A Rising Tide Lifts All Ships

This week, I wanted to talk about gold and inflation briefly before transitioning over to the Chilean market.

Welcome to the Global Capitalist - A newsletter on emerging and frontier markets viewed through the lens of history and culture.

Hey everyone, welcome back. This week, I wanted to discuss the topic of inflation, and why it is relevant today. Then, we will tie it back into the mercurial Chilean economy.

Thank you all for your continued support!

-Tom

Last Week Briefing:

Last week, Goldman Sachs finally came to a settlement from the long-standing 1MBD case, in which Malaysian financiers siphoned nearly $4.5 billion from the state-run investment fund. Goldman is reported to have disbursed $2.5 billion in cash to the sovereign wealth fund.

Argentinian President Alberto Fernandez stubbornly asserted, “There will not be another offer” in regards to Argentina’s restructuring efforts. Fernandez has refused to budge from his fifty-three point bond offering (53% of the bond’s face value) despite an upcoming August 4th deadline.

The U.S. closed the Chinese consulate in Houston, Texas, amidst rising tensions between the world’s two largest economies. China responded with a closure of their own, as American diplomats vacated the Chengdu consulate on Sunday.

Ant Financial, the parent company of Alipay, is going public. The company is estimated to be worth over $200B and is going public via a dual listing on the Hang Seng and the Shanghai Stock Exchange. Ant Financial was previously the largest “unicorn” company in the world.

I Love Goooooold

Before we dive into the Chilean economy: I want to talk about the price action of gold, amongst other metals, and its implications with respect to foreign exchange and emerging markets.

