E-Commerce: The Undisputed Champion of 2020

Margins? We don't need no stinkin' margins...

Welcome to the Global Capitalist — A free newsletter on international developed, emerging and frontier markets viewed through the lens of history and culture.

Trying something new with the font of this newsletter. Let me know if you hate it.

— Tom

Free Shipping or Bust

Few people would’ve foreseen the year we had at the beginning of 2020. That is, however, with the exception of some health officials in Wuhan. The jury is still out on that — Anyhoo...

“The logic was simple,” he said in Citron’s 2020 investor letter dated Jan. 4. “If we continue to stay at home, Amazon is a huge winner. If everything goes back to normal, Amazon will still be a big winner.” — BBG

The quote above is from Andrew Left, the founder of Citron Research, a prominent asset manager notorious for short-selling. Citron, according to their annual investor letter, had found some success in adding Amazon.com to their portfolio in late March. Put simply: Citron believed that Amazon would be able to perform well in all sorts of market conditions, particularly market conditions under lockdown.

Evidently, Citron was right. Shares of Amazon gained 75% in 2020 as the broader market added about 15%.

Then again, it was hard to lose money investing in e-commerce last year. In June, Forbes reported that the economic effects of lockdown accelerated the growth of online retail by 4 to 6 years. In November, online retail sales eclipsed $100 billion for the first time ever. Overall, online sales are expected to grow 32% ($795B) in 2020, occupying roughly 16% of the total U.S. retail market. The stewards of online retail demonstrably reflected this phenomenon in their quarterly reports:

Amazon.com, the world’s largest online retailer, saw net sales jump 70% through the first nine months of 2020. Amazon’s stellar top-line growth provoked the company to hire 400,000 employees over that same time frame.

eBay quadrupled their net income in the nine months ending September 30th. Shares of eBay gained a little over 40% on the year.

Shopify, the seller-focused online retailer based out of Canada, 2X’d their revenues in the first three quarters of 2020. Shares of $SHOP were boosted 177% on the year.

Last, but not least: Etsy, an online marketplace for homemade goods, saw sales double in both Q2 and Q3. Absurdly enough, Etsy sold over $350 million worth of custom made face masks on their platform in 2Q20.

Lions, Bulls, & Bears: Can you name the top 5 performing stocks in the S&P 500 in 2020? Answer below.

Obviously, the U.S. was not the only country subject to these kinds of lockdowns. E-commerce businesses excelled just about everywhere in 2020 — and markets were eager to reward these enterprises with steep valuations and cheap capital. However, the booming sentiment surrounding these kinds of businesses poses a larger question about the economics behind online retail. But we’ll get to that in a second.

One of the world’s highest-flying names in digital retail was MercadoLibre, the Argentine-based platform which (formerly) dominated the Latin American e-commerce market. In 2018, MercadoLibre saw over 56 million unique visitors from Latin America, twice more than Amazon.com, which was, coincidentally, the second most visited retail site in Latin America at that time. Through the first nine months of 2020, Mercadolibre recorded 112.5 million unique users. Consequently, operating income grew over 200%, thanks to 100% gains in total sales volume and gross merchandise value (GMV).

Shares of $MELI, which are listed on the NYSE, boomed 175% on the year, endowing MercadoLibre with an $100 billion market cap and making it the most valuable public company in South America. For context, MercadoLibre is roughly the same size as the Target Corporation, and is twice as big as Dollar General.

Curiously, MercadoLibre is HQ’d in Argentina. However, it is hardly an Argentine company. For starters, it’s not even in the MERVAL index! — (We spoke briefly about this the other week) — A mere 20% of sales are derived from Argentina, while 75% can be traced to countries like Brazil and Mexico. Quarterly sales figures are quoted on both a dollar-denominated, and FX-neutral basis. Notably, there are significant spreads between FX-neutral metrics and their dollar comparables. But, given the Peso's waning substance, could you blame them?

In the ever-increasing competitive landscape of digital commerce, MercadoLibre has found a formidable adversary in B2W Digital, a Rio de Janeiro based holding company. B2W Digital was born from the merger between Lojas Americanas, a weathered Brazilian department store founded in 1929, and Submarino.com, an online electronics platform. Lojas Americanas was considered to be one of Brazil’s first department stores, so it was quite controversial when they introduced online shopping in 1999. Fast forward 20 years, B2W’s websites hosted nearly 80 million unique viewers, outpacing MercadoLibre’s 69.6 million during the same year. This was particularly significant, given that B2W’s sites had only seen around 25 million hits in 2018. Last year, gross profits grew 68% and 51% in quarter two and three, respectively. Nevertheless, the company yields negative returns on equity and has historically only made a profit in one fiscal quarter.

