Crazy Eights

This week, we venture over to Asia to continue our multi-part series on the realm of sovereign wealth funds.

Welcome to the Global Capitalist - A newsletter on international developed, emerging and frontier markets viewed through the lens of history and culture.

Hey everyone, I apologize for the on/off weeks in writing this. I’ve been juggling some personal commitments and want to be sure these pieces remain thorough, informative, and interesting to read!

This week, we will be discussing some of Asia’s largest sovereign wealth funds. This piece is also pretty long, so again, feel free to skip around or come back to it if you’d like.

Also — If you’re a reader located outside the United States I would like to get in touch with you! Please shoot me an email at the.global.capitalist.news@gmail.com

Thank you all for your continued support!

— Tom

Not a subscriber yet? Join over 300 weekly readers by subscribing below!

You can expect a new letter every Tuesday or Wednesday!

If you enjoy this newsletter, please consider sharing it on Twitter, Facebook, LinkedIn, or anywhere else people may enjoy it.

Additionally, I ask that you go ahead and “Like” this post (Click the Heart Symbol above) to help me get noticed by Substack’s algorithm.

Finally, if you’d like to support me financially, I ask that you purchase a hat from my Etsy page. This helps cover my costs incurred in researching, writing, and editing this letter every week.

Plus, I think the hats look pretty cool…

Thank you all for your continued support!

Last Week Briefing:

Ant Group, which was expected to be the largest public listing ever, abruptly suspended their IPO on Tuesday, citing regulatory setbacks. Jack Ma, the co-founder of Ant Group, has been quite adamant in qualifying the company as a technology company, rather than a bank or bank-like enterprise. — CNBC

Saudi Aramco, the world’s largest oil producer, posted quarterly net income of roughly $12 billion, a 45% drop from the year prior. Despite pressure on the company’s bottom line, the fund has no plans of cutting their $18 billion dividend. — Wall Street Journal

Turkish President Recep Tayyip Erdogan has called for a boycott of French goods following Emmanuel Macron’s defense of a Charlie Hebdo cartoon depicting the prophet Mohammed. In the Islamic faith, illustrations of the prophet are strictly forbidden. — CNN

This is part two of a multi-part series on sovereign wealth funds. To read Part One, please click the button below:

“In a wind-torn valley, a pine tree may bend. But when the storm has passed, it will stand proud and thrive.”

— Taken from the CIC’s Annual Report, 2019

Few other institutions can hold a candle to Norway’s enormous government pension scheme — The Chinese Investment Corporation (CIC), however, is a rare exception.

The CIC is China’s official sovereign wealth fund and the world’s second largest of its kind, managing over $1 trillion in assets. The CIC resembles Singapore’s sovereign wealth vehicles in the sense that the corporation is an independent asset manager that is wholly owned by the People’s Republic of China. In turn, the CIC is responsible for allocating the country’s abundant foreign reserves with the goal of accelerating the development of the broader Chinese economy. As of the end of 2019, the corporation held roughly 42% of its assets in alternative and private securities while public equities composed a little less than 40% of total assets. Fixed income and cash equivalents populated the remaining segment of the portfolio.

The CIC manages its reserves through three subsidiaries: CIC International, CIC Capital, and Central Huijin. Each division is assigned their own unique mandate as to what and where they’re allowed to deploy capital. CIC International, for example, is designed to manage the corporation’s international assets, both public and private. In contrast, Central Huijin acts as a virtual proxy for the Chinese government, holding significant ownership in almost all of China’s state-owned banks, securities firms, and insurance agencies. This unique structure has warranted strict, internal “firewalls” to from investors and subsidiary companies to ensure that the CIC’s comprehensive investment process and the day-to-day operations of their portfolio companies are removed from influence of the CCP. Similarly, the corporation’s International Advisory Council (IAC) is tasked with brokering strategic business ties and identifying attractive economic opportunities across the world. The IAC has representation from all six continents, including former German Chancellor Gerhard Schröder, and John Thornton, the Chairman of Barrick Gold Corporation.

Photo from CGTN — Central Huijin Office, Beijing, China

CIC Capital was established in 2015 as means for the Chinese government to invest in private, industrial projects in international markets. Similar to other intermediaries we’ve read about, CIC Capital is divvied up between three distinct divisions:

Janus Asset Management Company: This vector exclusively invests in agribusiness and manages the China Global Agriculture Investment Fund.

Investment Department I: ID1 identifies global opportunities in infrastructure, mining, and energy.

Investment Department II: ID2 is reserved for residual investment opportunities that don’t meet the prerequisites of the other two CIC Capital subsidiaries.

