. Fast forward to today and Taiwan has reported 449 cases and 7 fatalities. If one were to visit Taipei, Taiwan today, you’d notice a city humming along as if nothing happened.

Taiwan’s stock market grew an impressive 23% in 2019, stemming from a fantastic year for the nation’s strength in manufacturing. This year, the market capitulated a quick 27% before ultimately rebounding nearly 40% from their March 19th lows. Taiwan is one of a handful of different manufacturing countries who are expected to gain from the gradual shift away from Chinese exposure. Taiwan Semiconductor Manufacturing, the largest company in Taiwan and the largest pure-producer of semiconductors in the world, recently announced plans to open a $12B plant in Arizona, as investors and multinational corporations alike seek to decentralize supply chains and exposure from China. Taiwan, however, will be at risk of an expanding Chinese empire, as neighboring Hong Kong was finally consumed by the autocratic giant just last week.

Widgeting: TSMC is the second largest company who participates in the semiconductor business… Can you name the top 5? Answer will be at the bottom.

South Africa Top 40 Index: -1.25%

Rounding out the top ten, the South Africa Top 40 is still down for 2020 although has shown more stability than its economy has. This market resilience could certainly be the result of concentration in South African stocks. After all, the index only tracks forty of the nation’s most valuable companies. These companies, by nature of large capitalizations, are more well-equipped to withstand economic turmoil.

I don’t say that to disparage the returns of the South Africa 40, only to highlight a feature of markets that is often overlooked. For instance, the Dow Jones Industrial is only comprised of thirty American companies yet is the worst performing U.S. index this year. The Dow’s concentration in energy, industrials, and consumer staples are meant to be a reflection of the actual economy and not representative of the nation’s largest companies.

In South Africa’s case, the SA40’s exposure is mainly concentrated in basic materials and technology, comprising roughly 35% and 25%, respectively. The largest components of South Africa’s stock market are players in the mining and banking sector, such as AngloGold Ashanti and FirstRand Ltd. Similarly, the price of gold has appreciated 17.2% in 2020 thus far, an unusually volatile swing for the commodity. Lastly, Naspers — the South African internet conglomerate, is gaining from the new retail shopping experience.

More Reading….

If you like what I write, be sure to check out these other blogs I frequent!

Investor Amnesia - A blog on financial market history.

Loud Mouth Media - A blog on markets, crypto, and life.

Of Dollars & Data - Data science and personal finance all in one place.

Epsilon Theory - Commentary on markets, politics, and economics seen through the lens of game theory.

A Wealth of Common Sense - Personal finance from an investing perspective.

Trivia Answers

Rhymes, not repeats:

As of July 2nd, 2020, Saudi Aramco is the largest publicly traded company in the world by market capitalization. In the 1930’s, AT&T was the largest corporation by market capitalization. The telecom giant would ultimately hold that title until the 1970’s when IBM would take its place. Thanks to Jamie Catherwood from Investor Amnesia for his help on this one!

Night at the Museum:

Latvia is home to the Museum of the World’s Greatest Liar, dedicated to Hieronymus Karl Friedrich Freiherr von Münchhausen. Latvia also mints a coin with his face on it.

Widgeting:

The Top 5 Largest Semiconductor Companies by Market Cap:

1) Intel Corp.

2) TSMC

3) Qualcomm

4) Broadcom Inc.

5) Micron Technology