Again, all of this being considered, these stories are less about the prospects of Argentina, Brazil, or any country in specific. Rather, these businesses and their valuations are a reflection of the euphoric manifestations of the Latin American market, and contingently the global market, as a whole.

Never Sell: Which American e-commerce business acquired a 19.5% stake in MercadoLibre in 2001? Answer below.

To reiterate, this is hardly a domestic phenomenon. Another key example of online retail euphoria was reflected in Africa’s bubbling digital ecosystem. The poster child of the continent’s e-commerce rush was Jumia Technologies, the copycat born from Germany’s controversial Rocket Internet. Rocket Internet, if you recall, is notorious for (quite literally) replicating successful established business models in fast-growing markets. In this case, Jumia was modeled in the image of AliBaba (whom we’ll touch upon in a second), operating in both an e-commerce and e-payments capacity. The familiarity of Jumia’s business model, coupled with the enormous upside on Africa’s digital economy boosted the company’s share price by over 500% on the year.

The inevitability of Africa’s digital transformation has garnered the interest of several key competitors across the continent. Naspers, South Africa’s largest internet conglomerate, has revealed their interest in the digital retail market through their stakes in Takealot.com, South Africa’s largest online retailer by sales, and Konga.com, the second most popular online marketplace in Nigeria. Naspers commands a $100 billion market cap as of this writing.

Jumia, however, released some pretty stodgy figures in Q3. Gross Merchandise Value (GMV) shrunk 27% YoY in third quarter while total orders grew a pedestrian 8.6% through the first nine months of the year. Of the platform’s listed merchandise, smartphones and electronics still occupy 43% of gross merchandise value, compared to 56% in 2019.

Again, this demonstrates how the market is a forward looking mechanism: Nigeria, which is Jumia’s largest market, is only expected to produce $6 billion in online retail revenue in 2021. Africa, as a whole, is expected to do $75 billon in online retail sales in 2025. That figure itself nothing to scoff. However, $75 billion pales in comparison to the broader addressable market for online retail. Eventually, continuing smartphone penetration and adoption of mobile payments will only drive more growth behind those figures.

Finally, if we meander over to Asia, the world’s largest online retail market, investors have been captivated by the likes of Sea Limited, the parent company of Shopee. Currently, Sea Limited is the most valuable listed company in Southeast Asia, thanks to shares gaining 400% in 2020. Shopee, the e-commerce arm of Sea, nearly tripled their revenues through the first nine months of 2020, crediting an 100% increase in both sales volume and gross profit. In Q3, Shopee was the most second most downloaded shopping app in the world.

Then again, the explosive performance of Shopee (and Sea Ltd. as a whole) demonstrates the enthusiasm behind the world’s fastest growing internet businesses. Notice I said internet businesses: Sea is indubitably a conglomerate, operating business units such as gaming and e-payments alongside its digital marketplace. And that, perhaps, provides a hint as to why there appears to be fewer and fewer standalone e-commerce businesses, particularly in the mega-capitalized sector.

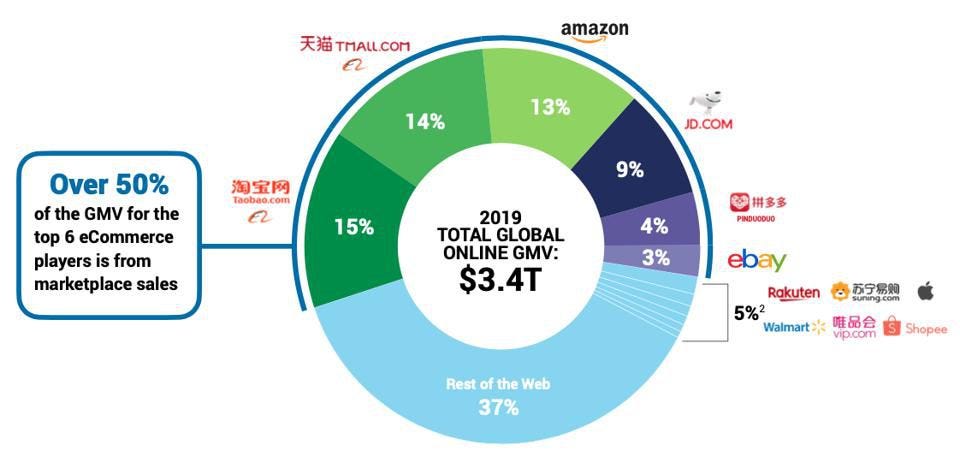

Shopee competes in the largest, yet most competitive online retail market in the world — and it appears everyone wants a slice of the pie. Asian-Pacific online retail sales are expected to comprise $2.5 trillion, or about 2/3rds of global digital retail spending in 2020. The vast concentration of tech-savvy, online consumers (Indonesia, for example has 89.3% internet penetration, compared to the U.S. rate of 90%.) has groomed Asia as a prime target for market share and customer integration.