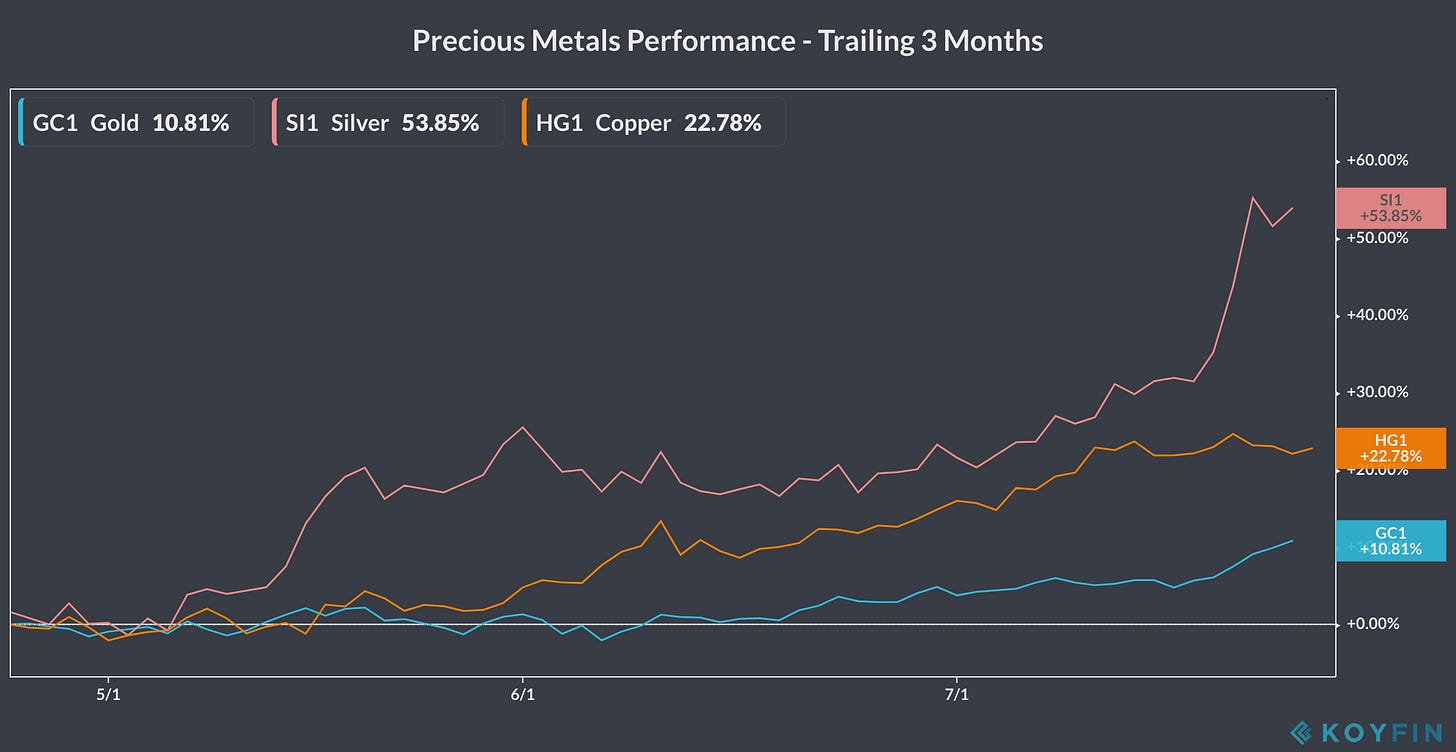

As of July 27th, an ounce of gold is as expensive as its ever been, touching nearly $2,000 per ounce. Similarly, silver is up over 28% this year, recently hurdling over $24 an ounce. VanEck’s Gold Miner’s ETF, which is composed of the world’s largest gold mining stocks, has added almost 50% this year, citing strong performance in multi-national companies such as AngloGold Ashanti (+55.60%), NewMount Mining Corp (+54.72%), and Franco Nevada Corporation (+59.46%). Precious metals are often considered a barometer of inflation, given the universal utility and uniformity of metals. Take for instance: gold. Gold used to go for around $20/oz in the 1920’s, and that could buy you a very nice suit at the time. You could argue the same is true today, with the exception of maybe Joseph A. Bank, where you can seemingly buy ten suits for the price of a McDonald’s Happy Meal.

Last Monday, the European Union announced a €730 billion (over $800B in USD) stimulus package, adding to the original €500 billion stimulus back in April. In a similar fashion, the U.S. Senate is currently debating another trillion-plus dollar stimulus to help prop up the limping global economy. Finally, the Bank of Japan has committed to “unlimited quantitative-easing” should the nation’s economy suffer the consequences of a second wave.

Without arguing the semantics or principles behind the stimulus, we’re going to say this fiscal stimulus is justified — millions of people are unemployed and hundreds of businesses have faltered. We certainly don’t want “Hoovervilles” like we saw in the 1930’s. It will be, however, impossible to ignore the monetary effects of this policy. For starters, quantitative easing is just a euphemism for “money-printing”. Money-printing equals more dollars. More dollars in the global financial system equates inflation. Inflation subsequently yields a weaker dollar. A weaker dollar ultimately means that foreign currencies, particularly those held in developing markets, will appreciate, meaning they are able to purchase more dollars. Now, take that previous sentence and swap “dollars” for any good, commodity, or financial asset that is dollar-denominated. A depreciating dollar means that a company in India now has the ability to purchase American imports at a cheaper cost with fewer rupees. Similarly, a Mexican municipality holding U.S.-issued debt would be able to service that debt at a lower real expense. If we extrapolate that hypothetical across the sphere of emerging markets, you should understand why this rings bullish for the rest of the world.

When considering the recent actions of sovereign monetary institutions such as the Federal Reserve, the European Central Bank, and the Bank of Japan, the bet on gold, or inflation in general, doesn’t seem that far-fetched. This doesn’t mean you should discount the strength of the U.S. dollar or flip your whole portfolio into gold. After all, history has shown us that stocks are a better hedge on inflation than gold. I’d be remiss if I wasn’t carefully measuring the input costs involved with many of these American-based, multinational giants. For instance, Tesla Motors is dependent upon nickel imports in order to manufacture their batteries. Other technology companies like Apple rely upon silver imports to assemble their iPhones. Multiply those situations across the economy and you’ll see a compression in corporate operating margins. The rising price of commodities will ultimately be passed onto the consumer. That is, however, if they’re willing to pay the premium.

It’s fair to say that a weaker dollar is bullish for foreign companies and countries, especially those markets where the domestic currency is not pegged to the U.S. dollar. Additionally, countries with some of the largest gold production, including South Africa, Peru, and Ghana, should be the contingent benefactors of gold’s bull market. Besides gold, other commodities such as copper, nickel, iron ore, and steel should appreciate, given inflationary behavior from the U.S. dollar. Similar to how strong oil prices can endow a country with newly created mineral wealth, countries with active mining production should anticipate a wave of prosperity from the appreciating price of precious earths.

I Ain’t Sayin’ She A Gold Digger…: Can you name the top three producers of gold, silver, and copper? Answer at the bottom.

