2021: Emerging or Submerging?

After a raucous 2020, emerging markets have plenty of reasons for optimism in 2021.

Welcome to the Global Capitalist — A free newsletter on international developed, emerging and frontier markets viewed through the lens of history and culture.

Happy New Year, everyone! My apologies for the long hiatus. In case you missed it:

I’ve recently enrolled into a course at a local university so I haven’t had the time to churn out the longform pieces as I did earlier last year. Then again, I still want to utilize this space to share some of my thoughts and findings from across the globe.

The monthly pieces will resemble my older work while the weekly write-ups may look a little different. Rest assured, the newsletter is keeping its main focus on international economics and markets.

Finally, I’m considering adding another contributor to this page to help strengthen our catalogue of content. If you, or know someone, who may be interested, please feel free to reach out! Similarly, if you know of any industry professionals who you believe could provide some unique expertise and perspective on some of the more pressing issues in global commerce, please send them my way.

Happy New Year!

Tom

Bulls on Parade

In November 2020, the three largest emerging market ETFs rocketed past their all-time highs, a figure not seen since the winter of 2018.

Naturally, as in finance (or any forecasting disciplines), many championed this performance as a vindication of their election thesis. Simply put: a Biden victory would introduce future (and presumably larger) economic stimuli, which in turn would compress the value of the dollar. A weaker dollar rings bullish for America’s trade partners, particularly those in emerging economies, as exports and dollar-denominated debt become cheaper on an exchange-rate basis. For the sake of this newsletter, we will assume that international asset prices are inversely correlated with the value of the Dollar. This relationship is glaringly evident in the following charts:

Again — I am not signaling the dollar’s defeat, nor do I believe the greenback will lose its status as the reserve currency, as I described in April. The dollar, however, is indubitably weaker. The yield on the 10-year treasury, typically a barometer of inflation expectations, has risen above 0.90%, adding roughly 30 bps since the end of September (Don’t shoot me if I quoted this wrong, I’m not a bond guy.) Assuming another stimulus bill is passed (I’m currently writing this on Christmas), the dollar will almost certainly fall further.

We’ll try not to make fun of Raoul for taking home FinTwit’s Charlatan of the Year.

