Better Luck Next Year?

Last week, we covered the best performing markets through the halfway point of the year. This week, we turn the page to the WORST performing markets through the first half of 2020.

Welcome to the Global Capitalist - A newsletter on emerging and frontier markets viewed through the lens of history and culture.

Hey everyone, welcome back!

This week, we will talk about the ten worst performing equity indexes through 2020 and I write a little bit about American education.

Thank you all again for your continued support! I encourage you to post and tag @TGC_Research on Instagram to be featured.

Also — Sorry I lied about these being short. I get carried away sometimes.

- Tom

Housekeeping:

FREE HAT: Details can be found here.

If you’d like to support me financially, you can BUY a hat from me at Etsy.com.

Old posts can be found here.

Feedback, questions, or insights here.

Follow us on Twitter: @TGC_Research

Follow us on Instagram: @TGC_Research

Follow Tom on Twitter: @TominalYield

**If you subscribe through Gmail, please move us from your ‘Promotions’ tab into your ‘Primary’ inbox so you never miss a letter!**

**None of this should be conveyed as investment advice. Speak with your advisor before investing in emerging markets.**

Last Week Briefing:

Australia has suspended their extradition agreement with Hong Kong, paving the way for Hongkongers to attain Australian citizenship.

Back to the Polish presidential election… The Presidential runoff election happened this past Sunday. Incumbent, right-wing President Andrzej Duda won by a razor-thin margin in one of the region’s most controversial elections.

The Central Bank of Nigeria devalued the Nigerian naira this past week, citing weakness in the price of oil and a shortage of dollar reserves.

Brazilian President Jair Bolsonaro tested positive for the coronavirus last week. He is not worried, however.

Can Only Go Up From Here!

Performance as of July 2nd, 2020. Data from TradingView.

Indice de Capitalizacion Bursatil (IBC): -32.31% YTD

The Venezuelan stock market — colloquially known as the General Index or, IBC — has the misfortune of being the worst performing stock index halfway through this year. Venezuela’s market has seen some exceptional volatility amidst the nation’s worst humanitarian crisis ever. The past three years have seen returns of -95%, +28%, and +5,500%, respectively. As mentioned in our Protests Edition, President Nicolas Maduro’s socialist experiment is unraveling quickly. The Venezuelan Bolivar has fallen 77% year-to-date and a civil war has broken out in the streets of Caracas, the country’s largest city. Economists from major international financial institutions (IFIs) have suggested “shock-therapy” measures in order to realign the Venezuelan economy.

Venezuela will likely remain in this vortex until the Maduro regime is removed. In other words: It’s going to get a lot uglier before it gets better.

Visual Representation of how many Bolivars equal one U.S. Dollar

Dubai Financial Market General Index (DFM): -25.42% YTD

If you’ve been reading TGC from the beginning, this one shouldn’t be too hard to figure out… Dubai’s economy is flush with oil money. It’s said that if you stick your finger deep enough in the sand in the United Arab Emirates, there’s a decent chance you’ll become a millionaire overnight. Naturally, the capitulating price of oil was sure to disrupt the DFM.

Emirati petroleum comprises over 30% of the nation’s gross domestic product, placing them ahead of countries like Nigeria, Russia, and Bahrain in terms of dependence on the mineral. In addition, the U.A.E. derives roughly 35% of its tax revenues from petroleum. The IMF estimates that the falling price of oil cost the government $270B in tax revenues.

As a response, the U.A.E. hiked the rate of the value-added tax or, VAT, to 15% and suspended the nation’s cost of living allowance for ex-pat workers. While the index itself isn’t that heavily tilted towards energy stocks, the damage control of the 2020 oil sell-off sent ripples throughout Emirati equities. For instance, the value-added tax — meant to be a tax on consumption rather than wealth or income — has dampened consumer demand. The five largest components of the index include two banks, two real estate holding companies, and a telecommunications firm. Excluding telecommunications, it hasn’t been a great year for those particular industries. The country which saw over twelve million visitors in 2019 will be keeping their fingers crossed for a more dynamic global economy in 2020-21.

