Arabian Nights

The Persian Gulf, dominated by energy, seeks to "diversify its portfolio" amid dwindling demand for petroleum.

Hey everyone, welcome back. I’ve decided to break this section up on the Middle East into a few sub-regions because there is so much to cover. The Middle East has seen a paradigm shift from being a theocratic, nation-state to one of the fastest growing, most diverse regions in the world. This week we’ll be focusing on the Arabian Peninsula.

Emerging & Frontier Market ETF Performance:

I am still working on some housekeeping on the referrals competition. In the meantime, if you know of someone who may enjoy this newsletter I will greatly appreciate it if you passed it along.

Many thanks,

- Tom

I welcome feedback, questions, or insights here.

Follow us on Twitter: @TGC_Research

Follow Tom on Twitter: @TominalYield

Last Week Briefing:

Pour one out for our friends in Peru and Argentina, as FTSE Russell announced the two economies will be downgraded to ‘frontier market’ and ‘unclassified’, respectively.

The Trump administration pulled funding from the WHO, sending ripples in geopolitical tensions.

Wuhan, China announced a 50% (yes, exactly 50%) increase in deaths from a revised analysis.

Black Gold, Texas Tea,

In the words of former U.S. Vice President, Dick Cheney:

“Oil remains fundamentally a government business. While many regions of the world offer great oil opportunities, the Middle East with two-thirds of the world’s oil and the lowest cost, is still where the prize ultimately lies, even though companies are anxious for greater access there, progress continues to be slow.”

While cheap gas is always a simple pleasure in life, the price of oil carries serious geopolitical and commercial ramifications. Petroleum, if you’re not familiar, is an omnipresent compound in our society. From common consumer items such as plastics and cosmetics to machine-powering diesel fuels, petroleum serves an incredibly integral role in our industrialized society. The steady demand for petroleum products has shown that countries can accumulate vast sums of wealth from monetizing their natural resources. That said, there is severe asymmetry in what countries have access to these resources. Countries can incur geopolitical risk in relying upon sovereign nations for their petroleum imports. OPEC, or the Organization for the Petroleum Exporting Countries, was founded as a means to coordinate oil drilling efforts with the goal of stabilizing prices. However, critics may argue that OPEC’s purpose is simply to perpetuate global demand for oil, thus enriching powerful oligarchs at the expense of competitive energy alternatives. While OPEC only produces around 40% of the world’s oil, they hold approximately 80% of the world’s oil reserves with 65% of those reserves held in the Middle East. Not to mention, of the fourteen OPEC countries, few of them can boast liberal democracies.

History has shown us that civil unrest and political instability can cause extreme volatility in the price of oil. For example, in 1973 an Arabic oil embargo quintupled the price of oil, leading to the proclamation of the Carter Doctrine. Recently, the U.S. assassination of Qasem Soleimani, an Iranian military leader, sent the price of Brent Crude up 4.4% to a near 52-week high. Recent advancements in drilling technology have catapulted the U.S. to the forefront of oil production, although that position has offered little protection in price of the commodity. Just last month, the Russians and Saudis broke out into an oil price war, flooding the market with excess supply and driving prices to under $20/barrel. In fact, there was so much supply in the market that tankers were sitting idly in the ocean full of oil. This occurred coterminously with the onslaught of the coronavirus, sending global markets plummeting. Last week, the G20 and OPEC+ agreed to an 10 million barrel per day production cut amid evaporating demand for petroleum. Although, given our new stationary normal, investors are wondering if the demand for oil will ever be the same again.

Phrasing: Who invented the term “Middle East”? Why is it called that?

“The City of Gold”

“I was dreaming about our land catching up with the modern world…I did not have the wherewithal in my hands to achieve those dreams. I was, however, sure that one day they would come true.”

