Belt & Road

This week we return to our country profiles while touching upon the economic fallout brewing between China and the rest of the world.

Welcome to the Global Capitalist - A newsletter on Emerging and Frontier markets viewed through the lens of history and culture.

Hey everyone, welcome back. This week we’ll be covering only a small piece of West Africa as I’d like to continue talking about some of the topical trends in emerging markets.

FREE HATS: Details can be found here.

A friendly reminder that you can find all of my old work here in case you ever miss a letter.

I welcome feedback, questions, or insights here.

Follow us on Twitter: @TGC_Research

Follow us on Instagram: @TGC_Research

Follow Tom on Twitter: @TominalYield

Last Week Briefing:

Beximco Pharmaceuticals, a Bangladeshi drug-maker, announced they will begin selling a generic version of remdesivir, an anti-viral used to treat coronavirus.

The U.S. Senate passed The Holding Foreign Companies Accountable Act on Wednesday in response to the growing concern over Chinese companies listed on corporate governance and fraud.

(Totally unrelated…) Baidu, the Chinese search engine, has reportedly considered de-listing from the NASDAQ in hopes of “increasing its value”.

Debt Diplomacy

Last week we spoke a little about how China’s time as the world’s manufacturing kingpin was slowly coming to an end. Major multinational companies including Samsung, Apple, and Nintendo have committed towards shifting their production out of China with the hope of removing themselves from the tumultuous Chinese ecosystem. The coronavirus pandemic had been the assumed catalyst for this decoupling. However, recent developments have revealed why it will be especially difficult to unravel China’s ties in the global marketplace.

Let us rewind back to late 2019— A simpler time where the biggest concern to global markets was President Trump’s trade war. Investors were apoplectic that not only Chinese products were tagged with tariffs, but places such as Canada, Latin America, and the European Union were collateralized in President Trump’s trade policies.

Encapsulating those economic regions within the trade war was not without substance. As a means to curb incumbent trade restrictions, Chinese businesses would take equity ownership stakes in various enterprises across the globe. Take for instance, Pirelli & C., the famous Italian tire maker. In 2015, Pirelli was acquired by ChemChina, a Chinese, state-owned chemical company, at around an $8B valuation. This tallied one of many deals executed by the Chinese, as Chinese investors deployed over $225B in capital across Europe in the period 2008-2018. What’s more, Chinese parastatals have taken ownership of over a dozen European shipping ports, indicating the Chinese repellent attitude towards international duties.

How did we get here?

In 2013, Chinese President Xi Jinping introduced China’s Belt & Road Initiative as a means of propelling the country to the forefront of economic superpowers. As defined by the World Bank, the Belt & Road Initiative is a China-led effort to improve regional connectivity and cooperation on a transcontinental scale. In other words, China will virtually write blank checks with the goal of brokering strategic alliances with nations across the globe. Recall the China-Pakistan Economic Corridor which we covered back in April: China has pledged the equivalent of $60B in foreign direct investment to the Himalayan nation for a string of energy projects.

Note of the nature of these deals — China is not buying stakes in Coca Cola, Kentucky Fried Chicken, or other trivial consumer products. Rather, these strategic mergers and acquisitions pays testimony to Chinese imperial industrial policy. These stakes ensure that China will no longer have to worry about cross-border risks. On top of that, a reduced dependence upon imports allowed them to create a global network of industrial staples. While there isn’t a precise number as to how large the Belt & Road Initiative is, the capital commitment is estimated to be north of $6 trillion dollars.

Consider the actions of the U.S. following the events of World War II: The U.S. catapulted themselves to an economic powerhouse through the orders of the Marshall Plan. In short, the Marshall Plan provided over $15B in loans to European countries in order to help the continent rebuild their cities and industries. Today, China has enacted their own modern-day Marshall Plan. Billions of Chinese loans have been earmarked for emerging and developed markets with the goal of helping them build and reinforce their infrastructure. This is commonly referred to as “Debt Diplomacy” given the financial nature of the relationship. The volume and provisions of the debt agreements also characterize the country’s predatory habits. In fact, Sri Lanka yielded a naval base to the Chinese because they were unable to meet debt payments. This is not a coincidence, nor is it an isolated event. The coronavirus pandemic unmasked the cruel complexion of China’s lending spree. Foreign Policy Magazine estimates that developing economies have over $135B in outstanding Chinese debt as of 2020. Countries such as Zambia, Kyrgyzstan, and South Africa have sought unprecedented relief from the IMF due to their unsustainable debt loads. Unfortunately, it would not be unexpected to see more African industrial “crown jewels” fall into the hands of Chinese enterprise.