After all, Bitcoin is trading at an all time high…

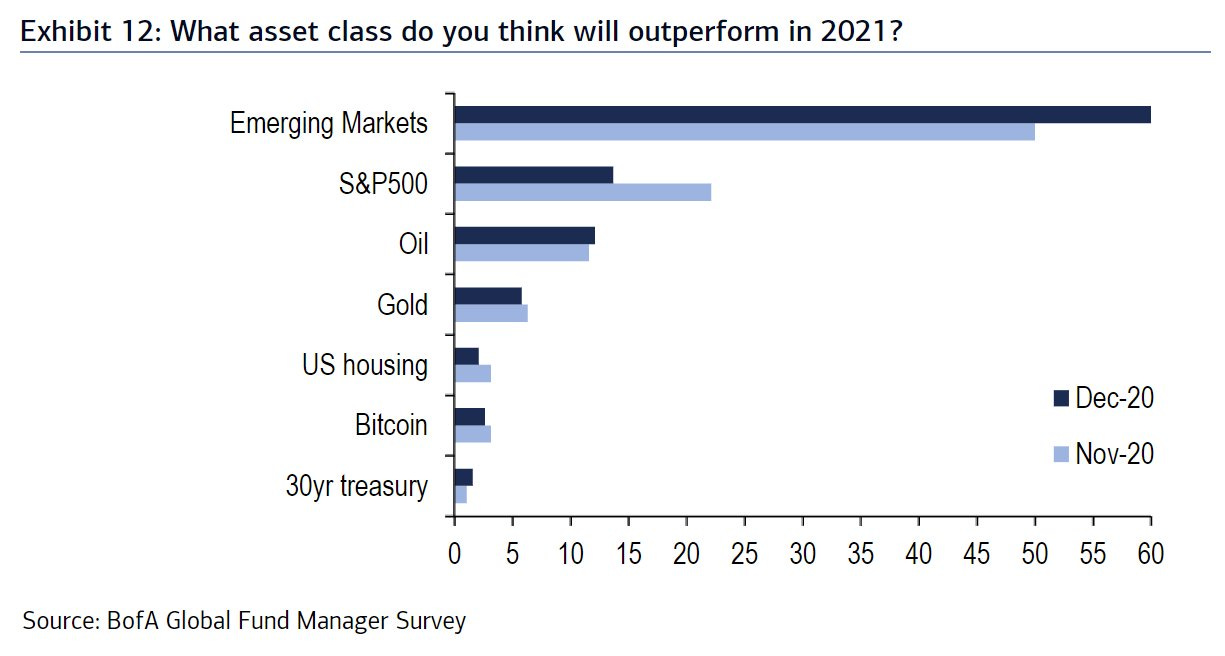

All of this being said, it’s not difficult to see why portfolio managers are drooling over the prospect of a new stimulus package. As reflected in the BofA Global Fund Manager Survey above, emerging markets stood out as the asset class most likely to outperform in 2021, beating out other sectors like the S&P and Oil. Barron’s recently published an article featuring the portfolio managers of William Blair’s $1.2 billion emerging market growth fund ($WBENX) who declared there were a “laundry list of reasons” to be bullish on emerging markets. Meghan Shue, Wilmington Trust’s Head of Investment Strategy, opined that emerging market equities could have additional upside relative to other sectors come 2021. Finally, Goldman Sachs Research echoed this sentiment with a focus on emerging market debt:

“EM debt still offers attractive risk premium for bond investors that cannot be ignored in an increasingly income-hungry, low inflation and low interest-rate world,” Greer said. “The story into 2021, however, remains clouded and much will depend on the evolution of the virus-versus-vaccine trajectory.” — Bloomberg

There is reason to believe this shift is currently underway: iShares Core MSCI Index ($IEMG), the largest emerging market ETF by assets, has seen over $5 billion in net fund flow since the beginning of the fourth quarter. Similarly, J.P. Morgan’s Emerging Market Bond ETF ($EMB), the largest emerging fixed income fund, has seen a $2.25B windfall in that same time frame. Over that same period, the IEMG index has grown over 18%, outpacing the S&P by over 7.5%. Then again, the market (traditionally) does not operate on a first-order basis.

Consider the geographic composition of the iShares $EEM ETF, the second largest emerging market ETF by assets: Chinese, Korean, and Taiwanese equities currently comprise roughly two-thirds of the portfolio’s assets. Ironically, these countries are also some of the only economies that are expected to grow in 2020, albeit some on a nominal basis. Chinese equities in particular have seen their share of the portfolio swell from under one-third to over forty percent of the index at the end of September 2020. Taiwanese and Korean equities also took a slightly larger share of the portfolio this year, thanks to the blistering performance of bluechip multinationals like Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung Electronics. In July, TSMC rallied 10% intraday on the news that Intel Corporation would be outsourcing chip manufacturing to their east Asian competitors. Broadly speaking, Taiwan’s TAIEX has blossomed over 22% year-to-date. Samsung Electronics, $EEM’s fourth largest component, has seen shares gain over 40% this year, thanks to 37% annual growth in operating profits and the shocking popularity of their new flip phone. The constituents of Korea’s Kospi Index are expecting to grow earnings by a collective 43% this year, trouncing their American counterparts in the S&P 500.

Party Pooper: South Korea’s Financial Service Commission recently threatened jail time for those caught practicing which popular, yet risky, trading activity?

Answer at the bottom.

In the States, we’ve heard plenty of outcry highlighting the split between America’s equity markets and the health of the underlying American economy. Rest assured, there are as many reasons to be bearish on emerging markets are there are bullish. Take for instance, the waning instability of China’s debt markets: Earlier this year, China’s largest property developer by revenue, Evergrande Group, warned authorities about their inability to service upcoming debt obligations, sending tremors through China’s economy before receiving a $4.6 billion lifeline from local SoE’s. As I write this, shares of the company have sank roughly 25% since the beginning of July.

China’s debt scares were not limited to real estate. In fact, Yongcheng Coal & Electricity (who borrowed at a AAA rating, by the way) defaulted on $150 million in commercial paper in early November, citing ‘tight liquidity’. Tsinghua Unigroup Co., a state-owned chipmaker, defaulted on a total of $2.5 billion worth of dollar-denominated debt between November and December. Through October, Chinese state-owned firms have defaulted on a collective $6.1 billion in debt, equivalent to the past two years of defaults, combined. Thanks to the tumult in China’s fixed income markets, over 20 different Chinese companies have shelved bond offerings this year, totaling $2.37B (RMB15.5B).

Then again, who’s really paying attention? Does anyone really care?

In November, the Middle Kingdom issued their first ever negative-yielding debt offering, a €4 billion issuance with an effective yield of -0.15%. The month prior, the country issued its largest dollar-denominated bond offering ever, totaling $6 billion. Both of these offerings were somehow subscribed more than four times over.

In other words: Yields are really, really, really, low.

A friendly reminder that this is a free publication. Please consider subscribing below to support my work:

With regards to other weaknesses in emerging economies, let us take a gander at the landscape of the Brazilian economy — specifically, Brazilian equities amidst their increasingly inflationary environment.