Those are the words of Zayed bin Sultan Al Nahya, founder and former president of the United Arab Emirates. The United Arab Emirates (U.A.E.) is structured exactly the way it sounds: Seven different kingdoms (‘Emirates’) united under one governing body. The U.A.E., like many of its neighbors, have been the beneficiary of a lucrative global petroleum trade. As a matter of fact, Emirati petroleum products comprise roughly 30% of GDP and over 50% of exports. The country’s oil prowess has placed them as the second largest economy on the Arabian Peninsula and the thirtieth largest economy in the world. Interestingly enough, the U.A.E. still boasts the most diversified economy in the Middle East. Their commitment to transitioning their economy away from the oil trade has driven by their strength in logistics, tourism, and financial services. Five of the nine largest companies in the Emirates are banks while the nation’s largest airline, Emirates Group, was ranked by Fortune as one of the 500 most valuable companies in the world.

Abu Dhabi, the capital of U.A.E.

In contrast to countries we’ve covered before, the U.A.E. has taken a much more “top-down” approach towards transforming its economy. The government has imposed a hefty 5% “value-added tax” on legacy businesses to help kickstart other factions of its economy. The value added tax is peculiar, given the fact that the U.A.E. does not levy an income tax. The state-sponsored initiative: U.A.E. Vision 2021, blueprints the trajectory of a diversified, prosperous Emirati economy by the year 2021. The initiative is built upon six pillars which include:

Sustainable Energy & Infrastructure: The U.A.E. is committed towards building a clean, sustainable infrastructure. The Emirates will fixate on incubating clean energy technologies to preserve quality of air, water, and life.

Public Safety & Justice: The U.A.E. has succeeded in cultivating a safe environment for their citizens. The U.A.E. ranks second in emergency response time and seventh in reliability upon emergency responders.

Shift towards knowledge-based economy: The Emirates seek to be the commercial, touristic, and cultural capital of the region. By doing so, they must transition from a labor-driven economy to a knowledge and service-driven economy. They hope to achieve the highest per capita income in the world.

The U.A.E. has made momentous progress in creating prosperous cosmopolitan hubs across the desert. Dubai, the largest Emirate city by population, is home to luxurious novelties such as an indoor ski lift, artificial islands, and the world’s only seven-star hotel. Abu Dhabi, the capital of U.A.E., is home to one of the hottest startup scenes in the world. Hub71, the Abu Dhabi state-owned startup incubator, has attracted $150 million to support budding companies. This is on top of Uber’s recent $3.1 billion acquisition of Careem, the Emirati ride-sharing app. The Emirates are on the fast path towards becoming a developed country. That said, the nation struggles with managing a vast ex-pat workforce. Emiratisation is a zeitgeist that aims to solve the underemployment issue with Emirati nationals. As a matter of fact, under half of the Emirati nationals participate in the workforce. Those who do, disproportionately hold positions in the public sector. As a result, the nation’s private sector consists of 95% foreign laborers. That said, the nation’s commitment towards liberalizing its economy and recapitalizing its infrastructure poses promising opportunities for the Gulf nation. The U.A.E. ranks 18th on the Heritage Economic Freedom Index, just a spot behind the United States and continues to be an opportunistic location for job-seekers and foreign enterprises. As the demand for oil struggles to find its footing, investors will discover how fortified the Emirati economy truly is.

Over / Under: What percentage of the world’s cranes are located in UAE? Line is set at 10.5.

Cutter or Ka-tar?