CIC Capital is especially significant given its role in China’s Belt & Road Initiative. CIC will work close alongside the People’s Bank of China and other multilateral development banks (Think: Chinese Development Bank) with the goal of exporting China’s industrial prowess. Of the first $10 billion committed to China’s Belt & Road initiative, $1.5 billion came from CIC Capital. Some of the fund’s most notorious deals include Turkey’s Kumport shipping terminal, in which CIC, alongside COSCO Pacific, acquired 65% of the port for nearly $1 billion. Additionally, last year CIC Capital acquired Cadent Gas, the U.K.’s largest gas distributor. In 2019, nearly $6 billion was deployed across 30 different projects, an increase from $4.9 billion in 2018.

CIC’s Aggregate Fixed-Income Allocations

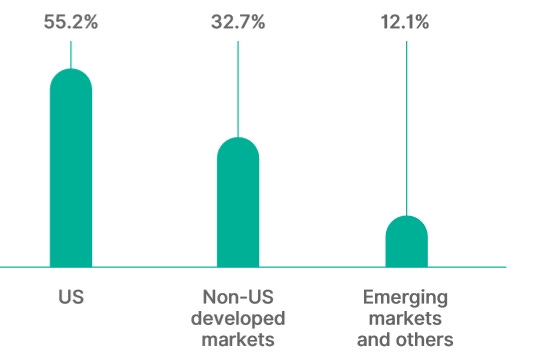

Geographic Public Equity Exposure

CIC International is the instrument in which the CIC owns and manages their publicly-listed assets. While their largest individual public holdings are largely a secret, the CIC as a whole is clearly partial towards U.S.-based assets. 55% of the fund’s total investments are located in the U.S., followed by a third in developed international markets and finally 12% in emerging and frontier markets. With regards to sector exposure, the CIC has the largest allocation towards Information Technology and Financial companies, occupying nearly 18% and 17% of the portfolio, respectively. One of the CIC’s most notable investments was their 10% purchase of Morgan Stanley back in 2007. During the peak of the 2008 Global Financial Crisis, rumors circulated that the CIC would rescue Morgan Stanley by acquiring nearly 50% of the business. Assuming their position has not changed since 2007, the CIC has seen a 67% gain from that trade. In the same year, the CIC also scooped up a 4.5% stake in The Blackstone Group (not to be confused with Blackrock). That position would be fully divested in 2018.

On the fixed-income side of the portfolio, two-thirds of the portfolio is invested in sovereign debt. Of that segment, 10% of sovereign debt hails from emerging and frontier markets.

Finally — Of the CIC’s subsidiaries, Central Huijin is the oldest, largest and most prominent, managing over USD$660 billion across the catalogue of Chinese state-owned financial institutions. Funny enough, Central Huijin has been in existence since 2003, long before the CIC was even created. Central Huijin would eventually get acquired by the newly-formed CIC in 2007.

This unique branch of China’s sovereign wealth fund is in the business of providing capital to nearly 20 Chinese state-owned financial services companies. Specifically, the subsidiary holds considerable stakes in the country’s four largest banks: the Commercial and Industrial Bank of China (~35% stake), China Construction Bank (~57% stake), Agricultural Bank of China (~40% stake), and the Bank of China (~64% stake). Coincidentally, these are also the four largest banks in the world by assets. Outside China’s Big Four, Central Huijin is sole owner of Shenwan Hongyuan Securities, the first listed securities brokerage on a Chinese exchange, and China Jianyin Investment Limited, an activist investment manager.

Central Huijin’s portfolio is a glaring reminder of how entangled the Chinese financial system really is, especially given the ominous rise of shadow-banking activity. Last year, Central Huijin and its subsidiaries bailed out floundering lenders including the Bank of Jinzhou and Hengfeng Bank, citing uncorralled systemic risks in the Chinese banking system. This year, developments regarding the cash-strapped Evergrande Group, and Ant Group’s manic, oversubscribed IPO indicate that China’s financial system is still levered as ever, even amidst our global economic slowdown.

Despite a 17% boost for the fiscal year 2019, the CIC has seen several prominent senior executives leave the company over the past few years. As you could probably gauge, this is an inopportune time for these departures, given the current economic and geopolitical environment. Looking forward, the CIC has envisioned a plan in which alternative assets comprise 50% of the entire portfolio.

Bo jio

Unfortunately, I haven’t had a ton of time to speak on the dynamics of the Singaporean economy. Hopefully, some of you have a little bit knowledge on the city-state, even if it came from the book/movie Crazy Rich Asians.

Singapore is not an emerging market. However, the country plays a significant role in the developing world, particularly in the blossoming Asian-Pacific. The nation’s strength as a financial, industrial, and logistical entrepôt has enabled them to become the second richest nation in the world per capita, only trailing the State of Qatar. The importance of Singapore’s economy has endowed the country with two of the world’s largest sovereign wealth funds: The Government of Singapore Investment Corporation (GIC) and Temasek Private Holdings. These funds are just two of the three financial entities that are controlled by the Ministry of Finance — the Monetary Authority of Singapore (MAS), the nation’s central bank, is the third. Each fund is its own distinct vehicle with separate goals in allocating Singapore’s sovereign assets.