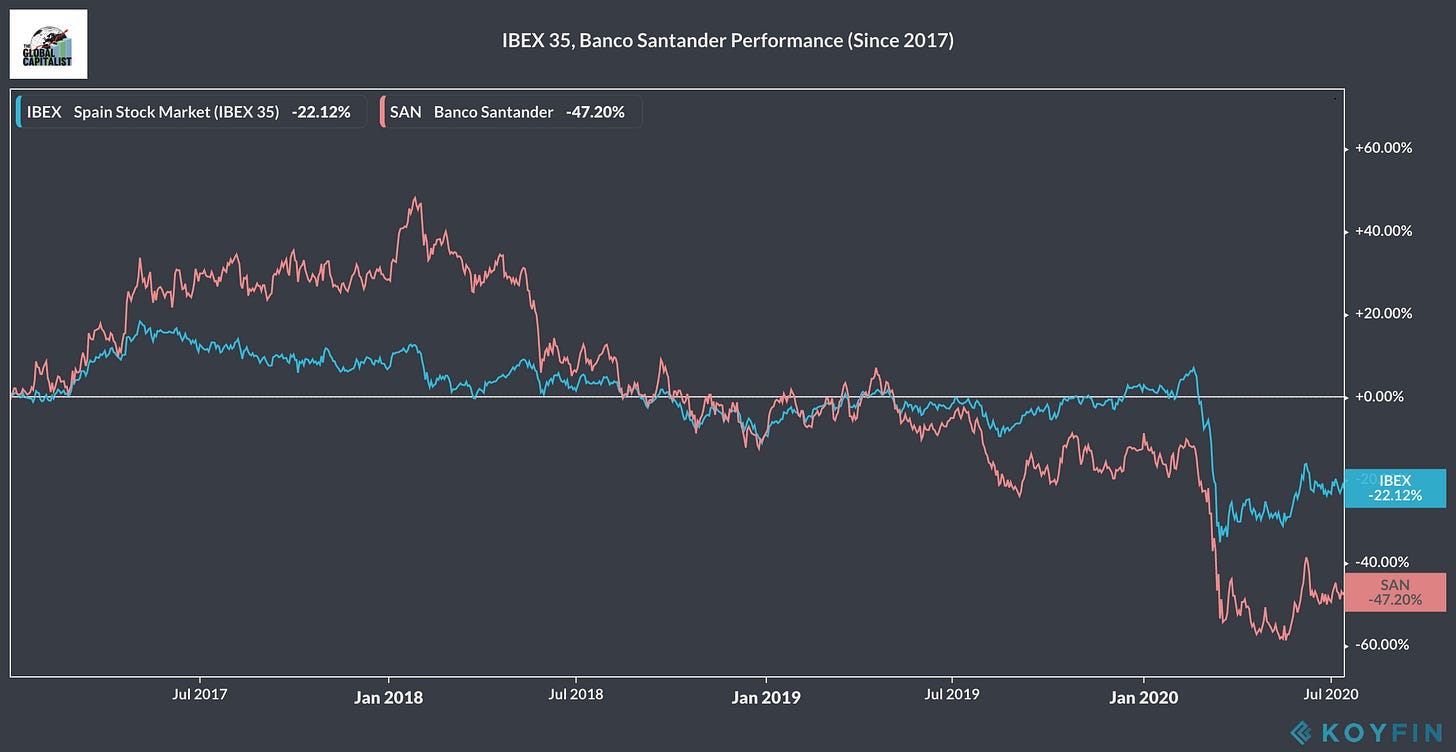

Bolsa de Madrid — IBEX 35 Index: -22.49% YTD

You’ll notice a theme here… Many of the countries home to the worst stock markets are also often heavily dependent upon tourism, oil and gas, or some combination of both. In Spain’s case, the nation relies upon tourism for 10% of its GDP. The biggest losers in the IBEX 35, are mostly concentrated in struggling sectors such as banking, hospitality, and real estate. Banco Santander, S.A. (Santander Bank), which is the third largest component in the index, has fallen over 40% from the beginning of the year, stemming from falling global interest rates and uncertain economic viability for staple businesses.