The quaint, monarchial city-state resting on the eastern coast of the Arabian Peninsula is another curious case. A nation slightly more populous than the city of Chicago, Qatar’s rapidly growing economy has spotlighted the country as the unlikely chosen host for the 2022 FIFA World Cup. The country, alongside the U.A.E., was added in 2013 to the MSCI emerging markets index following years of “on-the-fence” consideration. Qatar’s inclusion in the index was of no surprise of course, as the country ranks number one in income per capita and 52nd in nominal GDP. Like its neighbors, Qatar’s natural resources have anchored its economic growth with petroleum contributing 87% of export value. Qatar is also the world’s largest supplier of liquid natural gas (LNG) and sits upon 10-15% of the world’s reserves. In contrast to many of its Arabic neighbors, Qatar is not a member of OPEC. In fact, the country left in 2019 to focus on its future as the leading exporter of LNG and excuse itself from the politics involved with OPEC membership. This decision is emblematic of climbing demand for clean energy and dwindling tolerance for Saudi influence. Qatar’s lucrative LNG trade has placed the country’s vast wealth on par with their Saudi neighbors. Qatar is also home of the state-funded Al Jazeera news network. The network’s critical coverage of the Saudis and their allies has driven a wedge in the relationship between the two countries. The network has been an outspoken supporter of the Arab Spring and has been accused of supporting Iran’s regime. Consequentially, this has lead to a Saudi-led group embargo on Qatar’s trade routes.

Doha, Qatar

Qatar, like the Emirates, suffers from the issue of an unbalanced work force as ex-patriates dominant the labor market. As a matter of fact, the population of Qatar has skyrocketed from around 600,000 people in 2000 to over 2.75 million people in 2018. Qatari natives are now ethnic minorities consisting of only 11.5% of the population. Indian laborers in particular have been abundant, as roughly 1.3 million Indian immigrants are rumored to have emigrated to the Gulf nation for work opportunities. Similar to the Emirates, Qatar has titled the campaign of supporting Qatari natives “Qatarization” as they aim to achieve 50% native employment in their energy industry. The employment boom in Qatar has been buoyed by the royal family’s efforts towards pivoting their economy away from petroleum products. The Qatar Investment Authority (QIA) is a sovereign wealth fund formed as a vehicle in which the royal Al-Thani family can diversify their enormous oil wealth. The QIA holds roughly $330 billion in assets, including minority stakes in popular brand names such as Volkswagen, Barclays Bank, and Uber. The Al-Thanis also own over 24 million square feet of London property, more than the British Royal Family.

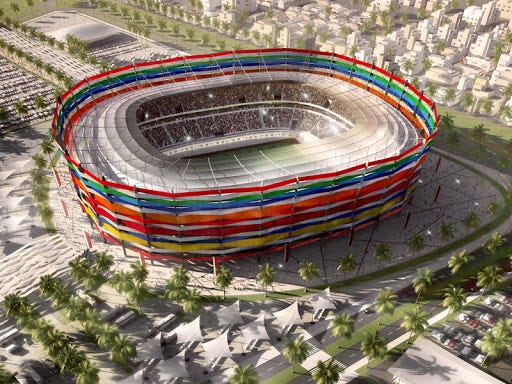

Proposed design for Al Gharafa Stadium, Qatar

Recently, the Al-Thanis were brought back into the spotlight over allegations that they nefariously influenced the decision to host the 2022 FIFA World Cup. Ethical concerns have been raised regarding the working conditions for stadium builders and other laborers. Not to mention, the extreme heat of the Qatari summer may require chemically engineering artificial clouds to keep athletes and fans cool. Nonetheless, the public’s focus on ethical, sustainable, governance businesses has jeopardized Qatar’s representation in the world’s most popular sport. This, alongside the economic sanctions placed upon Qatar from its Arabian neighbors serve as a reminder for the risks investors can incur when investing in emerging markets, especially in the Middle East.

Exacta Box: Qatar is home of one of the world’s most peculiar racing events. Can you guess what it is?

House of Saud

The largest exporter of oil in the world is arguably the most controversial of America’s allies. The Kingdom of Saudi Arabia has been synonymous with the identity of the region since the Al-Saud family has held power. As a matter of fact, the name “Saudi Arabia” refers to the Al-Saud family, who founded the first Saudi state back in the 18th century and have held power ever since. The Kingdom is the largest country and economy in the Middle East and holds the second largest estimated oil reserves in the world, behind Venezuela. The Al-Saud family is synonymous with oil wealth, as the Kingdom owns nearly 18% of the world’s reserves and is credited as a founding member of OPEC. In 2019, ARAMCO, the Saudi state-owned oil company, went public, kicking off the highest valued initial public offering (IPO) in the history of sophisticated markets. The company was listed at a $1.7 trillion valuation, topping American tech giants such as Apple, Microsoft, and Amazon, although falling short of the Crown Prince’s goal of $2 trillion. Subjecting the country’s oil operations to the scrutiny of public markets is indicative of the country’s focus on transitioning their economy amid the changing global marketplace.