The Unwind

There is mounting evidence that pegs China as the culprit behind a global misinformation campaign behind the origins of the coronavirus. Chinese state media has never been one to shy away from misinformation, accusing the United States — among other nations — of spreading anti-Chinese propaganda.

In reality:

Health experts have overwhelmingly agreed that the virus found its origin in Chinese wet markets, presumably from a bat or pangolin.

Wuhan, China — where the virus was reportedly consummated — is home to the one of the country’s largest virology labs. Vexations over the lab’s safety protocols have dated back to January 2018. The lab had also notoriously spent a lot of time researching bat-related pathogens.

The World Health Organization (WHO) reported in January that Chinese officials determined the virus had limited transmission between humans. Meanwhile, the WHO had been praising China for their “transparency” and “leadership” during this same timeframe.

Outside of their coronavirus follies, sovereign nations have growing worries over Chinese political influence in these regions. China’s stance on personal liberties directly contradicts the rights we celebrate in Western societies and could potentially jeopardize international diplomacy. The country’s treatment of Uyghur Muslims and African immigrants has shone a spotlight on the country’s horrific record of human rights. What’s more, China’s grip on sovereign, democratic territories such as Taiwan and Hong Kong is demonstrative of China’s reckless, unchecked imperialism. Just last week, China imposed a new national security law on Hong Kong, which would render their autonomy obsolete should it pass.

Foreign lawmakers are certainly looking to zero in on China’s unruly behavior given the ramifications of COVID-19. Debtors and opponents of China alike will face difficulties in shaking off the looming Chinese raincloud over their economy. On top of that, China’s economic recovery (substantial or not) has repositioned the country to act in their hawkish lending capacity. As countries seek relief in slowly reopening their economy, you can bet the Chinese will be reaching into their pocketbooks.

One Country, Two Systems: Hong Kong was under who’s governance before 1997? What event triggered this colonization?

Naija

Home to over 200 million people, Nigeria is the seventh largest country in the world and the largest country in Africa. The country is also the largest economy in Africa and comprises roughly 50% of the entire African population. The country is organized as a federation of thirty-six autonomous states, vaguely familiar to the federalist system we recognize in the U.S.. Nigeria has celebrated a democratic system of governance since 1999, earning them the label of a “Free” as defined by Freedom House. The country is amalgamated amongst Mexico, Indonesia, and Turkey as one of the MINT economies. If you recall from one of our first newsletters, the MINT economies are countries categorized by Fidelity Investments as a group of countries who offer similar growth prospects to the BRICS economies. What’s more, the countries represented in the MINT acronym are included due to their relatively diversified economies.

Muhammad Buhari — President of Nigeria

Nigeria is the largest OPEC country and is Africa’s largest oil exporter, with petroleum exports contributing 10% to the country’s GDP. While Nigeria is certainly strong in their petroleum sector, their financial services and telecom industries have really driven the lion’s share of their growth since 2000. Nigeria’s strength in banking can be traced back to their roots as a British colony. The Bank of British West Africa and African Banking Corporation — who merged in 1892 — are often credited with introducing modern banking to West Africa. To this day, over a hundred different banks operate in Nigeria with specializations ranging from commercial banks to what are known as development banks. Development banks typically serve a unique niche in the economy, providing specialized services such as agricultural or industrial lending.

First Bank of Nigeria Headquarters — Lagos, Nigeria

Nigeria’s banking industry maintains its sophistication through the authority of the Central Bank of Nigeria (CBN). The Bank prioritizes ample foreign exchange reserves, a stable domestic economy, and competitive macroeconomic positioning. Recently, the the central bank has taken unprecedented measures to maintain the country’s financial prowess. For starters, the 2008 Global Financial Crisis prompted the Nigerian government to form AMCON (the Asset Management Corporation of Nigeria). From 2008 to 2009, non-performing loans nearly quadrupled from 11% of gross total loans to over 37%. AMCON acted as the vehicle in which the central bank acquired non-performing assets to relieve Nigerian banks. Similarly, the central bank rebased, or recalculated their GDP in 2014, slingshotting them ahead of South Africa for the title of Africa’s largest economy. The recalculation estimated that Nigeria’s economy grew an additional 75% from 2010 to 2013, although it obviously did not make any material changes to the nation’s economy. Rather, the rebasing simply helped the Nigerian central bank get a better grasp of how their evolving economic output should be measured. Specifically, the central bank wanted to place a larger emphasis on the telecom industry’s contributions to economic growth.