Adding pain to Spain’s absent tourism traffic, a far-left socialist government was recently elected into power, distorting the outlook of the Spanish market. Pedro Sanchez, the prime minister of Spain, originally proposed a 10% banking tax to shore up the nation’s deficit. He has also proposed for the nationalization of utility companies within his comprehensive economic overhaul. This distate towards Sanchez’s policies are reflected in the performance of the IBEX. The Index has fallen over 20% since the beginning of 2017. The European central bank expects the Spanish economy to suffer one of the worst contractions this year, with forecasts of -11% GDP growth.

Egypt EGX 30: -21.50% YTD

Egypt’s EGX 30 saw a 5% rise in 2019, lagging behind the country's composite index yet showing a modest boost from the year prior. Egypt exists in a highly tumultuous sociopolitical landscape. Despite strong equity performance, Egypt was home to a string of anti-government protests in 2019, as the el-Sisi regime failed to provide a strong social safety net for his citizens. On top of that, the Egyptian economy is almost entirely operated through subsidiaries of the Egyptian military, eschewing the private sector from the market. As mentioned in our Egypt letter, the Egyptian military is responsible for roughly 40-60% of economic output, supplying goods such as baby formula and water. el-Sisi’s regime has taken some overarching measures to combat the spread of the virus, jeopardizing the government’s original goal of liberalizing the Egyptian market.

Lately, Egypt has entangled themselves in one of the biggest geopolitical bouts of 2020. The dam on the Blue Nile has become a contentious staple of North Africa. Egypt, Sudan, and Ethiopia all depend upon different, valuable resources from the dam. For instance, Ethiopia relies upon the dam to power their electrical grid. On the other hand, Egypt and Sudan needs the Nile to run for a continuous source of fresh water. By allowing Ethiopia to fill the dam, Egypt worries that they will not have control over their own water supply. As you could probably guess, a nation’s economy needs water to function.

Egypt’s geopolitical atmosphere has adequately frightened investors in the North African market. Pair their instability with vanishing tourist traffic and you have the fourth worst performing market of 2020 thus far.

Jakarta Stock Exchange — IDX Composite Index: -21.05% YTD

Unfortunately, there may not be a country less equipped to handle the economic effects of the coronavirus than our friends in Indonesia. The IDX Composite, which comprises all stocks listed on the Jakarta Stock Exchange, has fallen over a fifth this year, struggling from weak oil prices and receding tourist traffic.

Tourist Traffic, Indonesia

If you recall from our very first letter, Indonesia’s economic ascent has been fueled by its booming tourism sector. In 2019, over 16 million people visited Indonesia, attracted by its beautiful beaches and architecture. In 2016, tourism contributed $17B, or 11% to Indonesia’s GDP. Prior to the coronavirus pandemic, Indonesian President Joko Widodo honed in on tourism as the driving force behind Indonesian economy. Joko demonstrated this support by announcing the 10 New Bali project. This project aims to marry the government to the private sector with the goal of developing tourism hubs all across Indonesia, not just Bali. This plan is clearly expected to miss its goal as tourism traffic has plummeted, disrupting the long term goal of over twenty-million visitors a year. To add to the pain, the Indonesian government depends on oil for a quarter of the nation’s exports. You could probably imagine how Indonesian investors must’ve felt when oil futures were trading negative…

Bahrain Bourse All Share Index (BAX): -20.66% YTD

Bahrain, unlike many of the other Gulf countries, isn’t so dependent on crude petroleum. In fact, eight of the ten largest companies included in the BAX are banking stocks. In this case, I wanted to highlight the relationship between a developing economy’s finance sector and their industrial counterparts.