Prince Mohammad bin Salman Al-Saud pictured with Tim Cook, CEO of Apple.

If you couldn’t tell by now, sovereign nations don’t get too creative with the names of their government initiatives. Saudi Vision 2030 is the Kingdom’s state-driven initiative built upon three pillars: A vibrant society, a thriving economy, and an ambitious nation. These pillars are the foundation upon which they hope to achieve 96 different strategic objectives. For example, the Human Capital Development Program seeks to create a globally competitive education and training system as over 70% of citizens are under 30 years old. Mohammad bin Salman Al-Saud, the wunderkind of the Al-Saud family, has championed these efforts to catapult the Kingdom into the upper echelon of developed countries. Initiatives focused on personal liberties, economic freedom, and cooperation with other world leaders has changed the global perception of the petro-state. Not to mention, the eleven-figure proceeds from the ARAMCO IPO has allowed the kingdom to deploy dry powder into other industries. The Public Investment Fund (PIF), the Saudi sovereign wealth arm, checks in as one of the largest sovereign wealth funds in the world with roughly $320 billion in assets. Like the Al-Thanis (although not quite as wealthy), the Al-Sauds have used the PIF to take equity stakes in popular Western brands such as Tesla Motors, Uber Technologies, and recently Carnival Cruises. On top of that, the PIF is SoftBank’s largest investor, committing up to $45 billion to the battered Vision Fund II.

The Holy City of Mecca, Saudi Arabia

Despite the Kingdom’s vast resources and bountiful wealth, the country continues to find itself in poor standing with human rights groups. For instance, the assassination of Jamal Khoshoggi, the Washington Post journalist, has been closely tied to the Saudis, despite continued denials from the Al-Sauds. What’s more, Saudi Arabia has made little improvement to its record with women’s rights. Although, last August marked the first time women above 21 years old could travel without male permission.

Finally, the oil price war with Russia further demonstrates the country’s arrogance as a power broker in the Middle East. The capitulating price of oil imperiled the U.S. petroleum industry, although their longstanding relationship led the Kingdom to seek compromise. The Kingdom’s reliance upon the U.S. as a military resource should prove to be a leash for the Al-Saud’s errant behavior.

X-Games: In 2013, a popular fad called ‘Sidewalk Skiing” blew up among Saudi Arabians. What is it?

What I’m Reading/Watching:

Watching (movie): The Prisoner: One of the best thrillers I’ve ever seen. Highly recommend it if you have the stomach for it.

Reading (blog): Africa; A Venture Story: A venture capitalist’s reflection and discoveries from his two-month journey throughout the continent. I touched upon Africa’s growing economy a few weeks ago which you can read here.

Meme of the Week:

Trivia Answers

Phrasing: The Middle East was a term used by American Naval Officers in the early 20th century to describe the area splitting the difference between the near east (Ottoman Empire) and the far east (British India).

Over / Under: UNDER: While urban legends have said that the U.A.E. is home to 25% of the world’s cranes, the number is closer towards 2-3%. Still, there are an incredible amount of cranes in Dubai.

Exacta Box: Qatar is home to the lucrative business of Camel Racing. Originally, they used to use children as jockeys although recently they have transitioned to the more humane “robo-jockey”.

X-Games: Sidewalk Skiing is the ‘extreme sport’ of Saudi Arabia in which drivers balance a car on its side while keeping the vehicle in motion. It is legitmately something out of a Bond film.