Nigeria’s telecommunications sector has been an attractive opportunity for multinational and indigenous corporations. Given Nigeria’s vast and young population (The median age for a Nigerian is a little over 18 years old), telecom companies have flocked to capture valuable market share. Take for instance: MTN Group. MTN Group is headquartered out of Johannesburg, South Africa, yet receives roughly 33% of their revenue from their Nigerian segment. In addition, MTN also announced a $1.6B capital commitment to the Nigerian market, allocated over the next three years. The smartphone adoption rate has been a pedestrian 20-25%, although economists estimate that smartphone penetration could reach 60% by 2025. For any telecommunications company, a 10% share of the Nigerian smartphone market could mean an addition 20 million customers. The nascent telecom market has also spilled into other industries such as banking, insurance, and media. In fact, the CBN approved its first mobile banking license in July of 2019. They would issue an addition three licenses throughout the remainder of the year.

Within Nigeria, the port city-state of Lagos is Africa’s most populous city with over 14 million people. The city is considered one of the richest in Africa, with over 130 citizens being considered “ultra-high net worth”. Furthermore, Lagos is the cultural, financial, and societal epicenter for Nigeria. The Nigerian cinematic industry, mostly based out of Lagos, is frequently called “Nollywood” as a play on America’s film industry. That said, Lagos’ beauty should not mask the problems ailing the Nigerian economy.

Lagos, Nigeria

The country faces serious geopolitical risk given its geography and underdeveloped infrastructure. Boko Haram, a radical Islamist group based out of northeastern Nigeria, has been a violent obstacle to Nigeria’s growth. As corruption and cronyism seep its way throughout Nigeria, Boko Haram grew popular with disenfranchised Muslims who believed the West was perverting the West African nation.

Nearly 20% of Nigerians are unemployed while a larger portion are underemployed. While the country ranked 27th in nominal GDP last year, they ranked 121st on income per capita. Petroleum revenues do not comprise much of GDP, although they account for a significant majority of government tax revenues. Not to mention, Nigeria’s informal economic activity deprives the government of valuable tax revenues. The IMF estimates that nearly 65% of Nigeria’s GDP is informal by nature, with most of the activity concentrated in the agriculture and tourism sectors. Nigeria finds itself in familiar company with other African nations as they are severely indebted to the Chinese. In fact, China is the second largest creditor to Nigeria, holding nearly 40% of their external debt. Nigeria is expected to be servicing Chinese debt up until 2038, barring any substantial change in the Chinese hegemony.

Genealogy: Which present-day British bank can draw its roots to the Bank of British West Africa?

The Gold Coast

The resource-rich nation of Ghana was the first sub-Saharan African nation to achieve independence in 1960. Given the country’s abundant gold, diamond, oil, and cocoa reserves, Ghana was originally a hotbed for hungry European colonists, earning the moniker “The Gold Coast”. Ghana is a relatively small country, with a population of 30 million people and the 9th largest economy in Africa by nominal GDP. However, Ghana is Africa’s second largest producer of both gold and cocoa which has allowed for the country to compete in the global marketplace. Besides their natural resources, the Ghanian economy is one of the sturdiest in all of Africa, driven by a formidable services sector and advanced manufacturing capabilities. In fact, services account for nearly 50% of employed people, up from around 35% in 2009. In 2015, Ghanian services sector surpassed agriculture as the biggest contributor to GDP.