Brazil’s Bovespa Index has gained a meager 2.25% this year, burdened by a prolonged slump in oil prices and underperformance from the country’s financial sector. Chiefly, Itau Unibanco, Banco Bradesco, and Banco do Brazil, the country’s three largest banks, have shrunk 10.50%, 14.45%, and 23.10% this year, respectively. Not to mention, Petrobras, the infamous state-owned oil giant, has seen shares compress 6% this year, despite a euphoric 44% rally over the fourth quarter of 2020.

We are not facing an identity crisis. We are an oil company, — The demand will not disappear, and we don’t see other technology able to replace fossil fuels on a large scale [soon]. — Financial Times

Curiously, Petrobras has neglected the oil industry’s secular shift into alternative energies — presenting a slight juxtaposition relative to the world’s oil majors. Back in February, British Petroleum committed to net-zero emissions by 2050. Royal Dutch Shell and Total SE were quick to follow suit, establishing their own goals for net-zero emissions by 2050. Petrobras’ leadership, despite a recent pledge to reduce emissions 25% by 2030, has called the goal of net-zero emissions “a fad” and has been vocal about their conviction in fossil fuels.

Going Green: Only two American oil companies have established a goal for net zero emissions. Can you name them? Answer below.

The index has been predominantly buoyed by Brazil’s materials sector, populated by names like Vale S.A., a domestic mining company, (+32% YTD) and Gerdau (+24% YTD), a South American steel conglomerate. Then again, this outperformance could be attributed to a much more troubling development…

The Brazilian Real has been one of the weakest currencies in 2020, depreciating 22% against the Dollar and 27% against the Chinese Yuan. Unfortunately, these two countries also happen to be Brazil’s largest trading partners. The United States and China collectively comprise roughly 36% of Brazilian imports and nearly 40% of its exports. Furthermore, consider the fact that iron ore, a commodity which has seen prices grow 72% on the year, represents ~8.5% of Brazilian exports. China alone imported $22 billion worth of Brazilian iron last year, a year in which the country supplied over 18% of the world’s iron ore. Iron ore was effectively the chief beneficiary of a vivacious commodity bull market in 2020.

The inflating prices of metals, specifically iron ore, was clearly evident in some Brazilian financial statements. In the third quarter, Gerdau’s Brazilian segment saw gross profits soar 199% year-over-year. Meanwhile, Vale SA saw manganese ore and nickel sales spike over 180% annually, despite significant drops in production volume. Just last week, Vale dispatched another 6.3 million tonnes of iron ore, a 14% gain from the week prior.

It will be curious to see how Brazil’s iron trade will unfold in the coming year— Australia, who supplies 60% of China’s iron, has been particularly pugnacious with the People’s Republic, calling for an international inquiry into their handling of the COVID-19 pandemic. The souring relationship between the two countries has pushed China to issue cumbersome tariffs on Australian goods like wine and beer. Iron ore, however, has been excluded — at least for the time being.

Unfortunately, the cheapening value of the Real means that Brazilian index holders are tragically in the red for this year — at least on a real basis. Brazil’s CPI printed over 4.3% in November, thanks to an ambitious stimulus check program which allegedly drove a 16% rise in the cost of food and beverage nationally. Nevertheless, Brazil’s central bank was steadfast in keeping policy rates at an all time low during their recent December meeting to facilitate the economic recovery. Bank President Roberto Campos Neto, however, may be forced to raise rates in the new year, should inflation worsen in December.

Brazil’s market challenges the notion that inflation is a good thing for equities. Then again, the cheapening value of Brazilian exports and their growing sphere of influence in global trade could help dampen inflation and send tailwinds behind the world’s ninth largest economy.

A friendly reminder that this is a free publication. Please consider subscribing below to support my work:

If you guessed that Nigeria would be home to the world’s second best performing stock index in 2020, please come to the front to collect your prize.

This, however, will be a topic for next week. Happy New Year!

Trivia

Party Pooper: South Korea’s Financial Service Commission instituted a ban on short-selling back in March of this year. While the ban was set to expire in September, regulators chose to extend this ban until March of 2021. Recently, the Commission threatened anyone who partakes in naked short selling (selling without owning the underlying position) could be imprisoned up to a year or up to 5 times profit.

Going Green: Occidental Petroleum and Conoco Philips are the only two American oil companies who have committed to net-zero emissions by 2050.

The Global Capitalist

Follow us on Twitter / Instagram

Follow Tom on Twitter

**If you subscribe through Gmail, please move us from your ‘Promotions’ tab into your ‘Primary’ inbox so you never miss a letter!**

**None of this should be perceived as investment advice. Do your own research or speak with an advisor before investing in emerging markets.**