Finance sectors are instrumental in ensuring stable, sturdy economic development because emerging economies often need to widen their spending capacity to achieve growth. Given this role, banks often exhibit the most exposure when it comes to underperforming equities and businesses. There’s a saying that reads:

If you owe the bank $100 that's your problem. If you owe the bank $100 million, that's the bank's problem.

In this case, cheap credit has fueled much of the global economic boom following the 2008 global financial crisis. With that considered, you can understand how leverage in an economy can work as a double-edged sword. Prudent investors and allocators can expand their spending constraints at a cheaper cost yet when revenues sink, those debts are still present. Low interest rates allow risk-seeking allocators to accumulate mountains of debt with little restraint. All in all, the Bahraini finance sector is sure to suffer from underperformance as contingent sectors such as oil and gas, real estate, and hospitality struggle from the effects of the coronavirus.

Tel-Aviv 35 Index: -19.26% YTD

The OECD forecasts over a 6% contraction in Israeli GDP for 2020. The Bank of Israel, the nation’s central bank, opines that the economy will drop around 4.5%, barring a second wave in the virus. Israeli unemployment spiked over 20% in April, repelling more investors from their dynamic equity markets. Despite the index’s largest components partaking in defensive industries such as healthcare (Teva, Perrigo) and telecommunications (NICE Ltd., ), Israel’s exposure to geopolitical risk following the contended re-election of President Benjamin Netanyahu has sent ripples throughout the Israeli economy. Protestors have swarmed Jerusalem, the capital of Israel, to voice their objection to Israel’s encroachment on Palestinian land and Netanyahu’s alleged corruption scandal. Pair that domestic instability with an astronomical unemployment rate and you can get an understanding as to why Israeli stocks have fallen a little less than 20% so far this year.

S&P Lima — Peru General Index: -18.58% YTD

Peru had an exceptionally rocky start to 2020 when MSCI announced they would be removing the country’s emerging market status. Instead, the index demoted Peru to frontier market status. Technically speaking, this means that MSCI, alongside other emerging markets index funds are forced to sell out of their Peruvian securities in order to maintain their “emerging market” tilt. After all, you wouldn’t want to buy into a government treasury fund if they exclusively owned junk bonds…

A rising tide raises (and sinks) all ships…

Consider the technicals of an index fund: You purchase shares of an index fund with the goal of “passively” investing into the components of that index. By owning those shares, you effectively own a piece of every company held in that index. In order for that to occur, the fund (Think: MSCI, BlackRock, State Street) must purchase a proportional amount of the advertised securities in order to maintain the proper weighting in the index. For example, imagine that if tomorrow, Tesla Motors bumped American Airlines from the S&P 500. S&P 500 Index Funds would be forced to sell their positions in American Airlines in favor of share of Tesla Motors. Similarly, if shares of Microsoft are skyrocketing, the fund must purchase more shares of Microsoft to accurately reflect the real weighting of the index.

I’ll explain the technicals of ETFs and mutual funds in a future edition…

Peru’s inclusion in the frontier market index exposed the nation’s equity markets to the worst performing broad-market asset class. The MSCI Frontier Markets Index has fallen nearly 19% this year, compared to the MSCI Emerging Markets Index (-5.0%) and the MSCI EAFE (-9.9%) year-to-date. What’s more, Peruvian stocks are likely to hold heavier weights in those indices, assuming fund managers allocate weight in line with market capitalization. There is sufficient evidence to say that the poor performance of frontier markets as an aggregate, coupled with a stagnant tourism sector has depressed Peruvian equities.