For those who may be unfamiliar: Singapore is one of several developed countries in the world that can boast a current account surplus, meaning that their imports seldom eclipse their exports. To be fair, there isn’t anything inherently wrong with running a current account deficit. Plenty of countries, especially the United States, are known for routinely running large deficits. However, this particular feature of Singapore’s economy helps explain their massive stockpile of foreign reserves. Singapore’s foreign reserves are equivalent to nearly 80% of the country’s GDP, only trailing Hong Kong and Switzerland on a relative basis. These reserves are the nation’s lifeline, as the government cannot borrow money for expenditures. Instead, capital raised by debt issuances are invested accordingly by the MAS. The MAS, by extension, is mandated with maintaining the integrity of the Singapore Dollar, which is reinforced by their foreign currency reserves.

GIC Offices

The Government of Singapore Investment Corporation, or the GIC, is Singapore’s official sovereign wealth fund, managing over $450 billion in assets. The fund is the world’s first non-commodity derived sovereign wealth fund and was created as means of achieving “higher yields in the longer run” with the central bank’s foreign reserves. Unlike the MAS, the GIC has the ability to assume higher degrees of risk and will invest into a wider variety of asset classes, including real estate, private equity, and venture capital. As mentioned above, up to 50% of the capital gains, interest, and dividends from the GIC’s portfolio can used to supplement Singapore’s government budget, through what is known as the net investment return contribution, or NIRC. In 2019, the NIRC was roughly $12.5 billion, or 18% of Singapore’s budget.

The GIC takes a three-pronged approach to their portfolio strategy. Starting from the top, we have the reference portfolio, which is not a strict target allocation — instead, it is a reflection of the government’s risk appetite. Currently, the reference portfolio, which is quoted with a simple equity-to-debt allocation, is targeting a “65/35” split. Dictating the components of the reference portfolio is the policy portfolio, built to generate generous, risk-adjusted returns over a twenty-year time period. Any excess returns generated from the policy portfolio are channeled into the active portfolio, which seeks convex investment returns in secular market trends.

Policy Portfolio — GIC

GIC Geographical Allocation as of 3/31/20

The GIC is notoriously secretive with respect to their public equity holdings. Despite the fund being established in the early 1980’s, the first performance report was not released until 2008. Even today, their public equity holdings are scarcely released as to protect the value of the Singapore Dollar. That being said, the fund is quite outspoken about their value investment philosophy. Their recent annual report champions their systematic, bottom-up approach to investing, seeking generous total returns from securities detached from their intrinsic value — Sounds like they pulled this right from the Intelligent Investor, doesn’t it?

Prior to the pandemic, the fund had an objectively defensive portfolio, considering our current interest rate environment. As of March 31st of this year, the GIC had roughly 50% of their assets invested into cash or equivalent instruments. Meanwhile, 30% of their portfolio was held in public equities (15% for both emerging and frontier markets) and 20% in private equity and real estate. This, as a consequence, has yielded an underwhelming annualized nominal return of 4.2%, since 2000. The fund’s largest American-listed holdings include Tallgrass Energy (before it was taken private), 21Vianet Group (+212%), Dell Technologies (+22%), and Synchony Financial (-22%). What’s more, the CIC infamously scooped up minority stakes in CitiGroup and UBS during the Global Financial Crisis; Positions they still own to this day.

In the realm of private markets, the GIC has a storied history with some of the world’s premiere private investors. In fact, the GIC was one of the first partners in KKR’s first private equity fund. Since then, they have continued to work together in the private markets, deploying over $1.5 billion across three deals in 2019 alone. Additionally, the fund claims an early stake in Cisco Systems, facilitated through one of Sequoia Capital’s earlier vehicles. This year, the GIC was active in funding venture rounds for enticing private startups such as Klarna, the Swedish credit company, and RazorPay, the Indian digital payments platform. Historically, some other notable ventures have included Snapchat, Uxin, FlipKart, and Woowa Bros.

The fund, over a twenty-year rolling period, has returned a dismal 2.7%, barely outpacing the conventional inflation assumption of 2.5%. However, if the GIC’s cash-heavy positioning is any indicator, the fund will surely see overperformance returns from our swift economic rebound.

Remember, Remember: Singapore celebrates which peculiar holiday on November 19th? Answer below.