The Asian online retail market is huge, but how much capacity is there for new competitors?

Consider the pure volume of online retailers (either trading, or last funded at enormous valuations) across the Asian continent. First, there is FlipKart, the Indian retail behemoth which competes domestically with Snapdeal. In Indonesia, we have Tokopedia, the SoftBank & Sequoia-backed online retailer with over 140 million monthly hits. Tokopedia finds their chief competitors in Shopee, BliBli and Bukalapak, an online retailer akin to Shopify. In Singapore, where Shopee is headquartered, the company competes alongside Lazada, another Rocket Internet alumnus, and Qoo 10, a fashion-first online platform. There’s PG Mall and Orami in Malaysia. There’s Tiki and Thegioididong.com in Vietnam. I could go on! These companies all compete amongst one another — and that goes without even mentioning the Chinese Murderer’s Row of internet titans: Alibaba, JD.com, Pingduoduo, Tencent — just to name a few.

Friendly reminder that this is a free publication. Please consider subscribing below or sharing this post to support my work.

I certainly wouldn’t be the first person to decry the soaring valuations of nascent tech startups... But let’s be real here, it’s getting a bit ridiculous:

Shopify, for example, trades at a $115 billion market cap on an estimated $2.86 billion in revenue... Revenue! Keep in mind, the company made their first profit (a breathtaking $2 million!) last quarter. Pragmatically, the company issued over 3.5 million shares of their stock in Q2/Q3, cashing in on overwhelming market exuberance.

Continuing on, Jumia’s quarterly report celebrated an impressive 50% growth figure in Total Payment Volume. That’s fantastic, except for the fact that the company doesn’t derive any sales from their JumiaPay segment! That, however, did not prevent the company from floating a handful of superfluous figures that sold a story of scale and swelling market share. Fear not! The company is worth $3.5 billion.

MercadoLibre, as we touched upon earlier, trades at a market-cap equivalent of two Dollar Generals. I found this especially curious, given that Dollar General generated over 40x the amount of operating income than MercadoLibre in 3Q20. Target Corporation, which trades at a similar valuation, thumped MercadoLibre’s 3Q operating profits by nearly 80x.

Before the Wall Street Bets crowd finds this: I get it, I’m cherry picking a little. To the credit of these enterprises, these are indubitably formidable businesses gunning for the enormous future value of online retail’s total addressable market (Recall above that online retail is ONLY 16%[!] of global retail).

Furthermore, it has become clear that these valuations are not meant to reflect present day business conditions but instead a vision of what the company will be, someday in the future. An enterprise like MercadoLibre trading equivalent to say, Target Corporation, suggests that this company will eventually fill the utility of a big box department store. Structurally, as we highlighted across the Asian continent, more competitors will beget smaller margins and thus a smaller share of the market. The senior management of these kinds of businesses will be motivated to build (or acquire) uncorrelated business lines in order to sustain investor enthusiasm. Thankfully, borrowing costs are cheap!

The primary concern then lies within the expectation game. Put simply: When the prospects of a euphoric internet company begin to crumble — whether it be from compressing margins (Assuming there’s any margin at all) or political externalities — investors will be swift to commit their money to the next name.

By the way, what did happen to AliBaba shares at the end of the year?

That’ll be a topic for later. Enjoy the weekend.

Trivia

Lions, Bulls, & Bears: Etsy checked in as the second best performing component within the S&P 500 in 2020.

Never Sell: Ebay purchased a 19.5% stake in MercadoLibre in 2001. Fifteen years later, they sold the stake for an estimated $580 million.

The Global Capitalist

Follow us on Twitter / Instagram

Follow Tom on Twitter

**If you subscribe through Gmail, please move us from your ‘Promotions’ tab into your ‘Primary’ inbox so you never miss a letter!**

**None of this should be taken as investment advice. Do your own research or speak with an advisor before investing in emerging markets.**