U.K. FTSE 100 Index: -18.36% YTD

If you rewind back about ten million news cycles, you’ll be reminded that Brexit was a thing and actually, finally happened this past year. Five years following the referendum vote in 2015, Boris Johnson’s government finally withdrew from the European bloc and achieved independence. While this move might’ve been popular for Britain’s conservatives, investors were less confident about the future of Britain’s largest companies. For starters, Britain’s inclusion in the European bloc paved the way for unfettered access to the European market. Exiting the European Union meant that many of these trade deals and provisions would be annulled in favor of new, Pro-British agreements. In fact, the reason why it took Brexit over five years to exit the E.U. was because many of the multinational companies on both sides of the pond enjoyed an intimate trading relationship. The uncertainty surrounding the new trade landscape repels investors as few are willing to plant their stake in the tumultuous British marketplace.

This dismal performance is nothing new. The FTSE 100 has lost a little over 5% since the beginning of 2015, dwarfed by the performance of developed stalwarts such as the S&P 500 (+54.70%), Nikkei 225 (+30.88%), and MSCI EAFE Index (+19.93%). Britain’s recent underperformance can be traced back to its hasty departure from the E.U. coupled with their futile coronavirus response. Britain has the third highest level of coronavirus deaths in the world as the country struggles with its lockdown measures.

FTSE Strait Times Index (STI): -17.68% YTD

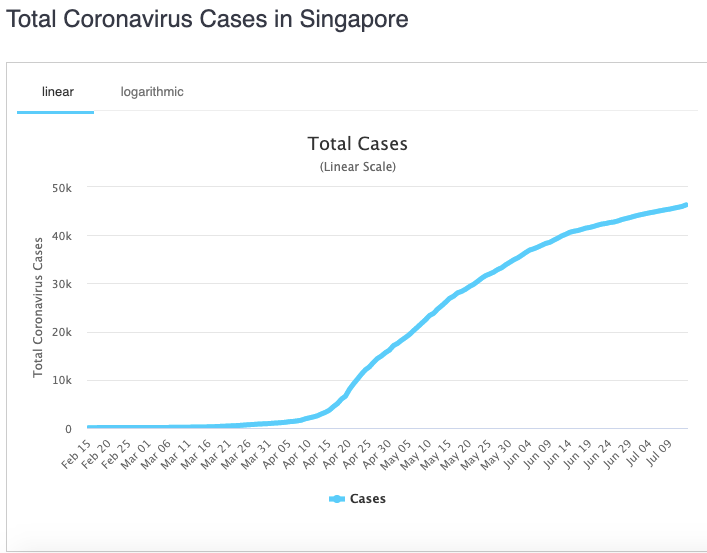

To round out the worst performing equity markets halfway through 2020, we venture over to Singapore, one of the richest nations in the world per capita. Bloomberg announced this morning that Singaporean GDP fell over 40% last quarter, the largest contraction in the nation’s history. Singapore, like many of the other countries we’ve mentioned here, has struggled with a stagnant tourism sector and low consumer spending. Additionally, Singapore is suffering from low export volume as supply chains find themselves backed up and lacking demand. In response to the sputtering Singaporean economy, the government pledged a whopping $93B or, 20% of GDP to keep businesses afloat. The government has verbally committed to even more stimulus if necessary.

Singapore held a presidential election last Friday, July 10th. The People’s Action Party, who has been in power since the 1980’s, successfully secured a victory but not without yielding a significant chunk of their majority. The opposition Worker’s Party achieved their highest level of representation in the Singaporean government. This election was considered to be a referendum on the government’s handling of the virus. Considering the relatively disappointing Singaporean response to the virus (Singapore has seen over 40,000 coronavirus cases), the nation’s citizens had a good reason to wish for change.

Some commentary on education

Last Monday, Harvard University announced they would only welcome 40% of their undergraduate class to campus for the 2020-21 academic year. Given the news and our country’s failure to contain the virus, this appears like an apt thing to do from the strongest academic institution in the country. Harvard is anything but the only school that has altered “back-to-school” plans because of the coronavirus. Yale, Rutgers, and UMass Amherst have already announced revised plans for the Fall semester. However, what really stirred an uproar in public circles was that Harvard, among other schools (who I’d assume are waiting for a nice Friday evening news-dump) are still charging a full tuition. Harvard can get away with it (only because Harvard is Harvard…) But what about everyone else? How do you justify charging full tuition for what is virtually a shell of the college experience?