Temasek Boulevard, Singapore

Temasek Holdings is a commercial investment company wholly owned by Singapore’s Ministry of Finance. The company manages over $420 billion in assets — placing them as the seventh largest sovereign wealth fund in the world. Similar to the GIC, Temasek was born during the late 1960’s amidst the fallout between Malaysia and Singapore. You see, the newly-independent nation of Singapore did not have access to the natural resources found in mainland Malaysia. Instead, Singapore would finance government expenditures through divesting ownership in state-owned businesses like Malaysia-Singapore Airlines and Singapore Telecommunications (Singtel). Interestingly enough, Singtel remains Temasek’s largest individual holding to this day.

The windfall from listing these state-owned enterprises would ultimately create an endowment that would protect Singapore’s state-held wealth. Today, the fund adheres to four investment themes: Transforming economies, growing middle income populations, deepening comparative advantages, and emerging champions.

Temasek Total Assets — Y-Axis quoted in billions (SGD$)

In contrast to the American sovereign wealth funds we covered last week, Temasek is glaringly partial towards the Asian markets. In the graph above, they cite “market dislocation” for poor performance in 2015. Don’t worry, you didn’t forget anything. The U.S. equity markets were quite boring that year. China, in contrast, witnessed one of the most euphoric boom-and-busts of our generation. As some of you may recall from our letter from September — 2015 saw the Shanghai Composite fall 50% from peak-to-trough, as frantic margin trading sent valuations of budding technology companies flying. Similarly, the nascent ChiNext Composite, meant to represent early, innovative tech companies, swelled over 120%, only to shed 30% of their gains going into 2017.

Black Monday: China’s equity market saw a single day drop of over 10% in what is now known amongst Chinese investors as “Black Monday”. What was the date of this phenomenon? Similarly, on what date did the American “Black Monday” take place? Answer below.

Nevertheless, Singapore’s conviction in the Chinese market has remained resilient. As of March 31st, Chinese securities held the largest share of Temasek’s portfolio— comprising 29%, or $88 billion of their geographic exposure. Overall, two thirds, or over $200 billion of the fund’s total assets are domiciled in Asia. Their largest individual holdings include Singtel, Singapore’s largest telecom company, MapleTree Investments, a real estate investor, and DBS Bank, the largest bank in Southeast Asia by assets.

North American assets, by contrast, make up only 17%, or $52 billion of total assets. Their public American holdings are mainly colored by financial companies, as Blackrock, Visa, and Paypal populate 35% of that segment. Blackrock is by far the fund’s largest American holding, occupying 20% of that geographic segment and nearly 4% of the entire company. Then again — the American portfolio is minuscule relative to the rest of the world. The fund has a 29% stake in DBS Bank (~$11B), a 16% stake in Standard Chartered (~$2.4B), a 7% stake in Adyen (~$3.8B), and a 3% stake in AIA (~$3.75B)— I could continue, but these are just the financial companies. Temasek also owns 25% of A.S. Watson, one of the world’s largest retailers, and 9% of InTouch Holdings, the parent company of the largest mobile operator in Thailand. Seems like a lot, right? Wrong — Public holdings are only 52% of the entire portfolio…

Temasek has recently been outspoken about their affinity for private investments, citing deteriorating economic fundamentals, especially amidst our economic crisis. Given Temasek’s ability to assume more risk, the fund has been generous with their private equity deployments. For starters, the company was one the first state-backed investor in Facebook’s Libra cryptocurrency, despite hesitation from other regulatory bodies. What’s more, Temasek has reportedly expressed interest in the long-anticipated public listing of Ant Group, Jack Ma’s FinTech giant. Finally, Temasek, in tandem with Google plunged a combined $350 million into Tokopedia, the Indonesian e-commerce company. Temasek is notorious for leveraging their capabilities to “lift unicorn companies”.

The fund is coming off their worst portfolio performance since inception amidst the COVID-19 crisis. However, the fund’s exposure towards enticing young startups and the booming Asian markets will surely generate tailwinds behind their performance in 2021.

Origins: What is the significance of Temasek’s name? Answer below.

Trivia

Remember Remember: Singapore is known for their peculiar affinity for toilets. In fact, every November 19th, Singapore celebrates World Toilet Day. Singapore is the birthplace of the World Toilet Organization.

Black Monday: Black Monday in China took place on August 24th, 2015. Black Monday in the United States took place on October 19th, 1987.

Origins: Temasek was Singapore’s original name, translated into Sea Town in Malay.

The Global Capitalist

Share TGC with 5 Friends, Win a Hat! Details can be found here.

If you’d like to support me financially, you can BUY a hat from me at Etsy.com.

Old letters can be found here.

Feedback, questions, or insights can be submitted here.

Follow us on Twitter: @TGC_Macro

Follow us on Instagram: @TGC_Macro

Follow Tom on Twitter: @TominalYield

**If you subscribe through Gmail, please move us from your ‘Promotions’ tab into your ‘Primary’ inbox so you never miss a letter!**

**None of this should be perceived as investment advice. Do your own research or speak with an advisor before investing in emerging markets.**