Speaking of Commodities…

Now that we’ve touched upon gold, let’s migrate over to the western coast of South America; Home to the country with the largest copper production in the world: Chile.

Chile is the world’s leading copper exporter, shipping out over 30% of the world’s copper supply. Unlike other developing nations, however, Chile has remained steadfast in channelling the nation’s copper production through the Corporación Nacional del Cobre de Chile or simply, Codelco. Codelco is Chile’s state-owned mining giant and the world’s largest copper production company, producing over 1.7 million metric tonnes (mmt) of copper in 2018. Coldeco was formed in the 1970’s following Augusto Pinochet’s coup of the Chilean government as Pinochet nationalized all of the foreign-held copper mines in Chile. This is especially peculiar, given Pinochet’s distaste towards socialist economic policy. For those unfamiliar: Pinochet was a militant revolutionary who overthrew Chile’s socialist regime as a part of Operation Condor in the 1970’s. It is estimated that during Pinochet’s reign, roughly 40,000 people “disappeared” under his rule. When Chile had its first democratic election in 1990 — not just Codelco — but Chile as a whole would be liberated to foreign investment and political reform. The 1990’s saw average annual GDP growth rates of 6.5% and by 1990, Chile had rocketed past the U.S. to be the largest producer of copper in the world.

While Codelco is required to return all excess profits to Chile’s treasury, copper’s dominance does not render the Chilean economy one-dimensional. Copper products compose over 55% of Chilean exports but only 8% of Chilean GDP. Codelco is a state-ran enterprise, although they work intimately alongside private, multinational corporations such as Glencore to develop copper mines across the country in order to maintain sufficient production. Codelco’s projects were halted due to COVID-19, however, the company remains optimistic on the future of the red metal, as production was boosted over 3% in the first quarter of 2020. In fact, some mines are being equipped with artificial intelligence technology to optimize copper output. Copper production is certainly positioned to grow, given booming demand in consumer electronics and new construction.

Patagonia, Chile

Besides copper, Chile’s strength in services, coupled with their high-income status has made Chile one of the strongest markets in South America and one of the largest emerging economies across the globe. As of 2019, Chile was the 40th largest economy by GDP, putting them at par with other promising EM countries such as Bangladesh, Pakistan, and Egypt. Chile is also revered for their economic liberties, considered one of the freest countries in the world. Chile ranked #2 as the most free economy in the America’s and is ranked the fifteenth most free economy in the world. What’s more, Chile is a formidable trading partner. The country is involved in over 30 different trade deals, including massive agreements with the U.S., EU, and China.

Chile’s services sector comprises roughly 50% of the nation’s GDP as industries such as technology, information services, and tourism have counterbalanced Chile’s dependence upon copper. In 2010, the Chilean government revealed “Startup Chile” a public incubator for Chilean entrepreneurs to grow their ideas and catapult the Chilean market onto the world’s stage. In fact, foreign companies have participated three times as much as their domestic, Chilean counterparts, indicating Chile global presence as a technology hub. At the end of 2018, the estimated value of Startup Chile’s portfolio was $1.4B with over 40 exits. Just recently, Startup Chile revealed a new program called the S-Factory, a separate startup incubator catered exclusively towards female-tech entrepreneurs. Chile’s presence as a booming technology hub in the southern hemisphere puts them at an advantage relative to their South American neighbors.

Chile, despite being the richest country in South America, is certainly not teflon. If you recall from our Protests Edition newsletter, Chile suffers from some of the world’s worst income inequality, with a Gini coefficient of 46 and a median monthly income of $550 a month. While protests have died down, the animosity surrounding Chile’s inequality and faltering social safety nets have remained present. GDP growth has floundered in recent years as violent riots and protests have dealt massive damage on Chile’s infrastructure and economic outlook. Last year, GDP number fell 2% from the year prior. Looking into 2020, Chile saw modest GDP growth of 0.4% in the first quarter, citing strength in mining activity. Keep a look out as Chile emerges as one of the stronger economies from the western hemisphere.

Island Living: Chile holds sovereignty over what popular tourism destination? Answer at the bottom.

Trivia

I Ain’t Saying She A Gold Digger:

Top Gold Producing Countries:

1) China

2) Australia

3) Russia

Top Silver Producing Countries:

1) Mexico

2) Peru

3) China

Top Copper Producing Countries:

1) Chile

2) Peru

3) China

Island Living:

Chile has sovereignty over Easter Island, home to the enormous Easter Island “heads”.