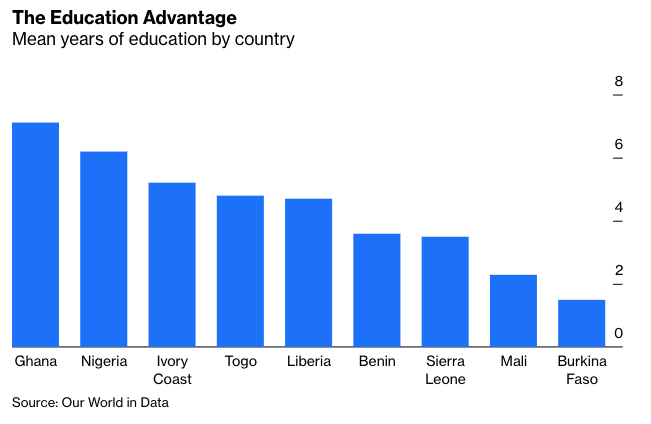

Graph from Bloomberg / @Noahpinion

Ghana boasts the strongest level of human capital relative to their West African peers, facilitating the country’s transition into a developed economy. In 1996, the nation introduced the “Ghana Vision 2020” initiative which established a goal for Ghana to be a balanced, middle-income economy by 2020 and then to be a fully industrialized, high-income economy by 2040. The basis of this plan is emblematic of the Ghanian government’s heightened emphasis towards their services industry. In particular, Ghana’s strength in manufacturing has attracted profitable foreign direct investment. In 2019, Toyota Motors announced their plans to open their first production plant in Ghana, scheduled for August 2020.

Cocoa, Oil, & Gold

The resilience of the Ghanian economy stems from the diversity of their natural resources. Consider the compounds that comprise nearly 90% of their exports: Cocoa, oil, and gold. Cocoa displays mundane price behavior, although has steady demand in consumer product. Oil tends to move in tangent with the decisions of OPEC, effectively marrying its price behavior to political instability. Similarly, gold tends to appreciate during times of economic instability, given its utility as a store of value. All in all, the presumed behavior of these commodities tend to move orthogonally.

Ghana’s affinity with digital media and smartphone technology has created an accommodative ecosystem for the growing role of the telecommunications companies. Ghana has a mobile phone penetration rate of over 100%, meaning that the number of voice subscriptions in the country are larger than the number of citizens living in the country. Participants in the sector include AirtelTigo, Vodafone, and MTN Group — the South African Telecom giant who occupies more than 50% of the Ghanian marketplace. These telecommunications firms have not only boosted GDP growth, but has created thousands of job opportunities for Ghanian nationals. In 2018, Vodafone unveiled a program in which Ghanian teenagers can learn viable programming skills. This demonstrates a strong foreign, corporate interest in the human capital of Ghana.

Ghana is considered to be one of the more “free” countries in Africa, given their strong record of protecting free speech. The Press Freedom Index — generally regarded as a barometer for how free a country’s mainstream media is — placed Ghana as the 30th freest press and the third freest in Africa, behind Namibia and Cabo Verde. For context, Spain is ranked 29th. That said, nearly one-third of Ghana’s media is operated by the state. This is should be good for competition in the media industry, although threatens a slippery slope of censorship. Despite a specified article in the constitution, the Ghanian government has historically found themselves violating their own free press laws. Unwarranted arrests and reports of bribes have imperiled Ghana’s role as patron of free speech.

Despite being listed as a “high-risk country” in the eyes of the World Health Organization, Ghana has successfully curbed the turmoil of the coronavirus. Ghana has seen under 7,000 cases and 32 deaths in a country of 30 million people. The country’s success in limiting the effects of coronavirus stem from the government’s swift action. Two days following the first confirmed case in the country, Ghanian President Nana Akufo-Addo mandated a nationwide shutdown and prepared $100M in emergency relief. In addition, the country has benefitted from the rising price of gold amid unprecedented action from central banks across the globe.

The nationwide shutdown is definitely positioned to disrupt the Ghanian economy. The Bank of Ghana, the country’s central bank, was forced to cut interest rates to an eight year low of 14.5% (in case you’re still hungry for yield…) According to Moody’s, Ghanian debt-to-GDP is expected to hit 70% in 2020 and the country has already asked for relief from the IMF and World Bank this year. This would not be the first time… In 2015, Ghana had sought the help of the IMF due to a tough budget crunch. Given the current economic condition, paired with $3.5B of outstanding Chinese debt, I wouldn’t be surprised to see the IMF come to the rescue once again.

What Do You Meme?: Which popular meme has its roots in Ghana?

Trivia Answers

One Country, Two Systems: Hong Kong was originally under British jurisdiction up until 1997 when it was returned to China. This agreement was brokered as a result of the British-Chinese Opium Wars of the mid-18th Century.

Geneaology: Standard Chartered is an ancestor of the first banks in Nigeria.

What Do You Meme?: The Ghanian Pallbearers have been one of the hottest memes of 2020.