To add to the current animosity consuming our country, U.S. Immigration & Customs Enforcement, (also known as ICE) announced that international students who are not enrolled in in-person classes would be deported. American activists darted to social media to show support for their foreign contemporaries. In response to this perverse government policy, colleges such as UC Berkley, NYU, and Colombia have exploited loopholes to protect and retain their international talent. I believe that these events are simply a catalyst for the foreseeable changes in global education.

The futurist in me pictures a complete overhaul of conventional education. The conservative-libertarian in me says that education suffers from a sequence of maligned incentives and mundane, state-led governance; This explains why American test scores have idled in recent years. The neoliberal in me says that education should be cheap; Subsidies from the state can marshal an educated, skilled workforce, which in turn benefits the entire country.

Nonetheless, our current system seems to dismiss the ongoing paradigm shift in our economy. Education as we know it has boundaries. After all, classrooms can’t scale. A teacher can only teach so many pupils without overwhelming themselves or the student. It can be argued that state involvement in academia adequately commoditizes education below the university level. ELAs, PSATs, and regent’s exams present an arbitrary understanding of how learning has progressed.

Now consider the secondary level: While data supports the thesis behind getting a bachelor’s degree, others will argue that the caliber of a bachelor’s degree has gotten weaker, given high college enrollment levels and an increased demand for specialized talent. In lieu of a traditional bachelor’s degree, I foresee individuals seeking specialized education or entrepreneurship in emerging fields such as computer science, graphic design, and digital media. Income Sharing Agreement (ISA) programs such as Lambda School and Make School have captured the interest of venture capitalists as an attractive alternative to conventional education. Technology should be able to democratize education, allowing for the best educators and institutions to reach thousands of students. Aswath Damodaran, a professor at New York University, has over one-hundred seventy thousand subscribers on YouTube. His videos consist of recorded lectures, and they each do thousands of views.

So Tom, what are you trying to say?

I’m saying that the U.S. hegemony in education is being tested by combination of political risk and technological disruption. International students may elect to study domestically to avoid the risk and clunkiness of American education. Even for those who’d like to study American education, they have access to free, online courses remotely without having to assume mammoth levels of debt. Unfortunately for the U.S., however, that equates to less ex-patriate employees in the American workforce and a higher retention of talent in developing economies. The strength of the American workforce be mainly traced back to the competitiveness of American secondary education. Even the most mediocre American university are considered prestigious on an international scale.

The fact that the U.S. has been gun-shy about this immigration policy is certainly a repellent for international students. What’s more, the government’s inaction on welcoming in Hongkongers is extremely disappointing for a country that is known for embracing refugees and freedom fighters. I’m hopeful there will be action taken. It is not only the right thing to do, but also beneficial towards economic growth. Nonetheless, It should be of no shock to see American education being a contentious topic in the 2020 presidential elections.

Trivia Answers

I wanted to try something new and fun this week and make this sort of a trivia competition.

The first three (3) people to email me (the.global.capitalist.news@gmail.com) with all of the correct answers will receive a free hat! I will announce answers and winners next week.

Questions are as follows:

1) From 2000-09, what was the BEST performing asset class in the world?

2) From 2010-19, what was the BEST performing asset class in the world?

3) From 2010-19, what was the WORST performing asset class in the world?

4) Can you name the top three countries with the worst NOMINAL inflation, from 2010-19?

4) Can you name me five different countries with negative yields on their sovereign interest rates?

5) Can you name 5 other indices that were not included in either the top 10 BEST performing markets or the top 10 WORST performing markets.

Good luck to you all!